Ještě horší výsledky než zkraje roku. Samsungu klesl zisk o 96 procent.

Po prvním...

Zobrazit více

Ještě horší výsledky než zkraje roku. Samsungu klesl zisk o 96 procent.

Po prvním...

Zobrazit více

Je správný čas na nákup akcií $AAPL Poté co překročil 3 biliony dolarů?

S oceněním společnosti kolem 3 bilionů dolarů je Apple nejen největší akcií na světě podle tržní kapitalizace. Akcie jsou skokově (z hlediska ocenění) nad ostatními „bilionovými“ akciemi.

Jediný, kdo se jim alespoň přibližuje, je Microsoft (NASDAQ:MSFT) s aktuálním oceněním kolem 2,5 bilionu dolarů.

Přesto...

Zobrazit více

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Malé problémy pro Apple, nebo neschopnost Goldman Sachs?

Máme svátek v USA a já se ráno pomalu prodírám novinky za poslední dny a narazil jsem na jednu, sice nepotvrzenou z žádných zúčastněných, ale zajímavou, hlavně pro fanoušky $AAPL

Goldman Sachs $GS jedná o převedení produktů z kreditních karet a spořicích účtů Apple $AAPL ke společnosti American Express $AXP , řekl zdroj...

Zobrazit více

Tak tohle je ta zpráva, o které jsi psal :) Zajímavý... ale věřím, že se to nějak vysvětlí

Akcie Applu míří k tržní kapitalizaci 3 bil. USD, Citi stanovila cílovou cenu na 240 USD

Americká technologická společnost Apple $AAPL by dnes mohla přesáhnout tržní kapitalizaci 3 bil. USD. Citibank včera stanovila cílovou cenu společnosti na 240 USD.

Akcie společnosti Apple v předburzovní fázi posilují o 0,6 %, což by znamenalo, že dosáhnou rekordní ceny 190,80 USD za akcii....

Zobrazit více

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Super zpráva pro Apple a pro nás fanoušky a uživatelé, no i když, spíše investory, uživatelé prostě konzumují jejich ceny no. 😂 Ale zaslouží si to a já držím dál. Přikupovat ale nebudu, zatím se mi nechce kazit průměr. Spíše jen uvažuji a nějakém tradu s cílovkou 200$.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

$AAPL dnes opět proráží na nový vrchol a to i v momentě, kdy hlavní indexy klesají.

Síla této akcie je neskutečná, ale opravdu je tak neohrožená jak se nyní zdá?

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Tak i tady budou výkyvy, ale dlouhodobě je to prostě gigant kterého jen tak nikdo nesrazí, hlavně nikdo s ním ani nechce soupeřit, takže jestli si to někdy Apple nepodělá sám, bude tu s námi dlouho. 😊

Bude Apple $AAPL do roku 2024 akcií v hodnotě 4 biliony dolarů?

...

Extrémně předražená a reklamou manipulovaná akcie Apple může klesnout na 1/3, nebo hlouběji. Zapomeň P/E a sleduj P/B! Apple má P/B 50, ale zdravé je P/B 2.

AI! Poslední dobou nejvíce zmiňované téma v investičním světě. Během covidu jsme měli šílenou tech. rallye. Když pandemie skončila, inflace a úrokové sazby vzrostly a tech. mega rally byla uhašena.

Teď tu máme novou rally!

ChatGPT zanechal v investorech pocit bujarého veselí. A nová rallye je v plném proudu, protože se oceňují nejrůznější budoucí možnosti umělé inteligence.

Proto...

Zobrazit více

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Hezky shrnuto a přidám se tu k Applákům 😂 taky si myslím, že s něčím přijdou ale později, až to bude pecka

Výzkumná společnost Kantar vydala po roce další srovnání nejhodnotnějších značek na světě, které vychází z názoru více než 4,2 milionu respondentů na 21 000 značek v 540 kategoriích.

1) Celková hodnota top 100 značek: 6.9 Bilionů (CZ) / Trilionů (EN) $

2) Top 3 (CZ): $AAPL 880 miliard $

$GOOGL 578 miliard $

$MSFT 502 miliard $

3) $KO se vrátila do první desítky. Devět značek se...

Zobrazit více

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Je to neskutečné a většina z nich tvoří mé portfolio, takže se nezlobím :)

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

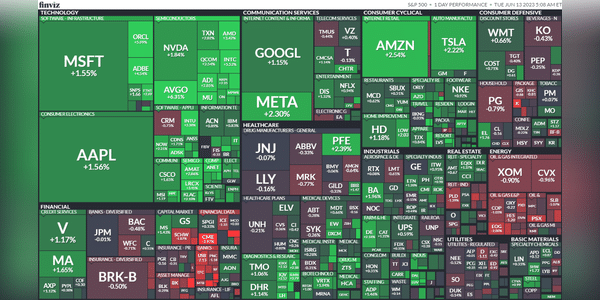

Kdybyste si měli vytvořit své vlastní osobní portfolio, které bude obsahovat 1 společnost z každého sektoru, jak by vypadalo?

