These 2 stocks have only recently had IPOs, but analysts recommend buying them

IPO (Initial public offering) is something that has been lagging in recent years. Indeed, we see a significant decline here, where not many companies have IPO'd in the last two years. But that does not mean that we cannot find interesting opportunities here.

It's not an easy task to understand the stock market these days. The year started on an optimistic note, but after a downtrend that began in February, the S&P 500 is almost back to the level it was at when 2023 got underway. And these confusing and uncertain times have been reflected in the IPO market.

IPOs depend heavily on the predictability of available capital; whether it's cheap or expensive, companies and investors want certainty. And what we're seeing now is an extension of last year's historically low pace of IPO activity. In the U.S., there were 16 IPOs this February, raising a total of $2.1 billion. That's just a small fraction of historical norms - last year we saw 40 February IPOs, and in February 2021, a total of 138 IPOs raising $47 billion.

Despite the IPO slowdown, investors may still want to look for "Strong Buy" opportunities among this year's newly public stocks. That's why today we're taking a look at the 2 hottest candidates that analysts like. Both have a Strong Buy rating from Wall Street analysts and both offer investors double-digit upside potential. Let's take a closer look.

NEXTracker $NXT

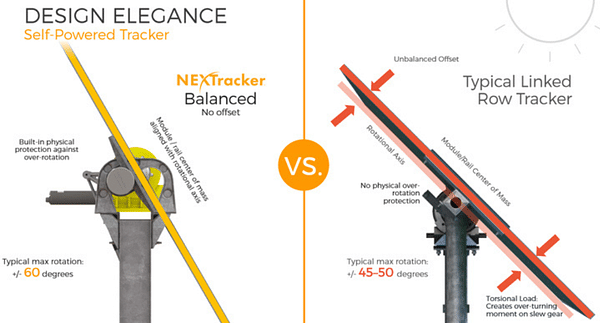

The first stock we'll look at is NEXTracker, a possible future leader in the global solar industry. The political push for green and renewable energy has opened up new vistas for companies capable of meeting the demands of the industry - and NEXTracker is doing just that, providing intelligent solar tracking systems and the software to support them to solar PV plants around the world.

NEXTracker's products enable PV plants to improve their performance through a combination of advanced control systems and data monitoring, and have made the company a global leader in the solar panel tracking niche. In total, NEXTracker has delivered tracker and software products that support more than 70 gigawatts of power.

🚨The systemshave proven themselves even in difficult terrain or extreme weather.🚨

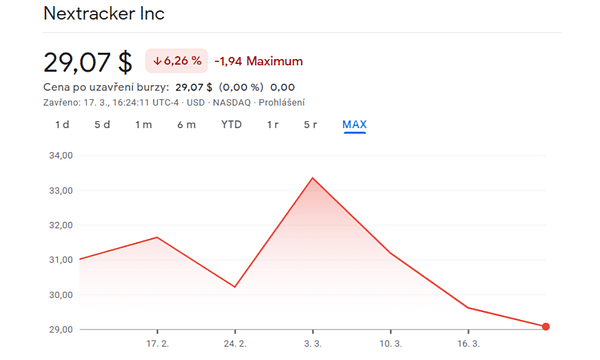

On February 8th of this year, NEXTracker announced the valuation of its IPO at $24 per share, with 26,600,000 shares of Class A common stock floated. This was an increased offering, with an initial price of $20 to $23. The company raised gross proceeds of $638 million, well above the $535 million it originally stated as its target. The stock debuted on the NASDAQ exchange on February 9.

In her NEXTracker coverage, Barclays analyst Christine Cho outlines a clear path forward for the company and explains why it offers strong opportunities for investors.

She writes:

"The case for solar is as attractive as ever and this long-term growth trend should continue: NXT is likely to be one of the key beneficiaries of growing global demand for renewable energy driven by 1) decarbonisation, 2) increased electrification and 3) rapidly falling costs, leading to an 8% CAGR in solar PV installations worldwide between 2022 and 2030. We expect NXT to maintain its dominant market share in the US and grow market share in the ROW as it takes share from fixed tilt systems."

