REITs are very popular among dividend investors. So today, let's take a look at 3 REIT companies that are not so well known among investors, but at the same time offer high dividend yields.

Real estate investment trusts (REITs) present attractive investment opportunities for investors seeking higher levels of income from investment portfolios. REITs are required to distribute 90% of their taxable income to shareholders in the form of dividends, often resulting in high dividend yields of 5% or more. However, investors should carefully assess the fundamentals of these funds to ensure that high yields are sustainable and keep in mind important factors such as dividend safety, valuation, governance, balance sheet condition and growth. In this article, we look at three REITs with high dividend yields.

Brandywine Realty Trust $BDN

Brandywine Realty Trust is a commercial REIT that focuses on the acquisition, development, ownership and management of office, mixed-use and retail properties. The company is primarily involved in the office real estate segment in select growth markets such as Philadelphia and Austin. These areas are characterized by strong job growth, innovative industries and demographic trends that are driving demand for office space.

Fourth-quarter results showed that occupancy in the portfolio fell from 90.8% to 89.8%, while FFO per share fell from $0.36 to $0.32. Despite the slight decline in performance, analysts say Brandywine Realty Trust remains an attractive option for investors looking for high dividend yields combined with the potential for capital growth. The company offers an incredible dividend yield of 17.6%.

- Brandywine Realty Trust's advantages include the ability to benefit from positive growth in its target geographies and an experienced management team that is focused on maximizing shareholder value.

- Disadvantages of this company may include sensitivity to changes in economic conditions in their target markets and competition with other office REITs and real estate owners.

As the REIT faces maturing debt, it must issue new debt at high interest rates. Because of these headwinds and high debt loads, the stock has plunged 47% in the past 12 months to a 13-year low. Due to the high interest expense, management has provided guidance of FFO per share in 2023 of $1.12-$1.20.

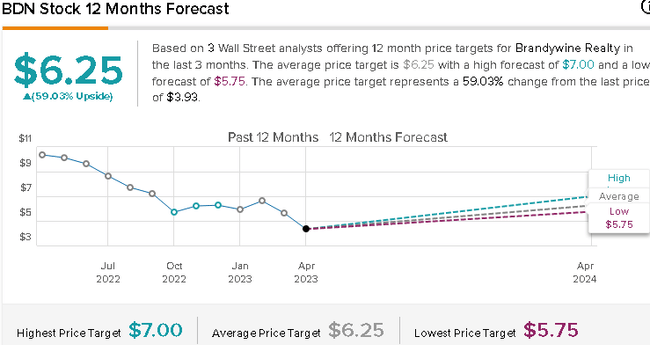

As we can see, despite these headwinds and the current office building situation, analysts see the share price trend quite positively. The average price target of analysts who have recently looked at the company is $6.25.

Uniti Group $UNIT

Uniti Group is an infrastructure REIT that specializes in investing in communications assets such as fiber optics, wireless towers and other communications infrastructure. Their portfolio consists of over 6.7 million fiber miles and 675 towers in the United States. The company provides services to telecommunications carriers that use their infrastructure to deliver broadband access and other technologies.

Fourth quarter results included consolidated revenues of $283.7 million, down 3.2% year-over-year, and $0.44 per share in AFFO. Uniti Group represents an attractive opportunity for investors seeking exposure to the communications infrastructure sector, which could benefit from growing demand for broadband access and other technologies. The company also pays dividends, with a dividend yield of 18.3%.

- Uniti Group's key advantages include growing demand for communications infrastructure and stable revenues from long-term lease agreements with telecom operators.

- Disadvantages may include regulation of the telecommunications industry, which can affect costs and operating practices, and dependence on a few key customers, which increases risk in the event of changes in customer relationships or the performance of those customers.

Uniti's fibre optic assets are critical infrastructure in the regions in which it operates and therefore the REIT should enjoy relatively stable cash flows in the face of a recession. The main source of total returns will be a combination of its stable cash flow business model and multiple expansion to offset the current deep discount in the stock. Given Uniti's low payout ratio, strong growth and the critical recession-proof nature of its assets, the dividend looks safe for the foreseeable future.

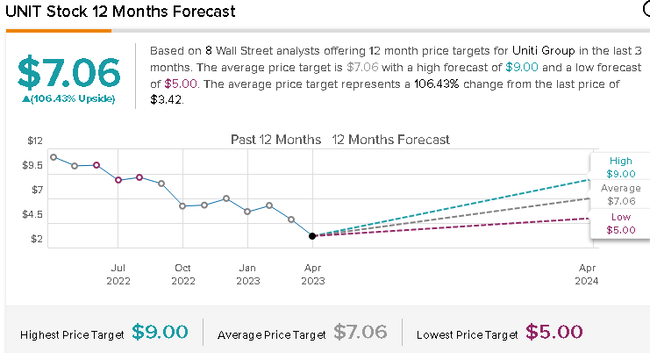

As we can see, all analysts who have looked at the company recently agree on the company's next upside with a price target of $7.06.

Office Properties Income Trust $OPI

Office Properties Income Trust is a REIT that focuses on owning and managing office buildings leased primarily to government and corporate tenants. Their portfolio includes a wide range of properties, including office buildings, research and development centers and office space. The company has a diversified portfolio that includes properties throughout the United States, with a focus on markets with high barriers to entry and stable rental income.

Fourth quarter results showed that occupancy remained nearly unchanged, while FFO per share fell -6% from $1.20 to $1.13. OPI represents a solid investment for those looking for steady income from office properties. The company also offers a very generous dividend of 25%.

- The benefits of Office Properties Income Trust include stable income from long-term leases with government and corporate tenants and portfolio diversification that reduces the risk of dependence on individual markets or tenants.

- Disadvantages include sensitivity to economic conditions that may affect demand for office space and the risks associated with maintaining and upgrading properties, such as the high cost of renovations or meeting building and environmental codes.

Due to asset sales and the expiration of certain leases, FFO per share has declined a total of -21% over the past three years. Over 90% of OPI's debt is fixed rate, but we expect interest expense to increase this year due to high interest rates.

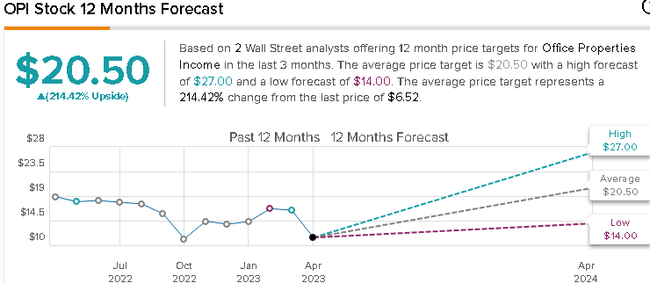

As we can see, analysts are optimistic about this company, agreeing on an average price target of $20.50.

Conclusion

While these 3 companies may tempt a lot of investors with high dividend yields, and may help them in generating passive income, it is extremely important to do a deeper analysis on these companies so that investors get to know each company in detail.

It's also good to keep in mind that the current high interest rate environment is not entirely conducive to REITs, so you should be wary and consider your investments carefully, and also think carefully about whether these companies are a good fit for your portfolio.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.