Recently, I see the focus of investor attention here at Bulios on Medical Properties Trust, a stock that has been going through a rough patch. What happened? Is it as much of a problem as a lot of people are saying? You'll find out all about that in today's article.

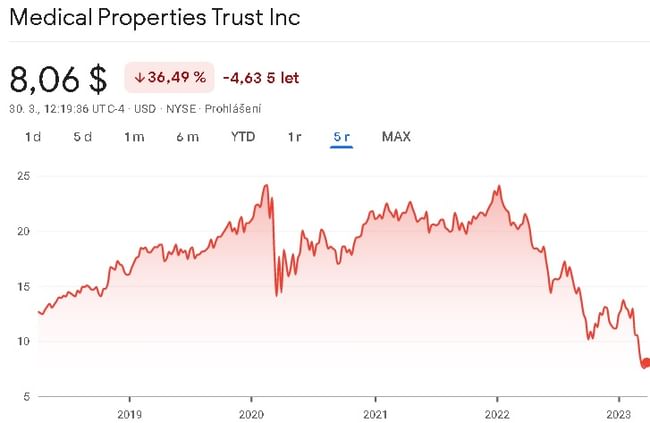

The stock value of Medical Properties Trust $MPW, a company that specializes in medical-related real estate, has been on a longer-term decline, recently dropping nearly 2% in one day. And that's based on recommendations from analyst Joshua Dennerlein of Bank of America Securities. Dennerlein downgraded MPW to Neutral and lowered the price target to $10 per share from the previous $13.

Recent events in the banking sector, including the collapse of Silicon Valley Bank SVB Financial Group $SIVB and the near-collapse of First Republic Bank $FRC, have negatively impacted some real estate investment trusts (REITs), including $MPW. Rising interest rates are making financing more expensive for REITs that rely on bank loans. In addition, $MPW is facing internal issues such as the bankruptcy of one tenant and another tenant that is several months behind on rent payments.

MPW's market capitalization is $5 billion with a dividend yield of 15.08%. This may be attractive to some investors, but the current challenges and risks associated with investing in $MPW must be considered.

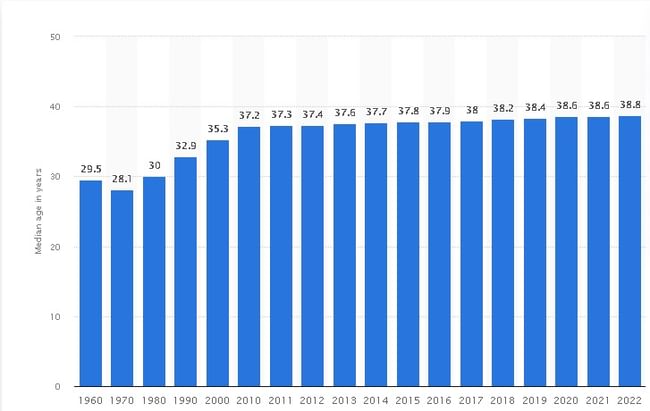

On the other hand, the U.S. population is aging, increasing the demand for medical care and stays in facilities operated by REITs. This trend suggests that the long-term outlook for companies like MPW may be positive if they can overcome current obstacles.

So let's do some summarizing. and say, is there anything to worry about, or is the current panic surrounding this company overblown. When we look at the statements, we see that despite all the problems, the company generated the same amount of revenue as it did in 2021. It didn't see revenue growth, but it didn't see a decline either. In spite of all the negative influences, the company recorded a year-on-year increase in net profit of around 38%. But what I find most important in REITs is funds from operations (FFO), where the company, even through all the headwinds, has seen FFO grow by about 4% year-over-year . Yes some may argue that this is low, but if the company was in more serious trouble with its tenants, this item would certainly not be growing. The company's debt level also seems fine to me personally. So let us summarise.

Challenges for Medical Properties Trust:

- Rising Interest Rates: Interest rates are currently on the rise, which means financing is more expensive for REITs like MPW. This factor can have a negative impact on the company's profitability.

- Banking sector in volatility: Recent problems in the banking sector, such as the collapse of Silicon Valley Bank SVB Financial Group and First Republic Bank, are causing uncertainty in real estate financing. This situation may limit MPW's ability to obtain new loans or refinance existing debt on more favorable terms.

- Internal Issues: MPW is experiencing some internal issues, such as the bankruptcy of one tenant and another tenant who is several months behind on rent payments. These problems can lead to reduced revenues and affect the financial health of the company.

Opportunities for Medical Properties Trust:

- Aging Population: the U.S. population is aging and the demand for medical care and stays in facilities operated by REITs is increasing. This trend may provide long-term opportunities for companies like MPW if they can overcome current obstacles.

- Portfolio Diversification: MPW could consider diversifying its portfolio by focusing on properties in other areas of healthcare, such as laboratories, medical offices or rehabilitation centers. This could reduce the risk associated with fluctuations in certain segments of healthcare.

- Strategic Partnerships and Acquisitions: MPW could seek strategic partners or make acquisitions that would expand its footprint and improve its financial performance. This could strengthen its competitiveness in the marketplace and increase its value to investors.

- Investing in technology: Companies like MPW could invest in advanced technology and infrastructure to improve operational efficiency and reduce operating costs. This would give them a competitive advantage and keep pace with changing customer needs.

Medical Properties Trust (MPW) shares are facing current challenges such as rising interest rates, instability in the banking sector and internal issues. However, long-term trends such as the aging U.S. population and growing demand for medical care suggest the company could have positive prospects in the future. Investors who are willing to weather the current sentiment storms and believe in the company's long-term potential may consider investing in $MPW stock as a discounted play on these trends.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.