The big crash of the banks disrupted all the market events and the debates about the market decline or growth went aside. But even the biggest economic event since 2008 didn't stop Larry McDonald from giving his eerily accurate answer.

Larry McDonald warns that U.S. stocks could plunge as much as 30% in the next two months as rising interest rates squeeze consumers and bored investors swap stocks for bonds.

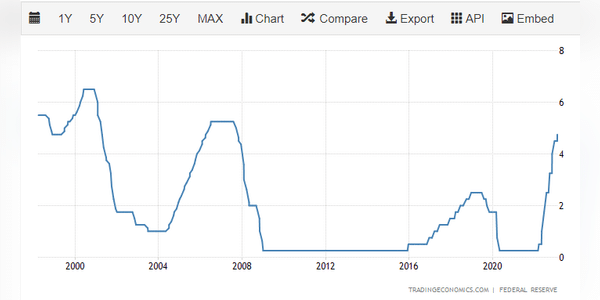

The founder of the Bear Trap Report said his set of 21 systemic risk indicators point to one of the highest probabilities of a stock market crash within 60 days. McDonald pointed out that the Federal Reserve has raised rates from near zero to 4.5% over the past year in an effort to curb historical inflation.

Higher rates increase borrowing costs and encourage saving at the expense of spending, which can help cool the pace of price increases. But they can…