Here we have an analysis of another car parts retailer that is special because it is one of the biggest players, but one that does not only operate in the US like most of its competitors, but also in other countries. Let's take a look at it.

AutoZone $AZO is an American company that sells automotive parts and accessories. The company operates a chain of stores across the United States, Puerto Rico, Mexico and Brazil and also offers online shopping. AutoZone's product line includes brake pads, filters, spark plugs, oil, radiators, lights, tires, and many other auto products. The company was founded in 1979 and is based in Memphis, Tennessee.

AutoZone is interesting for several reasons:

- It is thelargest seller of replacement parts for cars and trucks.

- AutoZone also strives to innovate and improve its services and offerings for customers. For example, the company offers fast online ordering with in-store pickup within an hour!

- It may be irrelevant to some, but AutoZone supports the community and charities. In 2020, the company donated more than $15 million to charity.

- International Expansion: AutoZone began expanding into international markets in 1998 and has gradually expanded into other countries such as Brazil. This sets it apart from most U.S. parts retailers, as many of them focus only on the domestic market.

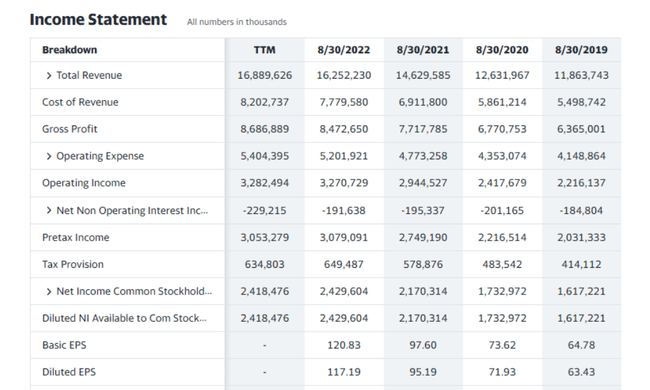

Finance

In an analysis of AutoZone's financial ratios, it can be seen that the company maintains a high level of profitability with high gross profit margins and net profit margins. AutoZone also has a very high return on invested capital, which means that the company is creating high value for its shareholders.

So as you can see, the last few years (despite the pandemic where many of these dealerships were losing sales), we've seen growth in sales, net income and EPS.

Balance Sheet

According to AutoZone's balance sheet data, you can see that the company has a high level of total assets with $15.275 billion as of August 30, 2022. This asset size has been increasing since 2019, which is a result of the company's good performance and growth.

The company's total liabilities (including minority interests) are $18.813 billion as of August 30, 2022, a significant increase from 2019. The company also has a high level of debt with total debt of $9.296 billion as of August 30, 2022.

Cash Flow

Over the past four quarters, AutoZone has achieved total operating cash flow of $3.219 billion and free cash flow of $2.496 billion. This means that the company has been able to generate enough cash from operations to cover its capital expenditures and still have enough cash to invest in the company's growth.

The company's financial cash flow was negative in the last four quarters with a total of -2.455 billion dollars, which includes the purchase of treasury stock and debt repayments.

Overall, AutoZone has a strong cash flow performance and has been able to generate sufficient cash to fund its operations, investments and company growth.

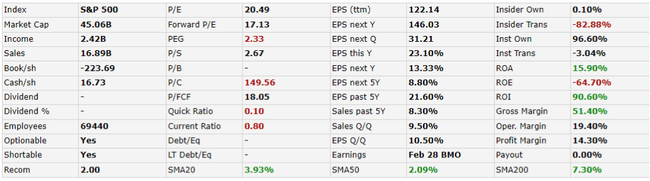

Based on this data, AutoZone appears to be doing well, with positive results over the past year and year-to-date, while also having decent margins. However, it has a high P/C ratio and negative ROE, which is not good. Next, I don't really like the PEG of 2.33, meaning the company's stock is relatively expensive compared to earnings growth.

- If anyone is more interested in the company, I would also look at the Insider Trans column (-82%).

Analyst estimates

The 21 analysts offering 12-month price forecasts for Autozone Inc have a median target of 2,750.00, with a high estimate of 2,899.00 and a low estimate of 1,890.00. The median estimate represents an increase of +9.82% from the last price of 2,504.14.

- What do you think of the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.