Today we will look at a very interesting sector that analysts believe has a promising future. This stems from various moves by governments, and also from the overall set-up of society. In fact, there are 2 stocks in this sector that Morgan Stanley analyst Andre Percoco likes.

The green energy economy is experiencing steep growth, with social and political factors encouraging a shift from traditional fossil fuels to sustainable and green energy sources. This trend offers investment opportunities, particularly in clean energy. Andrew Percoco, an analyst at Morgan Stanley, sees potential in renewable energy and recommends two stocks with 100% growth potential or more.

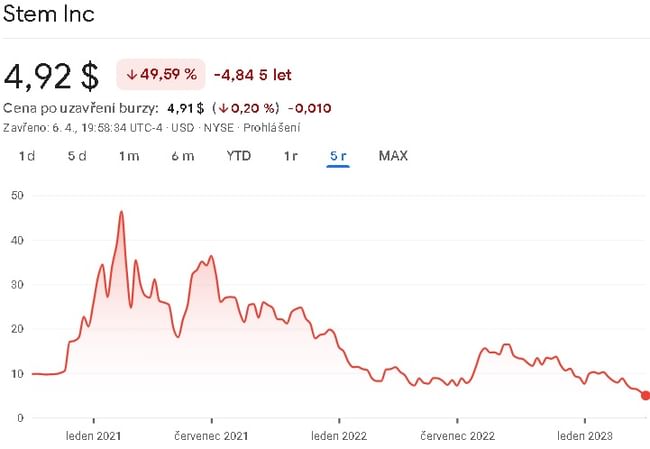

Stem, Inc. $STEM

The first of these stocks is Stem, Inc. $STEM, an innovative clean energy company that combines renewable energy, energy storage and artificial intelligence. Stem offers smart battery systems and an AI-powered platform that optimizes the connection between on-site power generation, grid power and stored energy. The company's customers can save up to 30% on their energy costs.

Stem's Athena platform is considered the most widely used system in its class. Its artificial intelligence has been trained over a long period of time, making it the most efficient software of its kind. The platform is available worldwide and operates in 75 jurisdictions. Stem estimates that its addressable market could reach $1.2 trillion by 2050.

Stem is already showing strong growth, with revenues of $363 million in 2022, a 186% year-over-year increase. Morgan Stanley's Andrew Percoco sees Stem stock as an attractive investment with 103% upside potential.

We continue to view STEM's software-focused strategy as a favorable way to play the energy storage market, and as a long-only growth driver that is vastly undervalued at the stock's current 20% discount to other energy storage stocks... We view STEM as a key beneficiary of the improving battery supply chain and see an attractive cross-selling opportunity between its legacy storage equipment and solar monitoring.

As we can see, Percoco is not alone in expecting significant upside in this stock. It was recently joined by 8 analysts who agreed on a target price of $13.63 per share.

Sunnova Energy International $NOVA

The second recommended stock is Sunnova Energy International $NOVA, a leader in solar energy. Sunnova handles all aspects of the solar installation process, from installing rooftop panels to connecting home power systems to energy storage. Sunnova also provides back-up services for its products, repairs, modifications and parts replacements as needed, and even assistance with financing and insurance.

Sunnova operates in 40 U.S. states and Puerto Rico and has more than 130,000 customers. The company expects to reach $1.1 billion in revenue in 2023, a 37% year-over-year increase. With its growth and broad portfolio of solar services, Sunnova is becoming a major player in the renewable energy industry.

Andrew Percoco of Morgan Stanley sees Sunnova Energy stock as an attractive investment with 100% upside potential. Percoco also emphasizes that the transition to clean energy is essential to combat the climate crisis and reduce greenhouse gas emissions. Thus, investing in green energy represents not only a financial opportunity, but also a means to promote sustainability and environmental protection.

We like NOVA's exposure to a significantly underpenetrated market (4% of U.S. households) with strong long-term growth prospects. There are several near-term risks, including a potential long-term slowdown in demand due to policy changes in California and its exposure to a potentially volatile financial environment that could put pressure on the stock. That said, we see this as an attractive buying opportunity for those willing to accept short-term volatility as the stock trades below the value of its existing assets.

Here again, we can see that Percoco is not a go-getter when it comes to this company. He was recently joined by 12 other analysts who agreed on a price target of roughly $33 per share.

Conclusion

The transition to clean energy and the growing demand for renewable energy-based technologies is creating room for further innovation and expansion. It is important to note that investing in green energy stocks can carry certain risks, such as market volatility and regulation, which can affect the market value of companies. However, progressive investors looking for long-term growth and sustainability opportunities should consider investing in companies such as Stem, Inc. and Sunnova Energy International.

Given the ever-growing interest in green energy and its role in combating the climate crisis, it is likely that investments in renewable energy will continue to gain traction. The significant growth in the shares of Stem and Sunnova demonstrates the market's focus on sustainable energy sources and technologies.

Going forward, we can expect the green energy sector to continue to grow and gain in importance. Governments, businesses and individuals are becoming increasingly aware of the need to switch to sustainable energy sources and reduce greenhouse gas emissions. This trend is likely to continue, allowing for further growth and expansion of companies such as Stem and Sunnova, and providing investment opportunities for those looking to support sustainable development and combat the climate crisis.

As a conclusion, green energy investments present a unique opportunity for those looking to combine financial gains with support for sustainable development and environmental protection.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.