The banking crisis is definitely the biggest event of recent years. A situation that has caused panic and billions of dollars of damage. It seems to have died down for a while and no one knows what to expect. Except for the CEO of JPMorgan, who is convinced that there is no longer anything to worry about. Why?

The good news is that JPMorgan Chase CEO Jamie Dimon, who is often seen as the voice of the financial industry, believes that the effects of the crisis are probably over - even if the Fed doesn't cut rates. Could more bank failures be coming? "I don't know," Dimon said on television Thursday. "But if they do, frankly, it's not a problem. I think we're getting close to the end of this particular crisis."

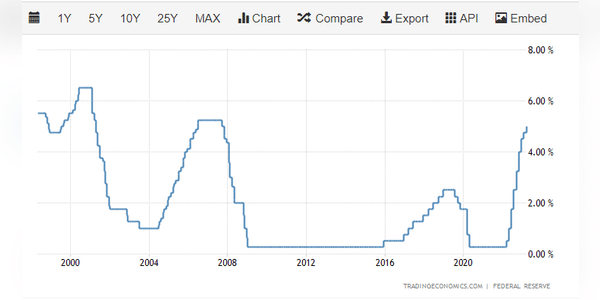

Dimon reiterated his view that the problems that led to SVB's collapse were obvious and should have been noticed by bank management. He said everyone in the industry knew about the dangers of rising interest rates and uninsured…