Analysis of Celanese Corporation, a company that delivers luxury results

Celanese Corporation is a company in the chemical sector that is delivering very solid results where we see long-term growth in sales, earnings and margins. But could the company be an interesting choice for your portfolio as well?

What is the company's business?

Celanese Corporation is a global chemical company that specializes in the manufacture and distribution of a variety of chemical products and materials for a wide range of industries. The main areas in which it operates include:

- The production of technical polymers such as acetates, polyamides and polyester fibers, which are used in the textile, construction, automotive and electronics industries.

- Production of industrial chemicals such as acetylene, acrylonitrile and formaldehyde, which are used as raw materials for the manufacture of plastics, pharmaceuticals, pesticides and other products.

- Production of specialty polymer materials such as copolyesters, thermoplastic elastomers and polyvinyl butyral films, which are used in the construction, automotive, medical and other industries.

Competitive advantages

Wide range of products: Celanese offers a wide range of products and materials, enabling it to cover the needs of different industries. This enables it to offer customers a comprehensive solution that covers multiple areas and reduces purchasing and logistics costs.

Innovative R&D: Celanese has a strong R&D department that focuses on innovation in chemical products and materials. In this way, it can offer customers improved products with better properties and performance.

International presence. This enables it to offer customers global solutions and provide benefits such as reduced logistics costs and faster delivery times.

Eco-friendly products: Celanese focuses on manufacturing eco-friendly products and materials that meet strict environmental standards and requirements. In this way, it can offer customers products with lower emissions and less environmental impact.

What kind of products do they even have?

Acetyl Products: this segment includes acetyl acetate, acetyldehyde, acetyl salicylate, acetic acid, and other acetylene-based products.

Material Solutions: In this category, the company offers thermoplastics, thermosets, rubbers, polymers, engineering plastics and other materials that find use in many industrial applications.

ETP (Engineered Materials). These are high performance materials such as Kevlar, impact resistant materials, puncture resistant materials and more.

Acetate fabrics: This segment includes cellulose acetates, which are used in apparel, coated textiles, etc.

Specialty Materials: This segment includes various specialties such as specialty polymers, additives, catalysts, and others.

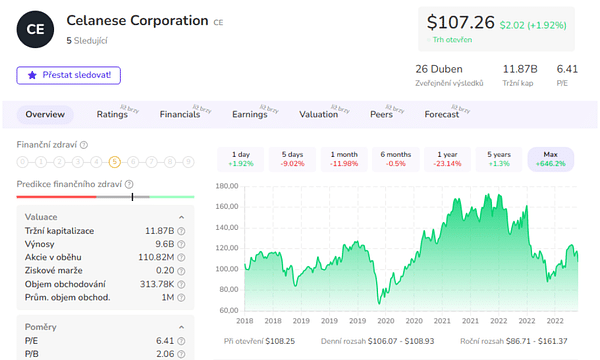

Celanese Corporation $CE

CE has a market capitalization of $11.89 billion and a P/E ratio of 6.4. This means that the company's stock is relatively cheap compared to the market average, which may be attractive to potential investors. The company's forward P/E ratio is 7.23, indicating that investors expect the company's earnings to grow modestly over the next year.

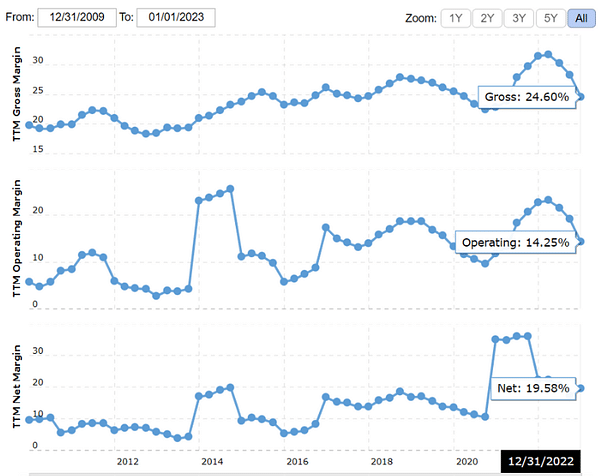

The company has good performance metrics, including high ROE (37.70%) and ROA (10.40%). While the company's revenue has grown by 9.5% over the past five years, EPS has grown by 20.5% during this time. The company also has a solid gross margin of 24.6%. Let's take a closer look 👇

A look at the financials

Revenue: we see that the company's revenue is gradually increasing. In 2022, it will reach $9.673 million, which is slightly higher than 2021 when it reached $8.537 million. Compared to 2020, revenues are even significantly higher, as they only reached USD 6.297 million then. The revenue development is therefore positive.

Gross profit: The company's gross profit has been around USD 2.3 to 2.4 billion in recent years. In 2022, it will reach USD 2.38 billion. This indicator should be reasonably high given the level of sales.

Net profit: The company's net profit has also been growing in recent years. In 2022, it will reach a value of USD 1.894 billion, which is significantly higher than in 2020, when it reached a value of USD 852 million. The development of net profit is therefore positive.

Earnings per share: Earnings per share (EPS) has also been increasing in recent years. In 2022, earnings per share were USD 17.34. This ratio should also be reasonably high given the level of sales and net profit.

EBITDA: The company's EBITDA has been around $2.1 billion to $2.5 billion in recent years. It will reach USD 2.175 billion in 2022. This ratio should be reasonably high considering the amount of sales and profit.

Margins

Balance sheet

Total Assets: The company's total assets have been gradually increasing, reaching a value of USD 26.272 billion in 2022. This is significantly higher than in 2021 and 2020, when they reached USD 11.975 billion and USD 10.909 billion respectively.

Total liabilities: the company's total liabilities are also gradually increasing, reaching a value of USD 20.167 billion in 2022. This is significantly higher than in 2021 and 2020 when they reached USD 7.438 billion and USD 7.014 billion respectively.

Shareholders' equity: the company's shareholders' equity is also increasing, reaching a value of USD 6.105 billion in 2022. This is significantly higher than in 2021 and 2020 when it reached values of USD 4.537 billion and USD 3.895 billion respectively.

Total capitalization: the total capitalization of the company has been gradually increasing, reaching a value of USD 19.010 billion in 2022. This is significantly higher than in 2021 and 2020 when it reached values of USD 7.365 billion and USD 6.753 billion respectively.

Total Debt: The company's total debt has been gradually increasing, reaching a value of USD 15.126 billion in 2022. This is significantly higher than in 2021 and 2020 when it reached values of USD 4.204 billion and USD 3.967 billion respectively.

Working capital: the company has positive working capital, which means it has more assets than liabilities. In 2022, working capital was USD 2.543 billion.

Analysts' forecasts

The 21 analysts offering 12-month price forecasts for Celanese Corp have a median target of 131.00, with a high estimate of 150.00 and a low estimate of 100.00. The median estimate represents a +21.95% increase from the last price of 107.42.

- How do you like the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.