A well-known financial veteran and investor is worried that the long-term wild market situation will result in a super crash that could send a well-known index to half its value and cause investors tremendous pain. What is he basing this on?

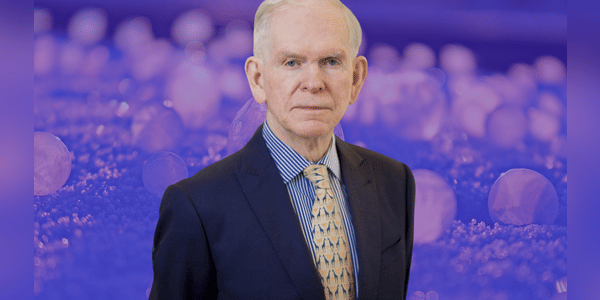

Who is Jeremy Grantham?

Jeremy Grantham is a British-American investor and the founder of GMO (Grantham, Mayo, & van Otterloo), an investment company that specializes in stocks and bonds. He is known for his pessimistic predictions about the markets and the world economy. Grantham was born in England and studied mathematics at the University of Sheffield and managerial economics at Harvard University. He then worked in various investment companies before founding his own company, GMO, in 1977.

Grantham is renowned for his long-term views on markets and his predictions about potential market bubbles and crises. In 2000, he predicted that the technology market bubble would soon burst, which it did. In 2007, he warned of a global financial crisis and its…