Jeffrey Gundlach says a recession will hit in the next 4 months as big problems start to emerge

Clear signals combined with a number of problems lead Jeffrey Gundlach to believe that we will see a recession in the next 4-6 months at the latest.

Who is Jeffrey Gundlach?

Jeff Gundlach is an American investor and manager who specializes in bond management. He is known as the "King of Bonds" and is the founder of DoubleLine Capital, which manages bond investments. Gundlach is considered one of the most successful bond investors and his investment strategies are highly respected in the asset management industry.

"Bond King" Jeffrey Gundlach says a recession will hit in the next four months as the market is already starting to show signs of trouble.

"With everything that's going on, I think the recession will probably be here in four months," the DoubleLine founder said Thursday in a Twitter Spaces chat.

https://twitter.com/TruthGundlach/status/1639132944370663424

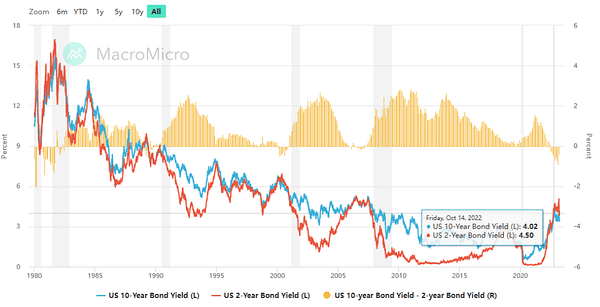

The bond market has been warning of a recession for months, with the 2-year yield surpassing the 10-year yield in October. The inversion of short- and long-term bond yields is a notorious predictor of a downturn, but Gundlach said he has shifted his time frame for the coming recession due to more yield moves stemming from the chaos of Silicon Valley Bank, which failed last week and was taken over by the FDIC in what was the biggest bank collapse since 2008.

Markets have lowered their expectations for interest rates in response, as Fed officials may hesitate to raise rates further to avoid putting more pressure on the financial system.

Expectations of lower rates caused a record two-day decline in the 2-year Treasury yield, which posted its biggest drop since 2008 on the day the JGB fell. It's another worrying sign of a coming downturn, Gundlach said.

"In all past recessions that last decades, the yield curve starts to deinvert a few months before the recession," he said in an interview this week. "At this point, when the de-inversion occurs, a 4-6 month time window starts to seem much more likely."

The Fed raised rates 450 basis points last year to bring down inflation, marking one of the most aggressive rate-hike cycles in history, which contributed to the SVB collapse by crushing the value of the bank's bond portfolio.

Please note that this is not financial advice.