Banks are about to turn off the credit taps. In response to rising interest rates and fears of an economic slowdown, lending standards are tightening, making it harder for consumers and businesses to access credit. For some borrower groups, especially those with lower incomes, credit is becoming almost unaffordable. This trend could escalate into a wider credit crunch affecting the whole economy.

Obtaining credit has become more difficult since the US Federal Reserve began to raise interest rates. In addition, the recent banking crisis has raised fears that credit standards will tighten even further, which could lead to a potentially damaging credit crunch.

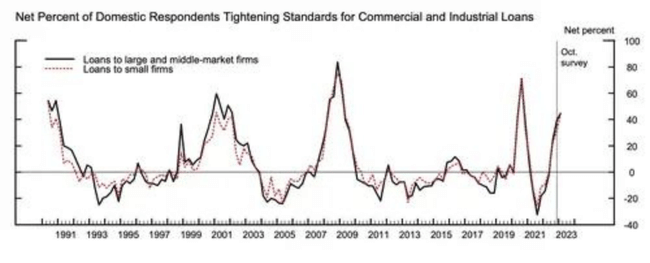

According to a Federal Reserve survey of senior loan officers, nearly 45% of banks made it more difficult for businesses to obtain commercial and industrial loans in the fourth quarter of 2022. The $2.8 trillion C&I loan market helps businesses buy equipment and hire employees. Measures taken by banks included raising minimum credit scores and minimum payments and reducing loan limits. Moreover, this tightening occurred even before the "explosion" of Silicon Valley Bank and Signature Bank.

Since lending is a vital part of economic growth, investors are watching how banks and other lenders avoid risk. A Federal Reserve Bank of Dallas survey released last week gave markets a snapshot of what has happened at regional financial institutions since the bank collapse. Lending to consumers has fallen and lending standards and conditions have "continued to tighten sharply" with a significant increase in the cost of credit.

"The credit crunch has begun," Torsten Slok, chief economist at Apollo Global Management, said in response to the Dallas Fed report.

So what does a tighter credit environment look like for borrowers? According to a 2014 document on the Federal Reserve's website, the credit crunch is "a dramatic deterioration in firms' and consumers' access to bank credit."

Banks have two main concerns, said Brett House, a professor of professional practice in economics at Columbia Business School. The first is whether borrowers facing higher interest rates can afford to repay and service their loans. The second centers on the bank's ability to maintain liquidity so that if depositors pull their money out, they have the cash to meet those demands.

This sets the stage for banks to protect liquidity, which can lead to greater hurdles for potential borrowers and spill over into a credit crunch.

The Fed's survey found a significant net increase in banks raising lending standards for credit card loans, and a slight tightening of requirements for auto and other consumer loans.

"There is no hard and fast regulatory rule on these things. Each bank will apply these lending standards differently."

The median consumer credit score is 700, so loan applicants with that score or higher should get approved for land and get competitive rates, he said. Slok said banks may also require and look for a long employment history, a solid or higher income level and consider whether they have long-term relationships with potential borrowers.

"It may mean that you have to have a higher income and a better history to assure the bank that if you lose your job, get sick or see some other dip in your income that you have assets that you can pull out to keep up with the loan payments," he said.

"Tighter lending standards can have a big impact on adjustable-rate loans versus fixed-rate loans, said CFRA equity analyst Alexander Yokum. The average mortgage rate paid by most Americans "barely rose" when they bought homes before the start of the Fed's latest rate cycle.

Note that this is not financial advice.