My guest for today's interview is Stanislav Cícha, a financial architect from Benefee International, with whom we will discuss investments, alternative investments, and his two favorite stocks.

Could you introduce yourself?

Hello to you and the readers, in my personal life I am first and foremost a husband to my wife and a father of two children, with whom we live happily on the border of Prague's Lesser Town and Smichov. I have a background in economics and information technology, which turns out to be a perfect combination that allows me a wide range of work. Apart from a very varied job, I am into sports, seek out good music and quality sound, and am interested in science and research, non-fiction, architecture, art and design. I love humor of all kinds, and I enjoy discovering exceptional wines and the charms of French cognac.

You'll probably be the first financial architect I interview. Can you elaborate a bit on what a financial architect does?

First of all, I would like to mention the other half of the team, my wonderful colleague Dasha Rozankova, whose vast experience and situational sense perfectly complement my analytical approach and long background in the IT sphere.

We have developed a methodology for our clients, which is the basis of our analysis and selection of the most appropriate strategy to achieve maximum or desired benefit. We combine elements that create synergies, combining the pleasant with the useful. The elements must not only stand firmly on the ground, but must support each other, and we pay great attention to this. I often feel a bit like a family doctor, our work doesn't end the moment the client leaves our "office", it is a long run, it requires perfect knowledge of the "terrain" and maximum trust, then comes maximum and results.

It is necessary to remember that you never build on a green field, no one is a blank sheet of paper, not even a newly born child, there are always links and connections, often very fundamental, and these you can either overlook, ignore or take into account and take into account.

Our solutions tend to be sophisticated, but at the same time as clear and understandable as possible for the client to feel comfortable with. You know the fairy tale about the three little pigs building houses? We are the third :-) We are perfectionists, we have high demands on ourselves and our clients, that's why they seek us out.

You are in the business of managing client portfolios, so I would like to know what you think an ideal investment portfolio should look like?

Yes, we do design and implement portfolios for clients, but more experienced clients naturally come in with a basic portfolio or a large portfolio that they are either not happy with or their situation has changed and it is appropriate to respond to that.

Some of them are really wrongly designed for their needs, others are just charged to the time of creation and do not correspond to the current situation. So, in order to speak concretely at all, we would first have to select the ideal investor; the answer would only make sense in that combination.

Nevertheless, I will try, perhaps a little more generally. We work with a very wide range of instruments, from equity ETFs, to bonds, to debt, to real estate, to precious metals/commodities and cryptocurrencies. An ideal portfolio should be well hedged first and foremost, i.e. it should not be the only funds at the client's disposal and should have a plan in case the portfolio fails for whatever reason - Covid, war in Ukraine, energy crisis or inflationary spiral.

It is not possible to go into detail here, but for the imaginary, well-funded long-term investor, I would recommend investing 30% of funds in the stock market today, especially in innovative technology and biotech ETFs, which are still very profitable at the moment in the post-Covid correction. Stable food companies and utilities, i.e. energy, water and waste management, should not be missed. Given the current geopolitical situation, I would also include the military and defense industries in the equity component. Of course, it is possible to settle for a proven index strategy, but we prefer to keep things more under control. I would like to stress here that in the case of equities, regular investment is also important to compensate for their volatility.

I would spread the full 50% into proven and long-performing qualified investor funds, where the investor is much closer to their investment than with equities, has the opportunity to see the production environment, see the technology, meet the people behind the individual funds and see the quality of the projects that will bring them profits in the years to come.

The remaining 20% is reserved for a combination of precious metals and cryptocurrencies, depending on the client's foundation. For precious metals I recommend a gold/silver/platinum combination, for cryptocurrencies currently only Bitcoin, here, as with equities, a strong recommendation for regular investment applies.

I saw on Linkedin that you also write about alternative investments. But are they also of any interest to the average retail investor? Or should they be considered at all?

Generally speaking, any well thought out investment is interesting, and today's world is changing so fast that conservative and alternative investments are starting to intermingle significantly in both directions.

In recent years, it has been the most conservative investments that have been the worst - whether I look at insured bank deposits, conservative supplemental retirement savings strategies or government bonds, all of which I would recommend to a client only in very specific cases, i.e. alternative investments. It's not too different with real estate, where thanks to expensive loans, high energy prices and upcoming tax changes, the stability of market value is also not entirely certain, not to mention liquidity.

