Feed

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

🥫 Kroger este în creștere - mărcile ieftine și bucătăria de casă conduc la rezultate!

În timp ce mulți comercianți cu amănuntul raportează stagnare sau incertitudine, Kroger $KR prezintă o creștere interesantă.

Acțiunile companiei au câștigat mai mult de 9 %după ce compania și-a îmbunătățit perspectivele de vânzări pentru întregul an și a raportat rezultate solide în segmentele...

Citește mai mult

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

📅 Evenimentele-cheie ale săptămânii viitoare!

Ne așteaptă o săptămână scurtată, dar cu atât mai interesantă, care poate influența semnificativ așteptările pieței cu privire la evoluția viitoare a ratelor dobânzilor și la sănătatea economiei SUA. Iată o trecere în revistă a celor mai importante evenimente care nu ar trebui ratate.

🧭 Luni

NY Fed Manufacturing Activity Survey - Un...

Citește mai mult

Zobrazit další komentáře

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Din ceea ce am citit, aceste rate nu ar trebui să se schimbe.

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Kroger: Lider defensiv cu potențial de creștere

Kroger $KR, unul dintre cele mai mari lanțuri de magazine din SUA, devine o opțiune atractivă pentru investitorii defensivi datorită modelului său de afaceri stabil și creșterii veniturilor. În ciuda unei volatilități mai mari a EBITDA (32%), acesta oferă câștiguri previzibile prin vânzările de produse alimentare și farmaceutice -...

Citește mai mult

Zobrazit další komentáře

Acțiunile valoroase cresc bine acum. Nu am $KR în portofoliul meu, dar, în rest, stocurile valoroase și de dividende din portofoliul meu au performanțe solide în prezent.

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

🗓️Ce ne așteaptă săptămâna aceasta? Evenimente-cheie pe piețe!

Săptămâna aceasta vine cu date macroeconomice importante, rapoarte financiare esențiale și declarații-cheie despre politica monetară. Printre cele mai urmărite evenimente se numără un anunț al lui Donald Trump, datele privind ocuparea forței de muncă din SUA și un discurs al președintelui Fed, Jerome Powell.

Luni

🛠 ISM...

Citește mai mult

Zobrazit další komentáře

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Discursul lui Powell de vineri va fi probabil interesant, dar rezultatele $CRWD și $AVGO vor fi, de asemenea, importante.

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

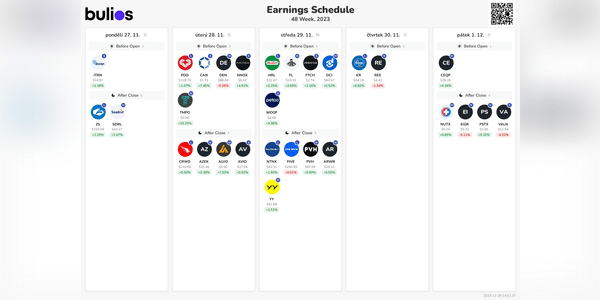

🗓️ Evenimentele-cheie ale săptămânii: Fiți pregătiți pentru oportunități de investiții! 🚀

Sezonul câștigurilor se apropie de sfârșit, dar săptămâna aceasta este plină de date economice importante. Nu uitați să urmăriți aceste evenimente! 💼

⚙️Pondělí:

ISM Manufacturing PMI: Acest indice oferă o perspectivă asupra stării de sănătate a sectorului de producție din SUA. 📈

🔒Rezultate...

Citește mai mult

Zobrazit další komentáře

Mulțumesc pentru recenzie și urări! Advent fericit și ție.

Vom vedea dacă se întâmplă ceva cu GME, dar eu nu mai tranzacționez acolo și sunt doar un observator. Indicii ar putea crește și mai mult pe baza datelor istorice, dar nu se știe niciodată :)

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

📊Kroger raportează rezultate solide în trimestrul al doilea al anului fiscal 2024! 🛒🛒

Kroger $KR, unul dintre cele mai mari lanțuri de magazine din SUA, a raportat săptămâna trecută, joi, rezultatele pentru al doilea trimestru al anului fiscal 2024.

Compania a anunțat un profit net impresionant de 466 milioane de dolari, o revenire majoră față de pierderea netă de 180 de...

Citește mai mult

KROGER - DIVIDEND INTERESANT

Kroger $KR este un jucător important pe piața comerțului cu amănuntul de produse alimentare, iar poziția sa puternică în industrie a generat rezultate financiare solide chiar și în timpul incertitudinii economice. Compania beneficiază de rețeaua sa extinsă de magazine locale care deservesc o gamă largă de clienți, iar acest lucru îi permite să ofere...

Citește mai mult

Zobrazit další komentáře

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

O companie bună, obișnuiam să mă uit la ei, dar nu vreau să am acțiunile lor în portofoliul meu.

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Creșterea susținută a Costco $COSTce urmează pentru el?💹

Costco este unul dintre cei mai importanți giganți din domeniul comerțului cu amănuntul, cu o reputație excelentă și un model de afaceri robust. Acesta este specializat în furnizarea de produse de calitate la prețuri foarte competitive prin intermediul program de membru. Cu o istorie de peste 30 de ani ,Costco s-a impus ca...

Citește mai mult

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

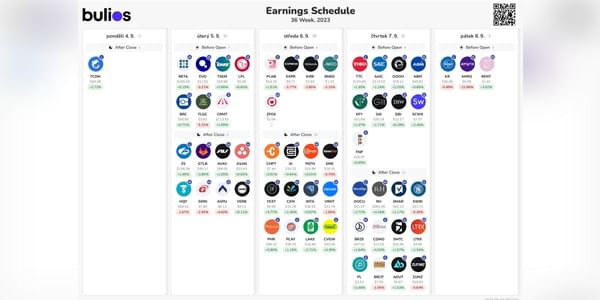

Investitori, ce rezultate ale companiilor veți urmări săptămâna viitoare?

Săptămâna viitoare nu va fi atât de interesantă din punct de vedere al rezultatelor, dar vor fi totuși câteva companii interesante care vor raporta rezultate. Voi fi interesat de rezultatele companiilor $CRWD, $FL și $KR.

Zobrazit další komentáře

Cu modul în care $CRWD a fost în creștere în ultima vreme, așa că sunt curios cu privire la rezultatele posibile, aș saluta în continuare o scădere la următorul doc, dar nu cred că va fi. :)

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Săptămâna aceasta nu este la fel de interesantă în ceea ce privește rezultatele, dar există câteva companii interesante. Mă voi uita la rezultatele $GME, $DOCUa$KR pentru interes.

Ce rezultate ale companiilor veți urmări săptămâna aceasta?

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Hei, investitori, $KR a raportat ieri rezultatele.

Kroger este o companie americană de retail alimentar.

Rezultatele :

Vânzări : 45,17 miliarde de dolari și se așteptau la 45,61 miliarde de dolari.

EPS : 1,51 dolari și se aștepta 1,41 dolari.

...Citește mai mult

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Nu mă interesează cu adevărat acest sector, așa că nici măcar nu am în portofoliul meu acțiuni precum $KR, $WMT sau $TGT.