After a promising start to the year, a cloud of anxiety and uncertainty has settled over Wall Street. The Federal Reserve is trying to strike a balance between controlling inflation and avoiding a banking crisis that could lead to a decline in stock valuations and exacerbate the coming recession. In short, the problems are still many, which is why analysts have created a selection of the top 3 stocks to hold in the coming recession.

After a turbulent final quarter of 2022, stocks have rallied strongly this year with renewed hopes that inflation has peaked, the Federal Reserve will move away from its rate hike mode, and any recession that might occur will be muted by the robust wage growth and savings that U.S. consumers have accumulated during the pandemic.

However, three months later, and in the wake of the biggest banking crisis the US has experienced since the 2007 recession, this optimism has diminished considerably and a cloud of anxiety and uncertainty hangs over Wall Street.

Now the Fed is trying to strike a delicate balance between controlling runaway inflation and ensuring that the banking crisis does not bleed into other sectors. This task is daunting because any credit crunch could have huge implications for private capital, private lending and commercial real estate ventures. This could lead to a fall in stock valuations and exacerbate the coming recession.

"The central nervous system of the economy, which is the financial system, is going to be more cautious," Nanette Abuhoff Jacobson, global investment strategist at Hartford Funds, said in a recent interview.

"Caution means they will lend less, and that means consumer and business activity will slow. That in itself will cause a slowdown in the U.S. economy, but it's likely to have a broader domino effect," she said.

As many analysts are concerned about the future, they are picking quality dividend stocks that will provide investors with at least some stability and steady income in the form of dividend payments even in a recession. So this is Morningstar analysts' top picks 👇

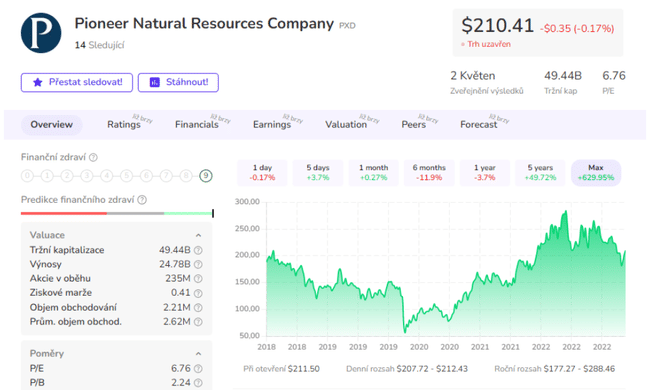

Pioneer Natural Resources $PXD

Pioneer Natural Resources is an American company that is engaged in the exploration, production and sale of oil, natural gas and other energy commodities. The company focuses on production in oil fields in Texas and the Permian Basin, one of the most important oil producing areas in the US. In addition, Pioneer Natural Resources is also engaged in research and development of new technologies for oil and gas production, which includes the use of horizontal drilling and hydraulic fracturing.

The company has a dividend yield of 12.95%, and has been paying a dividend since 2012, growing 119% over the past 5 years. Analysts say that despite extensive investment, the company has generated sufficient operating cash flow in recent years that could be used to cover dividend payments, so there is less risk of being at greater risk during a recession.

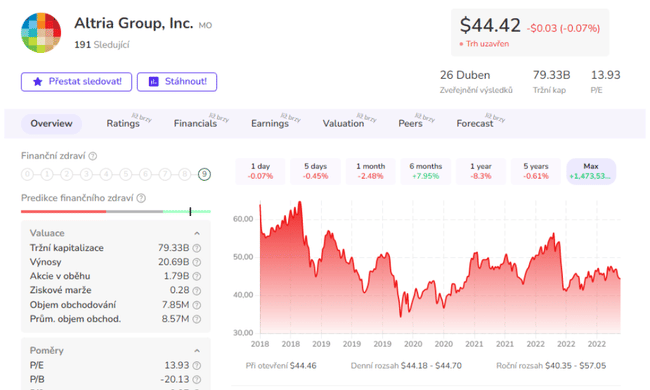

Altria Group $MO

Altria Group is a U.S. company that focuses on the manufacture and sale of cigarettes, cigars, electronic cigarettes, and other tobacco products. The company is the largest cigarette manufacturer in the U.S. and also owns several other brands such as Marlboro, Parliament, Virginia Slims, Benson & Hedges, and others. In addition to tobacco products, Altria Group is also involved in the production and sale of wine and various alcoholic beverages through its subsidiary Ste. Michelle Wine Estates.

The company pays a dividend of 8.46%, and is a steady player that has been paying and increasing its dividend for over 50 years, growing by over 7% in the last 5 years.

Based on recent cash flow figures, Altria Group appears to have sufficient operating cash flow to maintain and continue paying dividends. The biggest risk here is possible regulation and reduced demand, but that may well be an issue in another x years, so I wouldn't worry at this point and would hold the tobacco company comfortably in a recession.

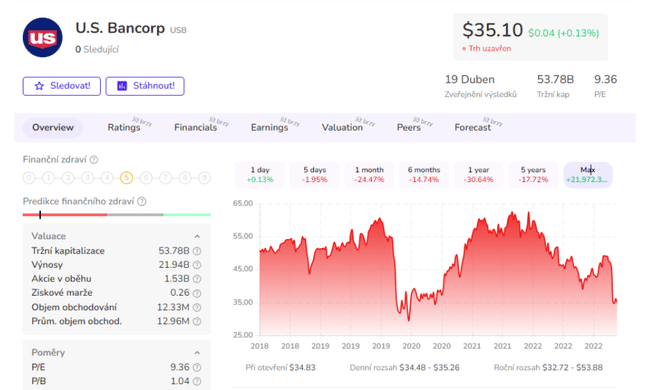

US Bancorp $USB

US Bancorp is a US financial services company that is engaged in the provision of banking and financial services. The company's primary activities include lending, mortgage and credit card origination, wealth management, investment services, and retirement fund management. US Bancorp also operates a network of ATMs and provides securities trading services.

The company is one of the largest banks in the U.S. and provides its services to individuals as well as small businesses, corporations, and government agencies. U.S. Bancorp is also committed to corporate social responsibility and supports a number of charitable and non-profit organizations.

The company pays a dividend of 5.47%, and has been paying it for over 10 years, with a 10% increase in the last 5 years. Based on recent cash flow figures, US Bancorp appears to have sufficient operating cash flow to maintain and continue to pay dividends. In addition, the company is generating positive free cash flow, which means it has enough cash to fund investments in its business as well.

- What do you think of the analysts' picks? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.