If you are referring to cryptocurrencies, comparisons are again made with their conservative counterpart, the state currency. In the case of the state-owned Czech koruna, as well as the EUR or USD, continuous depreciation well above central bank inflation targets is virtually guaranteed for the next few years. Cryptocurrency is already a broad concept today and I am personally very sceptical about most projects, I only see sense in BTC, especially in the long term, because I believe that in the future it will be the basis of an extended global payment system.

We can also consider private equity funds as an alternative, there are many of them on the market today and it is far from easy to separate the wheat from the chaff. However, if chosen correctly, such an investment is safer and more profitable than, for example, equities, for which unpredictable market sentiment guarantees considerable volatility.

So what is most interesting in terms of returns in alternative investments?

As I mentioned earlier, Bitcoin can certainly be attractive in terms of returns, but it also poses significant risk, which is why it is not advisable for most retail investors to allocate more than 10% of their investment funds to it.

At the moment, I find the most interesting at the moment to be the Qualified Investor Funds (QIFs), which offer very interesting options with a favourable performance/risk ratio. We have been strong in this area for a long time, we have the insight, we know the background, we know who is behind the projects and we can secure top opportunities. I won't name specifics, but we are currently focused on energy and renewables, high value-added engineering, venture debt and a narrow group of quality real estate funds.

I'm sure as an investment strategist and portfolio manager you have some equities as well. For example, can you tell us which 2 stocks are your favourites and give reasons why they are attractive, what potential you see, etc.?

My heart is in biotechnology. This area is likely to bring innovations later this decade that have the potential to significantly change the way most of society lives. It will bring huge profits to many shareholders, but most will walk away with a net zero. So biotechnology is certainly an interesting but challenging and somewhat adrenaline-fuelled industry.

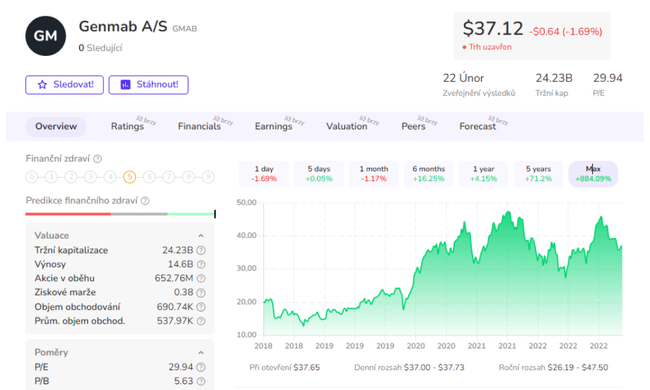

So, for all of us, I pick out of this box the Danish company Genmab, which is developing antibody drugs to fight cancer and other serious diseases. Genmab is no startup, with several approved drugs, solid revenues and over two dozen products in development for reputable big pharma companies. In addition to Genmab stock being approximately 40-50% undervalued right now, I expect earnings to grow 10-20% over the next few years.

The other popular headline is Norway's Kongsberg Gruppen, which is originally an arms company, but is now much broader in scope. In addition to producing sophisticated defense systems, it develops technologies for autonomous maritime transport, engages in space and ocean exploration, and operates a cloud-based digital ecosystem, enabling customers to efficiently process the vast amount of information that is generated in the operation of these sophisticated systems. The company's revenues are growing at approximately 10% per year, which is expected to continue this year. Personally, I see great potential in the expansion of unmanned shipping, several such ships already exist and the trend is clear. The company's traditional domain, the armaments industry, also looks promising, where I expect stable or growing sales thanks to the efforts of European NATO members to become less dependent on US capabilities. As icing on the cake, Kongsberg pays a dividend of around 3% of the current share price.

When you see the current market situation where banks are collapsing, do you change your investment strategy in any way? Do you adjust your portfolio to this?

Our strategies take into account that a sector will temporarily fail or get into trouble, as is the case now in banking or a year ago with technology titles. For long-term investors, such downturns can paradoxically be an opportunity for profitable accumulation. It can be a complication for those who have a specific short-term goal that they plan to follow through on. There, of course, we analyze specific cases and try to minimize losses.

At the moment, we do not see the situation in connection with the collapse of the banks as drastic. The failed banks operated in a very specific way, with a high proportion of risky assets. Credit Suisse of Switzerland has been cutting its throat for several years and the eventuality of its inglorious end has been largely priced in by the market.

- Did you enjoy today's interview? If so, be sure to follow us so you don't miss any more unique content. My guest today was Stanislav Cícha.

Please note that this is not financial advice.