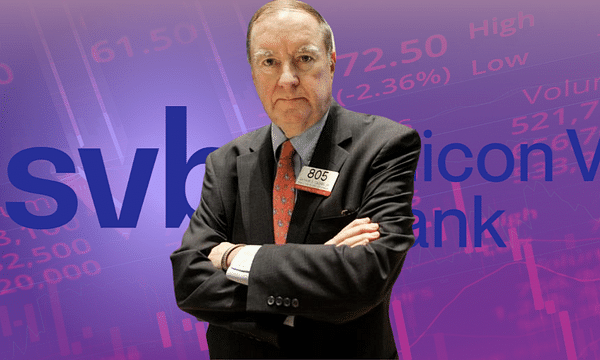

The market is on the verge of a Lehman Brothers-style event, says Wall Street veteran Art Cashin

Current events may be eerily reminiscent of 2008 and Lehman Brother's, says Art Cashin. The game, he says, is already in full swing, which may be piling on more and more problems.

Art Cashin, head of operations at UBS, said the market is heading for a Lehman-like event as the global banking crisis unfolds.

The veteran Wall Street trader said investors may be betting against big financial institutions after the collapse of Silicon Valley Bank and warned of an event comparable to the collapse of Lehman Brothers, which triggered the Great Financial Crisis in 2008.

"We're on the verge of doing what we did when Lehman Brothers got into trouble," Cashin said."

In the space of a week, Silicon Valley Bank and Signature Bank were seized by regulators, while Silvergate announced it was winding down operations and liquidating positions.

The panic extended to Credit Suisse, whose shares plunged 30% in a day after a major shareholder said it could not provide further financial support because of the regulatory cap.

Cashin said "the game is afoot" as some market participants may try to "agitate things as much as possible" for their own financial gain, rather than heeding the bailout and aid.

Opportunists could get a list of banks with the highest percentage of uninsured deposits, he noted, and influence stocks by drawing market attention to them.

"This is systemic. The Fed has forced many of these banks to reconfigure their portfolios," Cashin said, pointing to the U.S. central bank's rate hikes.

----

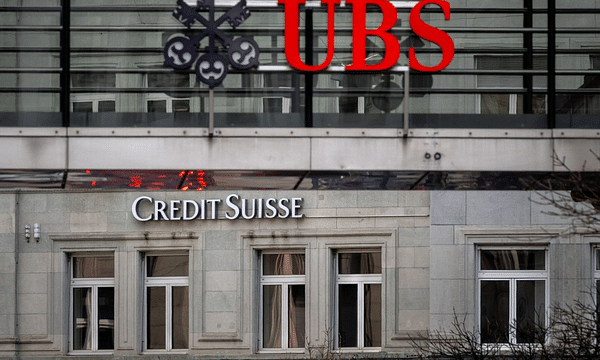

But things may be slightly better - UBS buys Credit Suisse

UBS has agreed to take over its longtime rival Credit Suisse for more than $3 billion, which regulators eager to stem a dangerous decline in confidence in the global banking system pushed through in the biggest banking deal in years.

The deal between the two pillars of Swiss finance is the first mega-merger of systemically important global banks since the 2008 financial crisis, when institutions across the banking landscape were broken up and merged with competitors, often at the behest of regulators.

The Swiss government has said it will provide more than $9 billion to cover some of the losses UBS may suffer from the CS takeover. The Swiss National Bank has also provided more than $100 billion in liquidity to UBS to help facilitate the deal.

Swiss authorities were under pressure to get the deal done before the Asian markets opened. They had to walk a fine line when they needed to get the boards of both banks to agree to the deal and avoid the alternative, a regulator-led liquidation of Credit Suisse, which could have proved more protracted and painful for the financial system.

- So Credit Suisse would have been resolved, what do you think will happen next? Will the banking sector recover?

- Will more cracks appear and perhaps contagion at other banks?

- What do you think of First Republic Bank, for example, which is flying like a roller coaster?

Please note that this is not financial advice.