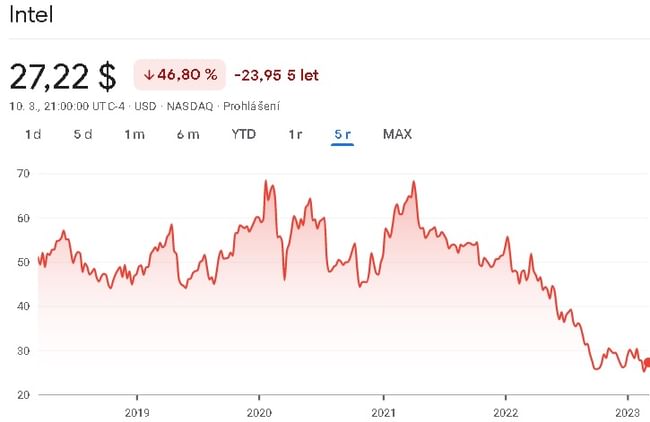

There has been a lot of talk about Intel lately. Unfortunately, however, the company is mostly talked about negatively and is described as a virtually dead company. And the latest results have added more fuel to the fire.

A lot of investors are calling Intel $INTC a dead company. In contrast, they are praising $AMD. Yes, AMD is certainly ahead technologically at the moment, but it certainly can't be said to have overtaken Intel, at least in terms of numbers. Let's take a look at the numbers of both companies. So is Intel really that dead?

Intel $INTC

So the first thing we'll start with is market capitalization, which tells us how the market values a given company. Intel's current market capitalization is roughly $111 billion. This figure will be useful for us later, because I want to show you something on it, but first let's look at the results the company has achieved for 2022.

For 2022, Intel reported $63.05 billion in revenue. This is the first decline in revenue in several years. In terms of net profit, the company reported a net profit of $8.01 billion. Here it is true that the net profit has been slightly declining for the last 2 years.

As far as debt is concerned, the total liabilities to equity ratio here is less than 1. Further, the company has sufficient amount in current assets to pay its liabilities, so in terms of debt, the company seems fine to me.

For the year 2022, the company has generated operating cash flow of USD 15.43 billion. In terms of free cash flow it was negative for the first time. This was due to investments in the construction of new production plants, as well as investments in upgrading existing ones. So I do not expect there to be negative free cash flow in the long term.

AMD $AMD

Here we also take a break from the market capitalization, which in this case is roughly $131 billion. So as we can see, both companies have very similar market capitalizations, and that's why I say we're going to break away from that. But what's different here is the results.

The company reported 2022 revenues of $23.6 billion. In terms of net income, the company reported a net profit of $1.32 billion here. Yes here the company has seen a growth in revenue over its competitor in the last year, but also at the same time it has seen a drop in net profit in this year.

As far as some of that debt is concerned, this company doesn't have a problem either. The ratio of total liabilities to equity here is less than 1. The company also has enough funds in current assets to cover its short-term liabilities in case of a problem. So everything is fine here too.

For the year 2022, the company has reported an operating cash flow of USD 3.57 billion. As for free cash flow, it was at USD 3.12 billion. The fundamental difference between Intel's negative free cash flow and AMD's positive free cash flow is Intel's capital expenditures.

What does this imply?

If we look at both companies, we find that both Intel and AMD have similar market capitalizations. That is, the market values both companies about the same. AMD is slightly better off, with a slightly larger market cap. What is striking, though, is the companies' results.

Even after the slump Intel is currently experiencing, it still generates more than double AMD's revenue, and nearly eight times AMD's net profit. Further, Intel generates nearly five times AMD's operating cash flow. The only thing in which Intel is worse than AMD is free cash flow, where Intel has had negative free cash flow for the last year, but we've already covered the reason.

How many times I hear how AMD is rolling Intel, how Intel is a dead company. Quite simply the numbers show something a little different. For AMD to roll over Intel, it would have to work hard enough to outperform Intel, which I don't think is in the cards anytime soon. In short, it is not realistic for AMD to be able to multiply its net profit back in a short period of time. In my opinion, there is simply so much bad sentiment around Intel that the market is valuing the company based on that sentiment and not giving as much weight to Intel's numbers. Yes, I realize that many investors will argue that AMD is overpriced, but I still don't think it's rational for Intel to be valued the same as AMD with these results.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.

Its some products are good and some are so so.