Bath & Body Works is the largest retailer of body care products in the U.S. with over 20% market share. The company operates a network of 1,700 stores and successfully focuses on high-margin and seasonal products that appeal to all types of customers.

Bath & Body Works is an American retail chain specializing in cosmetics, fragrances and body care products. The company operates more than 1,700 stores throughout the United States and Canada and is a subsidiary of L Brands.

Bath & Body Works dominates the body care market in the U.S. with a market share of approximately 20-25% (it is the 3rd largest player in the sector). Its main competitive advantage is its wide range of private label products with a favourable price/performance ratio, including brands such as Signature Collection, Aromatherapy and C.O. Bigelow. Bath & Body Works specializes in scented products such as aromatic candles, body lotions, shampoos, shower gels and products made from natural ingredients.

Some of the best-selling and most popular products include scented candles, aromatic body lotions and Christmas edition products. Bath & Body Works has a very strong Christmas season, realizing about 40% of its full-year sales, which is fascinating, but in a way it can be a risk component.

The company works closely with the Henrietta Lacks Sisters organization, which supports African-American women with cancer. As part of this collaboration, Bath & Body Works regularly holds fundraisers in its stores and donates a portion of the proceeds from the sale of select products to support the organization.

In recent years, Bath & Body Works has focused on strengthening its online sales and customer loyalty program. The goal is to reach younger generations of customers and maintain a high share of the competitive market for body care products. The company expects e-commerce growth to help further strengthen its position.

Risks

Bath & Body Works faces several risks that may threaten its business:

In recent years, many new brands have emerged in the market with natural cosmetics and eco-friendly products. This trend poses a risk that Bath & Body Works' customers will shift to alternative brands that they perceive as more environmentally and health friendly. While Bath & Body Works is also expanding its natural product offerings, it faces strong competition from new brands in this growing market.

Another risk is a slowdown in the retail market and a decline in footfall in brick-and-mortar stores, which would negatively impact Bath & Body Works' sales. The company is heavily dependent on sales through brick-and-mortar stores, although e-commerce has been growing recently.

Bath & Body Works' dependence on seasonal sales is also a risk. Roughly 40% of the company's sales are made during the Christmas season. If the Christmas season is weaker due to economic conditions or other factors, this could significantly reduce the company's annual sales and profits.

Finance

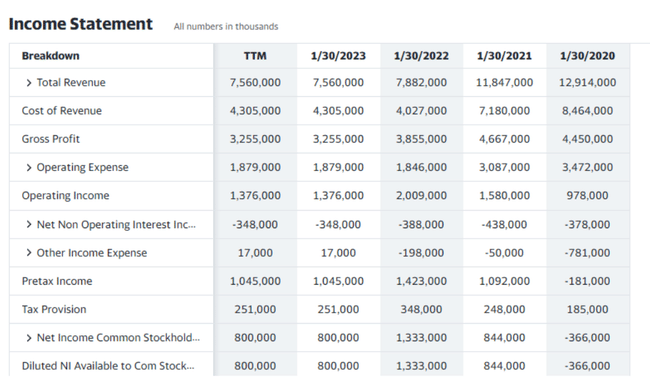

From Bath & Body Works' results over the past 5 years, we see a downward trend in terms of sales and fluctuations in net income. This is due to weaker than expected demand in the 2020-2021 period.

The company's gross profit grew in 2019 and 2020 due to rising sales, but has been gradually declining since 2021, while the company's operating expenses are relatively stable at around $1.8-1.9 billion per year.

Overall, Bath & Body Works has a stable and profitable business model but is largely dependent on sales through brick-and-mortar stores. E-commerce growth and expanding product offerings present opportunities for the company's continued growth, while store closures and slowing retail sales are major risks.

Balance Sheet

Bath & Body Works' balance sheet shows that the company has a strong balance sheet structure and liquidity. The company's total assets are around $6-12 billion, most of which are current assets, mainly inventory and accounts receivable.

Bath & Body Works' total liabilities are also high, around USD 7-12 billion per year. Most of the liabilities are current liabilities such as accounts payable. The firm's long-term liabilities are around USD 1-3 billion per year and consist mainly of loans and borrowings.

Bath & Body Works' equity is negative, which is due to the fact that the company regularly buys back its own shares. Excluding treasury shares, the company has equity of around USD 2-3 billion.

Working capital, the difference between current assets and current liabilities, is consistently positive at USD 0.9-2.8 billion. This indicates the company's ability to pay its short-term liabilities.

Bath & Body Works' net debt, the difference between loans and cash, is USD 2.5-4 billion per year. The ratio of net debt to operating EBITDA is low, around 1-2x, which is a conservative level of debt.

Overall, Bath & Body Works has a strong balance sheet structure with ample liquidity and moderate debt. The company generates stable operating cash flow, which allows it to pay down debt and fund growth investments. Given the high seasonality of its sales, a strong balance sheet and liquidity are key. Bath & Body Works is financially well equipped to weather short-term demand fluctuations and deal closures, as happened in 2021.

The company's strong balance sheet and liquidity are its strengths. Its high reliance on seasonal sales and bricks-and-mortar sales remains a key financial risk. Another potential risk is the possibility of rising interest rates, which would increase Bath & Body Works' debt service costs. However, overall, the company is in very good financial shape.

Cash Flow

According to the cash flow statement, Bath & Body Works generates stable and strong operating cash flow. Over the past 12 months, the company has generated operating cash flow of $1.8 billion. This cash flow comes mostly from an after-tax profit of $800 million adjusted for non-cash items such as depreciation and amortization.

BBWI's investing cash flow is negative as the company regularly invests in its brick-and-mortar store network and logistics. Over the past year, investment cash flow was -$328 million. The key item was capital expenditure of USD 351 million.

BBWI's financial cash flow was also negative last year, at USD -1.6 billion. This was mainly due to the repurchase of treasury shares for USD 1.3 billion. In addition, the company repaid USD 135 million in loans and borrowings and paid USD 105 million in dividends.

The company's free cash flow, i.e. cash flow after investments but before financing, was USD 1.5 billion in the last 12 months. This strong free cash flow demonstrates BBWI's ability to generate cash from operations after it has already funded investments to sustain and grow the business. The company uses this cash flow to pay down debt, pay dividends and repurchase shares.

Bath & Body Works' total cash position at the end of the period was $1.2 billion. The company therefore has a significant liquidity cushion, which gives it financial flexibility. BBWI's strong cash flow and cash position are a distinct advantage that allows the company to fund operations, invest for growth and return capital to shareholders through dividends and buybacks even in the event of temporary sales declines.

Based on these fundamentals and comparisons to peers, it appears that BBWI stock may be undervalued.

However, BBWI's main risk remains its heavy reliance on brick-and-mortar stores and seasonal sales. The company realizes 40% of its sales during the holiday season, so any weakness could significantly reduce full-year results. Competition from new natural cosmetics brands and possible store closures due to further waves of the pandemic are also risks.

Overall, BBWI appears to present an attractive investment opportunity for long-term investors. The company has a stable and resilient business model, a strong balance sheet and generates healthy cash flow. While the share price may fluctuate significantly in the short term depending on seasonal factors, the company is fundamentally sound and has the potential for further growth. Thus, for investors seeking stable dividends and the potential for long-term capital appreciation, BBWI may be attractive.

Analysts' predictions

The 18 analysts offering 12-month price forecasts for Bath & Body Works Inc have a median target of 48.00, with a high estimate of 76.00 and a low estimate of 35.00. The median estimate represents an increase of +26.85% from the last price of 37.84.

- What do you think about the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.