Cho gives some numbers that support these comments, rating the stock Overweight (Buy) with a price target of $42.

The consensus rating of Strong Buy is based on 12 recent analyst reviews, which break down to 9 buys and 3 holds. The stock is selling for $29.07 and has an average price target of $39.67.

Skyward Specialty Insurance Group $SKWD

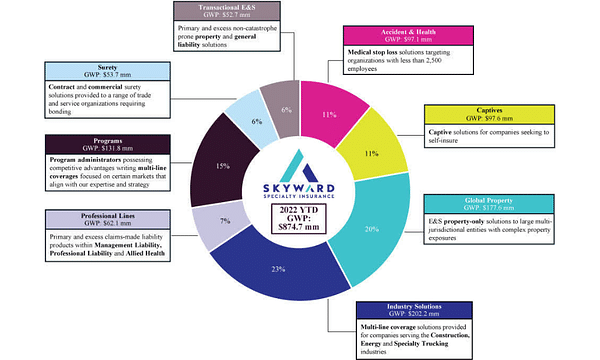

Starting with green energy, we'll focus on the insurance industry, where Skyward operates as a specialty insurance provider in the property and casualty segment. The company offers so-called liability policies for medical professionals, for industrial businesses, and for executives and professionals in a wide range of niches.

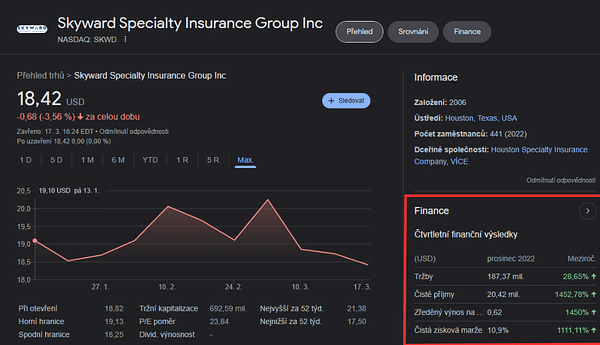

Skyward opened its initial public offering in early January, placing 4.75 million shares on the market directly, an additional 3.75 million shares on the market through existing shareholders, and granting underwriters options on an additional 1.275 million shares. The initial price was expected to be between $14 and $16 per share, and the stock opened for trading at a higher price of $18.90 apiece. A total of 10.29 million shares were sold in the IPO, which closed on January 18, well above the 9.775 million planned. The company raised approximately $134 million in gross proceeds from the sale, both for the company and the selling shareholders.

Since the IPO, the company has released some financial data that should be of interest to investors. Skyward had $879 million in gross premiums written and another $2 billion in assets as of September 30, 2022. In 4Q22, the results of which were reported in February, the company posted a net income of $20.4 million, up from just $1.3 million in 4Q21. The company's adjusted operating earnings for the quarter were 36 cents per share, up 56% year-over-year. Gross written premiums in 4Q were up 18% year-over-year.

Analyst Mark Hughes notes that Skyward is on a long-term upward trajectory and believes it can continue this trend into the future.

In his words:

"The company has generated 35% expansion in gross written premiums for continuing business over the past seven quarters and should sustain double-digit growth in the coming periods as it takes advantage of strong market dynamics and builds its footprint through new hires and expanded distribution... The company has a wide range of distribution resources that provide it with multiple options for continued growth and also protect it from volatility in any single area."

In light of these prospects, Hughes rates this stock a Buy, with a price target of $26.

All six recent Wall Street analyst reviews on Skyward agree that this new stock is one to buy, making the consensus rating a Strong Buy. The price target averages around $24.

- Interested in an IPO?

- How do you like these two stocks?

Please note that this is not financial advice. Every investment must go through a thorough analysis.