2 interesting stocks from an extremely important sector that nobody cares about and everybody ignores

A sector without which the planet and humanity would not be where it is? It's fertilizers. Something so essential, yet so completely overlooked. Sound like the perfect investment opportunity?

It's only because of fertilizers that the human population has reached such numbers. Without them, it would be impossible to feed such a mass of people. And that's something that strikes the smart investor as the perfect defensive option - there will always be a need. And I bring you a pick on two stocks from this very sector!

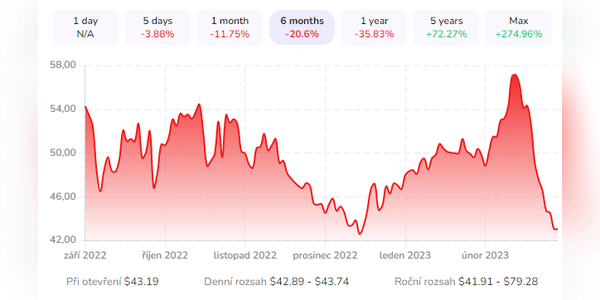

Mosaic $MOS3.4%

Mosaic is benefiting from strong demand for phosphate and potash, its cost measures, and higher prices as the market experiences the adverse effects of input cost inflation.

Mosaic is benefiting from strong demand and prices for phosphate and potash. Higher agricultural commodity prices and attractive farm economics are supporting fertilizer demand worldwide. Farm economics in most of the world's…