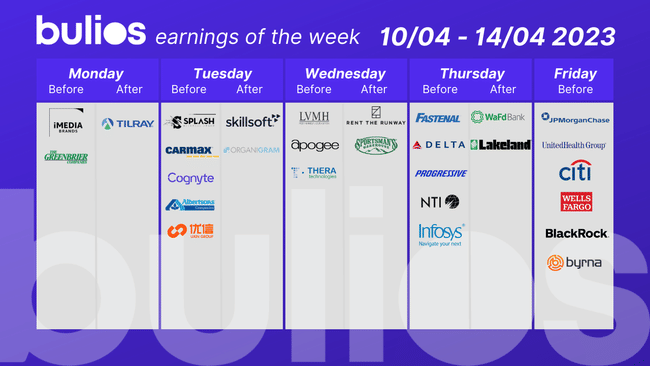

I would sum up next week as 2 days of boredom, then LVMH and then on Friday a series of interesting results kicked off by the banks. First of all JPMorgan, City, WellsFrago and BlackRock Investment Corporation. So we have a lot to look forward to!

What do analysts expect from these companies?

JPMorgan $JPM

JPMorgan Chase is expected to deliver year-over-year earnings growth on higher revenue after releasing results for the quarter ending March 2023.

The company is expected to post quarterly earnings of $3.40 per share in its upcoming report, representing a year-over-year change of +29.3%. Revenue is expected to be $35.37 billion, up 15.2% from the previous quarter.

Citi $C

Citigroup is expected to deliver a year-over-year decline in earnings on higher revenue after releasing results for the quarter ending March 2023.

The U.S. bank is expected to post quarterly earnings of $1.67 per share in its upcoming report, representing a year-over-year change of -17.3%. Revenue is expected to be $19.92 billion, up 3.8% from the previous quarter.

Wells Fargo $WFC

The market expects Wells Fargo to report a year-over-year increase in earnings on higher revenue after releasing results for the quarter ending March 2023.

The largest U.S. mortgage lender is expected to post quarterly earnings of $1.16 per share in its upcoming report, representing a year-over-year change of +31.8%. Revenue is expected to be $20.33 billion, up 15.6% from the previous quarter.

BlackRock $BLK

Wall Street analysts expect a year-over-year decline in earnings on lower sales. Specifically, the investment company is expected to post quarterly earnings of $7.90 per share in its upcoming report, representing a year-over-year change of -17%. Revenue is expected to be $4.24 billion, down 9.9% from the previous quarter.

UnitedHealth Group $UNH

Wall Street expects year-over-year profit growth due to higher sales. Specifically, the largest U.S. health insurer is expected to post quarterly earnings of $6.25 per share in its upcoming report, a year-over-year change of +13.8%. Revenue is expected to be $89.43 billion, up 11.6% from the previous quarter.

- Whose results do you care about? Let me know in the comments!