$AAPL dnes opět proráží na nový vrchol a to i v momentě, kdy hlavní indexy klesají.

Síla této akcie je neskutečná, ale opravdu je tak neohrožená jak se nyní zdá?

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

$AAPL dnes opět proráží na nový vrchol a to i v momentě, kdy hlavní indexy klesají.

Síla této akcie je neskutečná, ale opravdu je tak neohrožená jak se nyní zdá?

Bude Apple $AAPL do roku 2024 akcií v hodnotě 4 biliony dolarů?

...

Extrémně předražená a reklamou manipulovaná akcie Apple může klesnout na 1/3, nebo hlouběji. Zapomeň P/E a sleduj P/B! Apple má P/B 50, ale zdravé je P/B 2.

AI! Poslední dobou nejvíce zmiňované téma v investičním světě. Během covidu jsme měli šílenou tech. rallye. Když pandemie skončila, inflace a úrokové sazby vzrostly a tech. mega rally byla uhašena.

Teď tu máme novou rally!

ChatGPT zanechal v investorech pocit bujarého veselí. A nová rallye je v plném proudu, protože se oceňují nejrůznější budoucí možnosti umělé inteligence.

Proto...

Zobrazit více

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Hezky shrnuto a přidám se tu k Applákům 😂 taky si myslím, že s něčím přijdou ale později, až to bude pecka

Výzkumná společnost Kantar vydala po roce další srovnání nejhodnotnějších značek na světě, které vychází z názoru více než 4,2 milionu respondentů na 21 000 značek v 540 kategoriích.

1) Celková hodnota top 100 značek: 6.9 Bilionů (CZ) / Trilionů (EN) $

2) Top 3 (CZ): $AAPL 880 miliard $

$GOOGL 578 miliard $

$MSFT 502 miliard $

3) $KO se vrátila do první desítky. Devět značek se...

Zobrazit více

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Je to neskutečné a většina z nich tvoří mé portfolio, takže se nezlobím :)

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Kdybyste si měli vytvořit své vlastní osobní portfolio, které bude obsahovat 1 společnost z každého sektoru, jak by vypadalo?

Připomínám, že máme následující sektory:

Technology, Financials, Health Care, Real Estate, Discretionary, Energy, Materials, Industrials, Staples, Communications a Utilities.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Těžký úkol, ale když pominu současné ceny těchto akcií, tak by tohle imaginární porfolio vypadlo následovně:

Technologie: Apple (AAPL)

Finance: JPMorgan Chase (JPM)

Zdravotnictví: Johnson & Johnson (JNJ)

Reality: Prologis (PLD)

Konsumní sektor: Nike (NKE)

Energetika: NextEra Energy (NEE)

Materiály: Linde (LIN)

Průmysl: Honeywell (HON)

Defenzivní sektor: Procter & Gamble (PG)

Telekomunikace: T-Mobile US (TMUS)

Utility: American Water Works (AWK)

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Hele pár roků zpátky si pamatuju, že mi všichni říkali, že kupovat $AAPL je nesmysl, že už neporoste. No 300 %... nestěžuju si 🤷♂️ Tohle je akcie, kterou nehodlám nejspíš prodat ani kdybych viděl, že ocenění je už úplně v nesmyslu. Přijde mi totiž, že se úplně vymyká všem klasickým metodám a pravidlům.

Apple je prostě Appl, neexistuje společnost, která by se jim mohla vyrovnat, není divu, že tvoří v portfoliu Berkshire tak velkou a podstatnou část.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

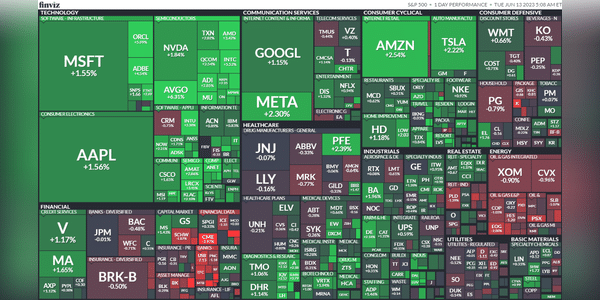

10 největších společností indexu S&P 500:

1) Apple $AAPL - 7,4 %

2) Microsoft $MSFT - 6,7 %

3) Google $GOOG - 3,8 %

4) Amazon $AMZN - 3,1 %

5) NVDIA $NVDA - 2,6 %

6) Berkshire Hathaway $BRK-B - 1,7 %

7) Tesla $TSLA - 1,7 %

8) META $META - 1,6 %

9) Exxon Mobil $XOM - 1,3 %

10) United Health Group $UNH - 1,3 %

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Trochu tím navazuji na svůj včerejší příspěvek, aby bylo vidět, jak velký vliv mají na celý index akcie Apple a Microsoft.

Hele všude teď čtu o $RNDR… dokáže mi někdo vysvětlit o co jde? Prý spolupracují s $AAPL $GOOG a $NVDA ale není mi to moc jasný

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Co jsem tak pochopil a zjistil, tak Render Network je předním poskytovatelem decentralizovaných vykreslovacích řešení založených na GPU. Render Token se zabývá poskytováním výpočetního výkonu na vyžádání prostřednictvím decentralizované sítě.

