Elon Musk touched on many topics during Tesla's recent earnings call, one of which was the lack of lithium refining capabilities. Since lithium is an essential component of electric vehicle batteries, there is an unmet need for refined lithium in the electric vehicle industry.

Lithium Americas (LAC)

Lithium Americas is engaged in the mining and refining of lithium and has great growth potential ahead. While still in the pre-production phase, LAC fully owns the Thacker Pass mine located in northern Nevada, which is its top asset given that it boasts the largest lithium reserves in the US. This makes the mine a valuable resource for the burgeoning electric vehicle industry, which needs premium li-ion batteries. In addition, LAC also holds full ownership and joint venture agreements for high-purity lithium mines in Argentina.

Although Thacker Pass is an interesting project, production is still a long way off and is scheduled to begin in 2026. The company announced the start of construction work in early March.

However, on its recent Q4 earnings call, the company said construction at its Cauchari-Olaroz mine in Argentina is "substantially complete" and production is expected to begin before the close of the first half of 2023. The company said it needs additional capital expenditure of less than US$50 million to achieve production and positive cash flow. LAC expects to reach full production of 40,000 t/y (tonnes per year) of lithium carbonate in the first quarter of next year.

In assessing the company's prospects, it is the long-term potential of the Thacker Pass mine that is at the heart of Blanchard's positive thesis.

"Given the asset portfolio and strategic geographic exposure to Argentina and the US, we maintain a Buy rating on LAC," the Deutsche Bank analyst said, "We are positive on management's ability to develop the Thacker Pass mine, although we recognize the inherent challenges inherent in this asset as it is a clay-based deposit." Nevertheless, Thacker Pass is a ~80ktpa hydroxide project in the US that should be very valuable to the US domestic lithium market."

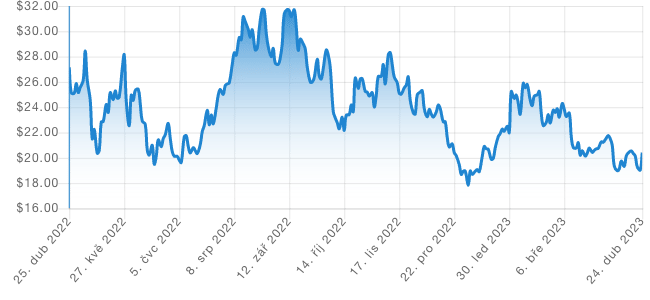

This Buy rating is backed by a target price of $26, and if met, would represent an annualised share price appreciation of 36%..