Připomínám, že máme následující sektory:

Technology, Financials, Health Care, Real Estate, Discretionary, Energy, Materials, Industrials, Staples, Communications a Utilities.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Těžký úkol, ale když pominu současné ceny těchto akcií, tak by tohle imaginární porfolio vypadlo následovně:

Technologie: Apple (AAPL)

Finance: JPMorgan Chase (JPM)

Zdravotnictví: Johnson & Johnson (JNJ)

Reality: Prologis (PLD)

Konsumní sektor: Nike (NKE)

Energetika: NextEra Energy (NEE)

Materiály: Linde (LIN)

Průmysl: Honeywell (HON)

Defenzivní sektor: Procter & Gamble (PG)

Telekomunikace: T-Mobile US (TMUS)

Utility: American Water Works (AWK)

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Hele pár roků zpátky si pamatuju, že mi všichni říkali, že kupovat $AAPL je nesmysl, že už neporoste. No 300 %... nestěžuju si 🤷♂️ Tohle je akcie, kterou nehodlám nejspíš prodat ani kdybych viděl, že ocenění je už úplně v nesmyslu. Přijde mi totiž, že se úplně vymyká všem klasickým metodám a pravidlům.

Apple je prostě Appl, neexistuje společnost, která by se jim mohla vyrovnat, není divu, že tvoří v portfoliu Berkshire tak velkou a podstatnou část.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

10 největších společností indexu S&P 500:

1) Apple $AAPL - 7,4 %

2) Microsoft $MSFT - 6,7 %

3) Google $GOOG - 3,8 %

4) Amazon $AMZN - 3,1 %

5) NVDIA $NVDA - 2,6 %

6) Berkshire Hathaway $BRK-B - 1,7 %

7) Tesla $TSLA - 1,7 %

8) META $META - 1,6 %

9) Exxon Mobil $XOM - 1,3 %

10) United Health Group $UNH - 1,3 %

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Trochu tím navazuji na svůj včerejší příspěvek, aby bylo vidět, jak velký vliv mají na celý index akcie Apple a Microsoft.

Hele všude teď čtu o $RNDR… dokáže mi někdo vysvětlit o co jde? Prý spolupracují s $AAPL $GOOG a $NVDA ale není mi to moc jasný

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Co jsem tak pochopil a zjistil, tak Render Network je předním poskytovatelem decentralizovaných vykreslovacích řešení založených na GPU. Render Token se zabývá poskytováním výpočetního výkonu na vyžádání prostřednictvím decentralizované sítě.

S Apple spolupracují na poskytování výpočetního výkonu pro strojové učení a AR/VR aplikace. S Google Cloud integrují svou síť, aby poskytovala výpočetní kapacitu pro Google Cloud Platform. S NVIDIA integrují jejich grafické karty a technologii RTX do své sítě, aby poskytovali optimalizovaný výpočetní výkon pro 3D rendering a vizualizace.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Pouhé dvě akcie tvoří 26 % indexu NASDAQ a 14 % indexu S&P 500. Těmito dvěma akciemi jsou $MSFT a $AAPL .

Takhle nevypadá zdravý trh.

#NASDAQ #SP500

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Díky za novou informaci. Je fajn, že tyto akcie rostou, ovšem jelikož investuji také do ETF, tak nevím jestli se mi to úplně líbí :)

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Další budoucí spolupráce pro dvě obrovské společnosti.

Tento rok je zatím v růstu velkých společností, hlavně díky AI, ale i další zajímavé produkty se přináší na trh. Jelikož jsem fanouškem Apple $AAPL tak zde přidám jednu doplňující informaci k partnerství s $DIS díky oznámení VR. Jinak na celkové novinky z pondělní konference udělal hezký příspěvek https://bulios.com/status...

Zobrazit více

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Souhlasím s tebou, a názor mám podobný. Na video jsem koukal a jak tam říká Petr Mára, Vision pro aktuálně nikdo nekonkuruje, jelikož je to úplně něco jiného a je to na jiném levelu. Ovšem jak píšeš, je tam ještě spoustu otazníků.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Tento uživatel má díky předplatnému přístup k exkluzivnímu obsahu, nástrojům a funkcím.

Jim a predikce 😅 Děkujeme za konec růstového období.

Oproti covidové době brutální propad poptávky po paměťových čipech, což také zapříčinlo pád cen těchto čipů - nižší marže. Úplně si to asi nepohlídali a nepřizpůsobili poptávce výrobu.