Lake Resources NL is exploring and developing lithium brine projects in Argentina. Despite suffering a loss of A$5.7 million in the last financial year and a loss of A$2.8 million in the last 12 months, it has managed to cut its losses and come close to achieving profitability, which has not escaped analysts.

"I think now is a good time to take a look at how Lake Resources NL $LKE is doing because it looks like it could be on the cusp of a big run, says analyst Bell Potter."

Lake Resources NL is exploring and developing lithium brine (a concentrated solution of lithium salt and other salts) projects in Argentina. Despite suffering a loss of A$5.7 million in the last financial year and a loss of A$2.8 million in the last 12 months, it has managed to cut its losses and move closer to profitability.

"Given that the path to profitability is what Lake Resources investors are thinking about, we decided to gauge market sentiment. Below we provide a summary of mining and metals industry analysts' expectations for the company."

Analysts expect the company to suffer a terminal loss in 2024 and report a positive profit of A$20 million in 2025. The company is therefore expected to reach profitability in approximately 2 years. What rate of year-on-year growth will the company need to achieve to become profitable in that timeframe? Using a range of best case scenarios, an average annual growth rate of 79% is calculated, which is rather optimistic! If the company grew more slowly, it would become profitable later than expected.

We won't go into the specific situation of Lake Resources, but note that metal mining and processing companies have rather erratic cash flows that depend on the natural resources mined and the stage the company is in. That said, high growth rates are not uncommon, especially if the company is currently in the investment phase.

Analyst Bell Potter says the stock is a buy with 300% upside potential available to investors. What will propel Lake Resources' share price up 300%? Bell Potter has a speculative buy recommendation on Lake Resources stock with a 12-month price target of $2.52. That implies a 309.8% upside for investors buying ASX lithium shares today. It's welcome news for shareholders who have suffered many blows recently. These include a falling share price, softening lithium prices and a bearish outlook for the commodity.

The company also continues to face a sustained attack on short selling from US activist group J Capital. Finally, with no production planned until 2024, Lake Resources' shares may attract less investor support than producers such as Allkem Ltd (ASX:AKE), Pilbara Minerals Ltd (ASX:PLS) and Core Lithium Ltd (ASX:CXO).

Its flagship Kachi project is due to start production in 2024. In 2023, Lake Resources announced two conditional offtake agreements for 50,000 tonnes of lithium carbonate per year, factors that will propel the company. Bell Potter likes the look of these deals. Here's their latest commentary on Lake Resources:

"LKE has announced ... two conditional agreements with a combined of 50 ktpa lithium carbonate (LC) offtake and a 20% equity placement. WMC Energy (Netherlands) and SK On (Korea) have signed a 10-year offtake of 25 ktpa LC from LKE's Kachi project. Both companies are expected to invest 10% equity in LKE; WMC at US$1.20 per share and SK On at an agreed 20-day VWAP. Both agreements are subject to the release of a definitive feasibility study for Kachi, successful operation of the Lilac demonstration plant, completion of LKE's financial due diligence and formal documentation and approval."

Lake Resources (ASX:LKE) is interesting for several reasons:

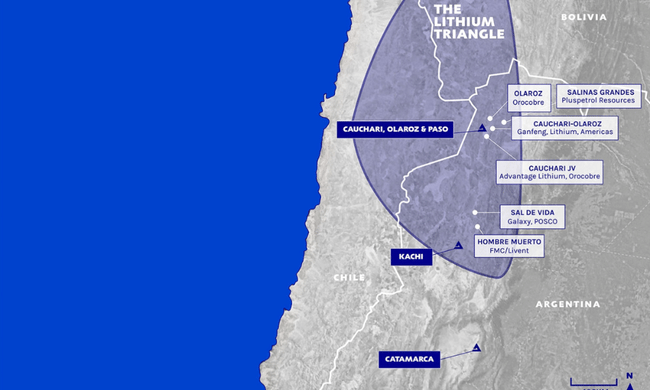

1. Owns large scale lithium brine resources - Lake Resources owns the Kachi, Olaroz and Cauchari lithium brine projects in Argentina with total reserves of 4.4 Mt of lithium carbonate equivalent. Its Kachi project is one of the largest undeveloped lithium brine projects in the world with an estimated resource of 1.1 Mt of lithium carbonate equivalent.

2. Innovative extraction technology - Lake uses innovative lilac solutions technology to environmentally extract lithium from brines. This technology uses ion exchange instead of traditional evaporation, resulting in high purity, low cost and low environmental impact.

3. Strong demand and customers - Lake Resources has already announced two conditional supply agreements with WMC Energy and SK On for the supply of 25,000 tonnes per annum of lithium carbonate from the Kachi project. This indicates strong interest in their future production.

4. Excellent growth potential - With a target share price of $2.52 from brokerage firm Bell Potter, Lake Resources has a growth potential of over 300% for investors. As projects progress to production, the company should be well positioned to achieve this price target.

5. Recent Progress Announcements - Lake Resources recently announced the completion of a definitive feasibility study for Kachi, a significant milestone. It also announced the results of new drilling at Kachi, which confirmed an extensive and high-grade lithium resource.

- What do you think of the company? 🤔

Please note that this is not a financial advisory. Every investment must go through a thorough analysis.

Do I understand correctly that they mine the lithium brine and use it to produce the lithium needed to make batteries? Looks interesting and I'll definitely put the company on my watch list.

I'd say it's more of a speculation than an investment. Relying on something is not a good thing, but their plans don't look bad overall.