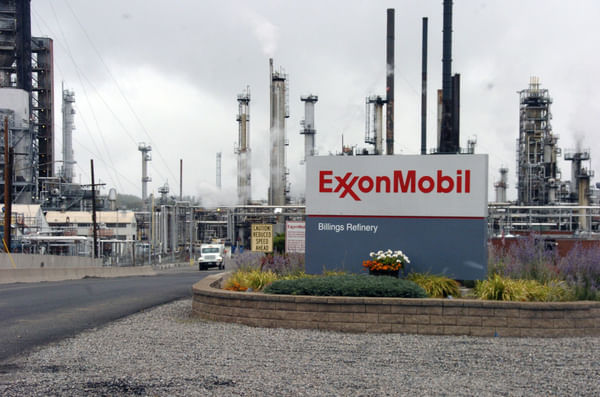

Exxon and Chevron results and assumptions

Exxon posts record first-quarter profit on higher production

Exxon Mobil ($XOM-0.2%) on Friday posted a record first-quarter profit that was more than double the year-earlier figure and beat Wall Street estimates as rising oil and gas production overcame a drop in energy prices from high levels.

Oil companies are riding this wave of relatively higher oil and gas prices, with profits benefiting from strong demand and cost cuts related to efforts to counter the Covid-19 shutdowns three years ago.

"We delivered record results in the first quarter even though energy prices and refining margins softened somewhat," Chief Financial Officer Kathryn Mikells said in an interview.

She said strong production growth was the biggest contributor to the better-than-expected earnings. Exxon's quarter was driven by new crude and fuel volumes thanks to the start-up of new offshore projects and refinery facilities.

Its revenue rose to $11.43 billion, or $2.79 a share, compared with $5.48 billion a year ago, which included a write-down for the Russia exit.

Its oil and gas production rose by nearly 300,000 barrels per day (bpd) compared with a year ago levels, excluding asset sales and the Russia exit. Last year's results included a $3.4 billion after-tax write-down of Russian oil and gas interests.

The increased production reflects a 40% increase in production in the Permian Basin in Texas and in Guyana, where the company brought on stream a second drilling platform last year that increased production by about 240,000 barrels a day. The higher volumes partially offset a 16% decline in oil prices from the previous year.

Capital Structure

Valuation / Dividends

Capital Eff. / Margins

The first quarter results also reflect an expansion in fuel production. The company completed the startup of a new crude oil processing unit at its Beaumont, Texas, plant last quarter, which increased refining capacity by 250,000 barrels per day.

The producer ended the first quarter with $32.7 billion in cash, but Mikells said it has no urge to use it for mergers or acquisitions.

Exxon would be open to transactions that could offer synergies and provide good returns for shareholders, she said. However, it is focused on increasing production in the Permian Basin, Guyana and expanding the Beaumont refinery, among other things, Mikells said. "We're really focused on making sure we execute on these organic opportunities."

Chevron beats estimates and boosts first-quarter profit despite oil price drop

Oil company Chevron ($CVX-0.3% ) beat market expectations Friday as it boosted first-quarter profit, with refining gains offsetting declines in energy prices and oil and gas production.

Net income rose 5% to $6.57 billion, or $3.46 per share. That compares with the Wall Street consensus, which projected the same profit of $3.38 per share, according to data from Zacks Investment Research.

The company's strongest sector was oil refining, where higher margins helped boost revenue more than fivefold to $1.8 billion.

However, its upstream oil and gas division saw a 25% drop in net profit due to a large year-over-year decline in prices.

Brent crude, the global benchmark for oil, traded at an average of $82 a barrel in the first three months of the year, down 16% from a year ago and down 7% from the fourth quarter.

"Brent prices are high, yet relatively low. But you still see mid double-digit returns," Chief Financial Officer Pierre Breber told Reuters, referring to the return on invested capital.

The second-largest U.S. oil company ended the quarter with $15.8 billion in cash, down 12% from a year ago but about $10 billion more than it needs to run the business, Breber said.

Big oil companies are holding on to more cash in case of an economic slowdown and to be ready if there is a new wave of consolidation.

"The intent is to have cash return to shareholders steadily over time," Breber said, adding that Chevron will only pursue transactions that are beneficial to shareholders.

"We're still looking," he said when asked if Chevron is discussing acquisitions. "And we have a very high bar because we don't have to close any deals."

Capital expenditures jumped 55% to $3 billion from a year earlier, mainly due to investments in U.S. projects.

Chevron is increasing production in the United States while cutting it in other countries. Total production fell 3% from a year earlier to 2.98 million barrels of oil and gas per day due to contract expirations in Thailand and the sale of shale lands in South Texas.

The decline was partially offset by a 4% increase in production in the Permian Basin, the largest shale basin in the U.S. The company is also bringing a new platform onstream in the Gulf of Mexico.