One card bet. This simple man only became a billionaire because of Berkshire Hathaway stock. How did he do it?

It is often said that investors should diversify their portfolios. Well, as we'll show today, sometimes it's good to go against the tide and just avoid diversification, for example. Let's take a look at the story of one investor who got rich precisely because he knew how to choose well and didn't worry too much about diversification.

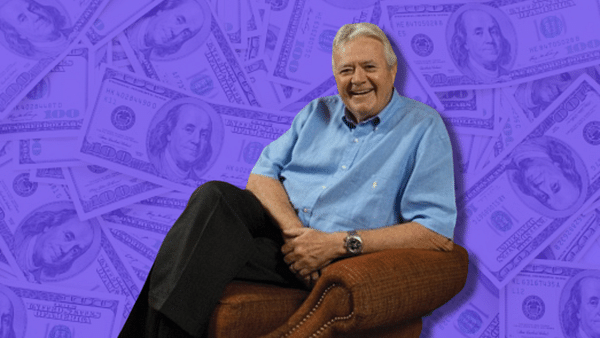

Stewart Horejsi is one of today's successful billionaires. But he made his vast fortune thanks to one smart investment. According to the latest Forbes ranking, his fortune is estimated at $2.8 billion. But how did he become who he is today? And what is his path to riches?

Horejsi's story began in the 1960s in Kansas, USA. After attending the University of Kansas, he joined his family's welding company, Brown Welding Supply LLC. At the time, the company was experiencing a period of stability and growth. However, in the 1980s, things began to change and the business began to decline due to increasing competition.

To cope with the new market realities, Horejsi turned to literature. He read the book "The Money Masters" by John Train and became interested in investing. This decision, as it turned out, was to change his life forever.

His first investment was in Berkshire Hathaway Inc. stock, which was then worth $265 a share. It seemed risky, but Horejsi trusted his intuition and continued to invest in Berkshire Hathaway, even through the risk associated with this single investment direction.

https://www.youtube.com/watch?v=Fk0GQCZbF0k

Horejsi's decision to invest in Berkshire Hathaway was no accident. He was an admirer of Warren Buffet, chairman and CEO of Berkshire Hathaway. In his interview with Wealth Estates, he described Buffett as one of two people who exude an "aura of integrity." This characteristic, combined with Buffet's ability to create shareholder value, inspired Horejsi to make his first investment in Berkshire Hathaway.

His faith in Buffett's ability to run the company was ultimately rewarded. Over the next few years, he bought a total of 5,800 Berkshire Hathaway shares. Today, each of those shares he bought for less than $500 is worth about $500,000. This made Horejsi a billionaire and one of the most successful investors in the world.

Horejsi's story is an example of how one well-thought-out investment can change the fate of an individual and an entire family. His decision to invest in Berkshire Hathaway, despite the fears and risks, was the pivotal moment that brought him out of financial hardship and into the world of billionaires.

What does this story tell?

Although his story is unique, it offers some important lessons for potential investors.

- The first is the value of thorough research and understanding what you are investing in. Horejsi didn't invest in Berkshire Hathaway by accident or out of some caprice; he did so because he thoroughly understood the company's business and had deep confidence in its management.

- The second lesson is the value of patience. Horejsi didn't get rich overnight. His wealth was the result of decades of patience and trust in his investment decisions. During those years, he had to face many challenges and undoubtedly overcome many doubts about his investment strategy.

In the end, Horejsi's story is a reminder that investing can be an effective path to wealth. Although there are many paths to becoming wealthy, investing in stocks such as Berkshire Hathaway may be one of the most effective.

Conclusion

Horejsi is one of the most successful investors in the world today, but his story began as a family businessman from Kansas looking for ways to manage competition and achieve financial stability. His journey to billions was filled with challenges and risks, but also with courage, confidence and patience. His story can be an inspiration to all who dream of financial success and independence.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.

I was intrigued by his last name, nice. However, as Warren Buffett says, you only have to be right once. 👍