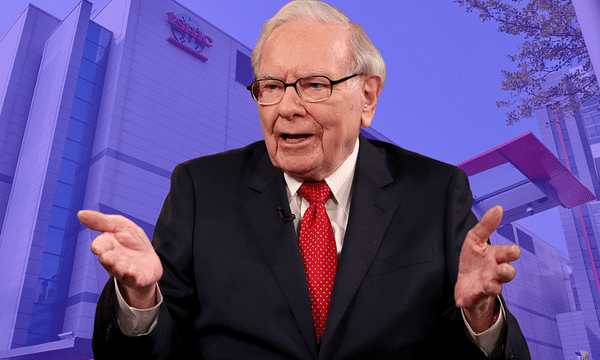

Warren Buffett finally gives his reason for divesting TSMC stock

Warren Buffett gave the reason why he sold TSMC stock to $TSM. Although the move was considered surprising from a man known for long-term bets, Buffett explained his investment calculations in an exclusive interview with Nikkei Asian Review.

Warren Buffett says geopolitical tensions were a major "factor" in the decision to sell Berkshire Hathaway's majority stake in Taiwan-based global chipmaker TSMC.

Buffett, 92, delved into the investment challenges during an interview Tuesday with Japan's Nikkei news agency. He was quoted as saying that TSMC is a well-run company but that Berkshire has "better places" to deploy its capital.

In February, Berkshire Hathaway announced that it had sold 86% of its TSMC shares, which it had purchased for $4.1 billion only a few months ago, a move that many people did not understand given its attention to the long term.

The size of the purchase suggests that the initial purchase was likely made by Buffett himself, rather than one of his portfolio managers, according to various agencies.

TSMC is considered a "national treasure" in Taiwan , supplying semiconductors to tech giants including Apple and Qualcomm. It makes the world's most advanced semiconductors in bulk, components vital to everything from smartphones to washing machines. The company is considered so valuable to the global economy and to China - which claims Taiwan as its own territory even though it has never controlled it - that it is sometimes even referred to as part of a "silicon shield" against a potential military invasion by Beijing! The presence of the TSMC is seen as a strong motivation for the West to defend Taiwan against any attempt by China to conquer it by force.

In recent weeks, tensions have increased in the Taiwan Strait after China simulated "joint precision strikes" on the island during a series of military exercises. Beijing began the drills on Saturday, a day after Taiwanese President Tsai Jing-wen returned from a 10-day visit to Central America and the United States, where she met with House of Representatives Speaker Kevin McCarthy.

While we can only speculate on this, it has also long been expected that demand in this sector would cool, which may have been one of the reasons for the Buffett sale. This was also confirmed to us during the quarterly report.

Chipmaker TSMC, Apple's main supplier, forecast a 16% drop in sales for the second quarter of the year as consumers grapple with excess inventory while a weakening global economy clouds the demand outlook.

The world's largest chipmaker, Taiwan Semiconductor Manufacturing, said industry inventory levels are currently higher than expected and will "export to healthier levels" in the third quarter.

"As we move into the second quarter of 2023, we expect our business to continue to be impacted by further customer inventory adjustments," Chief Financial Officer Wendell Huang said after TSMC reported the smallest quarterly earnings growth in nearly four years.

However, TSMC is investing for long-term demand despite the current softness in the market, CEO C.C. Wei said.

The chipmaker expects its business to bottom out in the second quarter and pick up after that, matching the improved outlook projected by iPhone maker Apple, Nvidia and Advanced Micro Devices, some of TSMC's biggest customers.

- What's your take on TSMC and the potential conflict or cooling of demand?

Please note that this is not financial advice.