MGM Resorts is a gambling industry giant that owns an impressive array of iconic casinos and resorts in Las Vegas and around the world. Now the company is still recovering from the pandemic, with its debt load more than doubling in recent years. Still, MGM is returning to revenue growth and generating decent cash flow to invest in business development, pay down debt and return funds to shareholders.

MGM Resorts $MGM International is one of the largest casino and resort operators in the world. The company operates luxury casinos and hotels primarily in Las Vegas, but also in other destinations in the U.S. and China.

MGM owns and operates some of the most iconic casinos in Las Vegas such as the Bellagio, MGM Grand, Mandalay Bay and The Mirage. As a result of this concentration, the Company owns a dominant share of the Las Vegas casino gaming market. MGM, however, is best known for the luxurious experiences it offers its guests, whether it is in terms of accommodations, food, nightly entertainment or gaming.

MGM's competitive advantages include a strong brand, extensive property portfolios in attractive locations, and loyalty programs that help attract repeat guests. In addition, the Company seeks to maximize revenue from non-gaming activities such as shows, nightclubs, bars, restaurants, shops and conferences.

In the future, MGM plans further expansion in Asia, particularly in Japan and Korea. It also wants to invest in technologies such as augmented and virtual reality that could enliven the guest experience. Another growth area is sports betting, which MGM enables online and in brick-and-mortar locations. The company aims to become a global leader in entertainment and hospitality.

MGM Resorts has several key plans and initiatives for the future:

1. Expansion in Asia - The company sees great potential for growth in Asia, particularly in Japan and Korea. MGM already operates a casino in Macau and plans to open new facilities in Japan when gaming regulations there allow foreign operators to enter.

2. Augmented and virtual reality - MGM is investing in the latest technology to enhance the guest experience. It plans to introduce virtual reality into its casinos and hotels, which could attract younger generations of gamblers.

3. Online betting growth - The company is expanding into online betting and sports betting, which is gradually being legalised in the US. MGM has entered into partnerships that will allow it to expand its betting operations into other states. Online betting is a promising industry and can supplement revenue from brick-and-mortar locations.

4. Increasing the share of non-gaming revenues - MGM is trying to diversify its revenues away from gaming to other sources such as concerts, shows, shopping, bars, restaurants and conferences. The goal is for non-gaming activities to account for at least 50% of total revenues.

5. Acquisitions of smaller companies - MGM regularly considers and executes smaller acquisitions that allow it to expand into new markets and acquire new brands and properties.

Finance

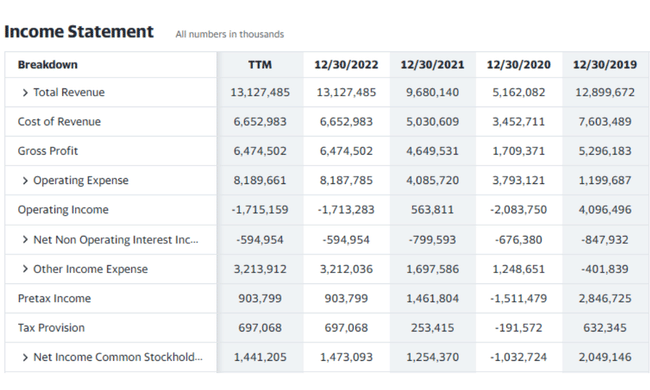

MGM Resorts' financials show that the company has been hit hard by the COVID-19 pandemic in recent years. In 2020, total revenues have declined 60% to $5.16 billion and net income has declined more than 50% to a loss of more than $1 billion.

Then in 2021, MGM began to recover as economies reopened and restrictions were eased. Revenues rose to US$9.7 billion, although they still remained below pre-pandemic levels. Net profit returned to positive numbers, reaching USD 1.3 billion.

For the 12 months to the end of Q3 2022, revenues continued to grow to USD 13.1 billion. Net profit increased to USD 1.4 billion, but still fell short of pre-COVID levels.

However, we see that operating expenses grew slower than revenue, which helped improve operating margin. MGM continues to struggle with higher debt, which reached USD 17 billion at the end of Q3, while interest expense is weighing on net income.

Balance Sheet

MGM Resorts' balance sheet shows that the company has significantly increased its debt during the COVID-19 pandemic. Total debt has increased by more than 120% to $33.9 billion from the end of 2019 to the end of Q3 2022. Most of the debt is bonds, loans and operating leases.

Despite the increase in debt, MGM also saw its total assets grow 36% to $45.7 billion, mainly due to acquisitions and investments. The value of property, plant and equipment was USD 21.7 billion.

Shareholders' equity decreased by 58% to USD 5.4 billion during the period, reflecting losses during the pandemic and higher debt burdens.

Working capital of USD 3.6 billion provides the company with some financial flexibility. However, the ratio of total debt to EBITDA climbed to 5.8x, indicating that the company is relatively highly leveraged. MGM's ability to pay down debt and invest in growth could be limited if its profitability does not improve.

MGM will need to focus on debt reduction once operations fully recover. This will be key to maintaining financial stability and flexibility going forward. The gradual recovery of MGM's key markets and the growth in profit margins should help generate free cash flow to repay debt.

Cash Flow

In 2020, the company generated operating cash flow of $1.5 billion as their facilities were closed or partially operational while their capital expenditures declined to $270 million.

In 2021 and for the 12 months to the end of Q3 2022, the situation has improved due to the gradual opening up of the economies. Operating cash flow and operating cash flow reached US$1.4 billion and US$1.8 billion, respectively, although still below pre-pandemic levels.

However, financial cash flow remained negative as MGM paid down debt and repurchased its own shares. Total cash at the end of 2022 then increased slightly to USD 6 billion.

On the positive side for MGM, it is once again generating positive operating and free cash flow. This allows it to invest in growth, pay down debt and return value to shareholders. However, higher investment in post-pandemic operations and relatively strong debt may continue to constrain cash flow.

MGM currently trades at a price-to-earnings (P/E) ratio of 38, signaling that the stock is relatively expensive relative to earnings. However, future earnings growth should lower this ratio. By comparison, the average P/E in the casino and resort sector is 19.

A price-to-sales (P/S) ratio of 1.27 indicates that the market value is equivalent to 1.27 times trailing 12-month earnings. This is lower than the industry average of 2.2, which may indicate that the stock is relatively cheap relative to earnings.

A price-to-book value (P/B) ratio of 3.56 indicates that investors are paying $3.56 per $1 of book value. This is higher than the industry average of 2.4. Thus, from an asset perspective, MGM is not cheap.

MGM generates an operating margin of 11% and a net margin of 11% as well. Return on assets (ROA) is 3.2% and return on equity (ROE) is 28.2%. These are satisfactory indicators, albeit below the industry average.

The company pays a minimal dividend as cash flows are directed more towards debt repayments and investments, but at least a little is returned in forms other than share buybacks. However, the debt/equity ratio of 1.84 is relatively high, which poses a risk.

Analysts' expectations

The 15 analysts offering 12-month price forecasts for MGM Resorts International have a median target of 57.00, with a high estimate of 68.00 and a low estimate of 47.00. The median estimate represents an increase of +27.06% from the last price of 44.86.

- What do you think of the company? 🤔

Please note that this is not a financial advisory service. Every investment must go through a thorough analysis.

MGM Resorts: recovering gambling giant bets on growth and new technology