S Apple spolupracují na poskytování výpočetního výkonu pro strojové učení a AR/VR aplikace. S Google Cloud integrují svou síť, aby poskytovala výpočetní kapacitu pro Google Cloud Platform. S NVIDIA integrují jejich grafické karty a technologii RTX do své sítě, aby poskytovali optimalizovaný výpočetní výkon pro 3D rendering a vizualizace.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Pouhé dvě akcie tvoří 26 % indexu NASDAQ a 14 % indexu S&P 500. Těmito dvěma akciemi jsou $MSFT a $AAPL .

Takhle nevypadá zdravý trh.

#NASDAQ #SP500

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Díky za novou informaci. Je fajn, že tyto akcie rostou, ovšem jelikož investuji také do ETF, tak nevím jestli se mi to úplně líbí :)

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Další budoucí spolupráce pro dvě obrovské společnosti.

Tento rok je zatím v růstu velkých společností, hlavně díky AI, ale i další zajímavé produkty se přináší na trh. Jelikož jsem fanouškem Apple $AAPL tak zde přidám jednu doplňující informaci k partnerství s $DIS díky oznámení VR. Jinak na celkové novinky z pondělní konference udělal hezký příspěvek https://bulios.com/status...

Zobrazit více

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Souhlasím s tebou, a názor mám podobný. Na video jsem koukal a jak tam říká Petr Mára, Vision pro aktuálně nikdo nekonkuruje, jelikož je to úplně něco jiného a je to na jiném levelu. Ovšem jak píšeš, je tam ještě spoustu otazníků.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Jim a predikce 😅 Děkujeme za konec růstového období.

Goldman Sachs uvádí, že technologičtí giganti Apple $AAPL, Microsoft $MSFT, Alphabet $GOOG, Amazon $AMZN, Nvidia $NVDA, Tesla $TSLA a Meta $META dosáhli v roce 2023 působivého průměrného výnosu 53 %.

Ostatních 493 společností v indexu S&P 500 údajně dosahuje v průměru 0 %.

Nějak mi ta statistika nesedí, co firmy jako Salesforce, Adobe, Coca Kola, AMD, Berkshire a X dalších...

Zobrazit více

Sedí to... ty firmy mají v indexu až moc velké zastoupení a pak to tak vypadá... Ale ono zase určitě přijde doba, kdy SNP budou táhnout i ty firmy, které dnes mají průměrné zhodnocení těch zmiňovaných 0%... Nic neroste věčně a i tyto firmy nepotáhnou index do nekonečna.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Amazon $AMZN rozšíří nabídku mobilních telefonů pro členy služby Prime.

Apple $AAPL bude nabízet spořicí účty s vysokým výnosem.

JP Morgan $JPM nyní kontroluje více než 15 % bankovních vkladů v USA.

Google $GOOG nyní kontroluje více než 90 % celosvětového vyhledávacího provozu.

Meta $META právě oznámila, že má 3 miliardy aktivních uživatelů na všech svých platformách.

Několik...

Zobrazit více

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Neřekl bych, že je to špatně. Kdyby ano, tak takovou otázku si můžeme klást už roky, jen nahradíme produkty a služby těchto gigantů. Ba naopak je to krok kupředu, pokud chtějí dominovat i do budoucna, nesmí usnout na mrtvém bodě se stejnou nabídkou.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Nadhodnocený technologický sektor podle hlavního stratéga Dave Sekera ve společnosti Morningstar.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Jsou tam nějaké dobré body a nějaké, které jsou trochu proti. Já tam taky teď vidíém moc růstu a čekal bych nějaký propad. Pokud bychom se dostali na ještě nižší úrovně, než jsme byli minulý rok, to by byl teprve nářez. Zatím stále na trhu netekla krev...

SHRNUTÍ PONDĚLNÍ APPLE KONFERENCE

Společnost Apple v pondělí podle očekávání představila svůj první vstup na trh s rozšířenou realitou, Apple Vision Pro. Konkrétní informace uvedené v keynote na letošní Worldwide Developers Conference však zřejmě nechaly investory poněkud chladnými.

Zatímco na začátku pondělní seance se akcie společnosti Apple $AAPL APL dostaly na rekordní úroveň...

Zobrazit více

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Líbí se mi nový macbook air a nový watch OS. To je asi tak vše, ale pak přišly na řadu ty brýle a to je teda něco. Nic takového zatím není a pokud to opravdu funguje tak, jak ukazovali, tak je to game changer. Na druhou stranu porad přemyslím nad tom, proc bych si to mel kupovat. Je to drahé, práci udělám na notebooku a pokud chci koukat na film, mám televizi. Asi si na to real využití ještě musíme počkat.

Bulios Black

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Tak i tady budou výkyvy, ale dlouhodobě je to prostě gigant kterého jen tak nikdo nesrazí, hlavně nikdo s ním ani nechce soupeřit, takže jestli si to někdy Apple nepodělá sám, bude tu s námi dlouho. 😊