We already know a lot about the issues surrounding banks, so today we'll look at what the experts think. How serious do they think the issue is and what can we expect next?

The collapse of the Silicon Valley bank has caused panic as the financial sector experienced its biggest bank crash since 2008.

Regulators in California shut down the firm on Friday, putting it into FDIC receivership, and the company's stock plunged 87% in two days as some venture capital firms advised their startups to pull cash out of SVB.

SVB then said it was considering a bid for sale after it failed to raise new capital following steep losses from the sale of a bond portfolio that soured amid rising interest rates.

Here's what some prominent Wall Street figures have to say about the whole situation

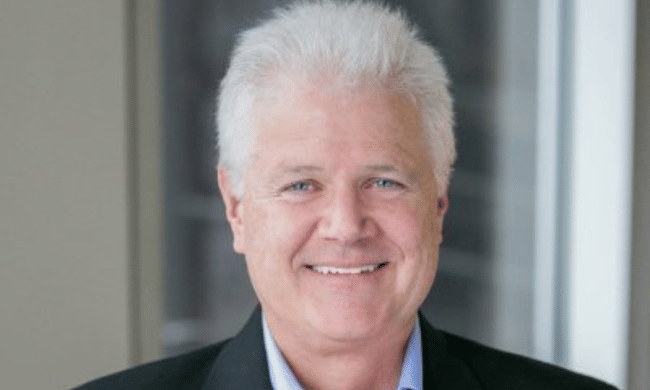

Brian Levitt, global market strategist, Invesco

"Silicon Valley Bank and First Republic have emerged as prime examples of banks with business models and balance sheets that are ill-prepared for an environment of rising interest rates and ever-increasing recession risk," Levitt said.

"Investors who smell blood will then turn their attention to the next bank exposed to interest rate risk and specific credit risk, and then to the next. First Republic Bank, which has significant exposure to coastal real estate markets, appears to be next on the list."

Brent Schutte, chief investment officer, Northwestern Mutual Wealth Management

"I see today's news as a warning to the Fed that their actions are having a harsh impact," Schutte said. "It's possible it could convince them to slow their pace, especially if concerns are growing about other regional banks with exposure to the technology space. Technology is extremely important geopolitically for the U.S., so this failure may raise broader concerns among policymakers.

"The important thing is that we don't believe this is anything like the 2008-09 period. The largest and most systematically important banks have been heavily regulated and stress-tested for years. But to me, this is a warning to the Fed about the future base effects of their aggressive rate hikes."

Lundy Wright, partner at Weiss Multi-Strategy Advisers

"The regulators' input was confirmation that the bank is dead or nearly dead. I think doing nothing would be very negative and have terrible consequences," Wright said.

"When you raise interest rates quickly, after 15 years of over-stimulating the economy with near-zero rates, to not imagine that there is leverage in every pocket of the company that will be put under pressure is a naive notion."

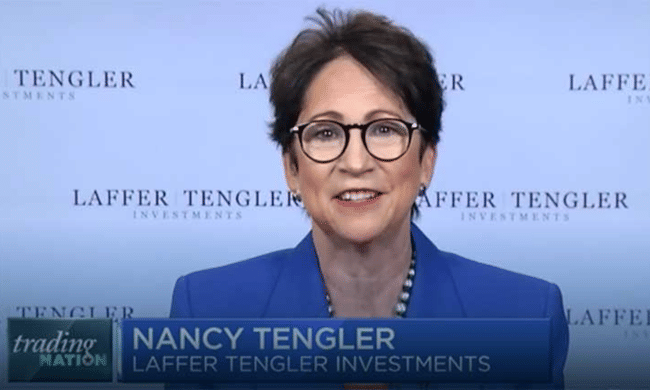

Nancy Tengler, CEO and Chief Investment Officer, Laffer Tengler Investments

"This is what we often get from regulators: they close the stable door after the horses are out of the barn," Tengler said. "There is a laziness factor that has settled into the financial business over the last decade, when money was virtually free. "

Jamie Cox, managing partner, Harris Financial Group

"When the Fed raises interest rates 500 basis points in a few months, things like SVB will happen," Cox said. "The Federal Reserve is the creator of the crisis and will likely have to cut rates to solve it."

Quincy Krosby, chief global strategist, LPL Financial

"Tracking bank stocks and exchange-traded funds, especially regional institutions, should signal whether there is a broader problem," Krosby said. "Any turmoil could also be felt in the hedge fund world, which is why considerable attention is being paid to any pressure that comes from unusual selling and panic."

- What do you think about this issue surrounding the banks?

- Are there more problems ahead?

- Will the Fed be able to keep raising rates?

Please note that this is not financial advice.