The battle of the semiconductor ETFs: Which has the upper hand?

If you are interested in semiconductor companies, this article is for you.

Today, we're going to take a look at the 2 largest ETFs that invest in companies focused on this sector.

I probably don't need to tell youwhat an ETF is, but to recap: it's a publicly traded exchange-traded fund. Its sena normally replicates the price of the company to which the fund is linked. However, if you have funds that invest in different companies, their exchange price is obviously affected.

Semiconductors rule the world. Without them, we would not have modern technology as we know it. Thanks to increasingly advanced manufacturing and component planning technologies, we have reached a point where computers are often at a higher level than software. The processor, as the brain of every smart device, contains several billion transistors. The fact that we have managed to shrink these components to almost atomic levels is what makes our machines so powerful today. Today, the most advanced chips are built on 5-nanometer technology and more are in the works.

According to Moore's law, in 10-20 years we will reach the limit of possible transistor shrinking and the associated performance of modern processors.

Companies in the industry are already working hard to invent a way to go further and not stop progress. But to do this, a lot of money needs to be invested in research and technology. This step is difficult and if you want to bet on one company to do this, you need to have a golden hand when choosing.

A much easier way is to spread your capital across multiple companies. Then you don't have to stress about whether your company will achieve the desired result. The easiest way to diversify is through ETFs.

IShares Semiconductor ETF $SOXX

The IShares Semiconductor ETF is managed by iShares, a division of BlackRock, one of the largest asset managers in the world.

This ETF tracks the performance of an index related to the semiconductor industry. It includes stocks of various companies in the chip manufacturing, semiconductor materials, semiconductor manufacturing equipment and other related sectors. This diversification provides the investor with a very good portfolio of stocks related to semiconductor manufacturing and research. You have an overview of the entire manufacturing process from mining to the actual processing of the final product.

The largest positions include the well-known $NVDA, $AMD, $QCOM or $INTC.

Each of these innovative companies is different yet they are very close to each other. As the main difference is how they manufacture their processors. Let's leave aside the fact that $NVDA or $AMD makes chips for both graphics and processors. Intel $INTC is a company that is in full control of its manufacturing. They make their own designs and then make the processor themselves and don't have to rely on other factories like $TSM. This is Intel's main advantage and why their processors are mostly used in traditional laptops or desktops.

The fees are friendly for this ETF. The Expense Ratio is at 0.35% and that's it. If you would like to learn more you can do so here: https://www.etf.com/SOXX

The largest proportion of investments is in the US and an overwhelming 90%. China and Taiwan are a close second. Then the Netherlands and France. This is a mix that offers even a slight diversification across continents.

Current price

The fund manages over $7.7 billion and is traded on the NASDAQ exchange. It was founded in 2001 and has managed to gain over 500% since then. The current price per share is trading on the exchange at $431. The price is 23% away from the peak and in line with the growth of the stocks it owns it is no wonder. Since the beginning of the year, this ETF has gained 25% and is not stopping.

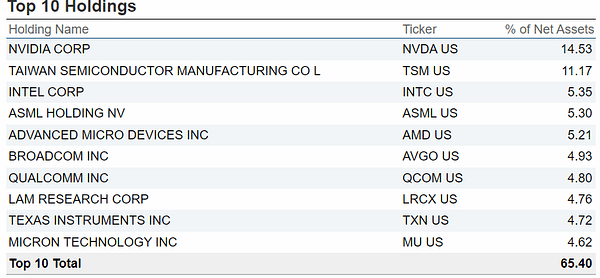

Van Eck Semiconductor ETF $SMH

Focuses on investments in companies operating in the semiconductor sector. It is managed by VanEck, which is a well-known provider of ETFs and other investment products.

This fund tracks the performance of a specific index related to the semiconductor industry, which focuses on companies that manufacture semiconductors, chips, semiconductor components, or semiconductor manufacturing equipment. The fund aims to provide investors with diversified exposure to this dynamic sector with high growth potential.

This fund is slightly more expensive, but "only" by Expense Ratio - 0.35% and NET Expense Ratio - 0.35%.

More info here: https://www.vaneck.com/us/en/investments/semiconductor-etf-smh/

The biggest advantage for a lot of investors will also be the lower total cost per unit. It is now $130. Of course one can buy these ETFs in pieces, but some people prefer to buy whole pieces if possible.

Their portfolio is very similar to the previous ETF only with different ratios of stocks in it. The largest position is still $NVDA. But the second is $TSM followed by $INTC.

Semiconductors are the foundation of modern technology, powering everything from smartphones and computers to artificial intelligence and autonomous vehicles. With rapid technological advances, demand for semiconductors is expected to grow, bringing investment opportunities.

By investing in the VanEck Semiconductor ETF, individuals gain access to a diversified portfolio of companies operating in the semiconductor industry. The fund tracks the performance of a specific semiconductor-related index that includes companies involved in the manufacture of semiconductors, chips, semiconductor materials and related equipment.

One of the main benefits of investing in this fund is the ability to gain exposure to the entire semiconductor industry without the need to select individual stocks. This eliminates the need for extensive research and reduces the risk associated with investing in a single company. The fund provides broad market exposure, allowing investors to benefit from the growth potential of multiple companies operating in the semiconductor industry.

Chart

The chart of the two funds looks very similar with the price difference. In this case, the price is high as the semiconductor companies themselves are growing and performing well. Nvidia $NVDA will report its results next today. This will be another stepping stone for future price movement.

Conclusion

I personally like the semiconductor sector, but it is too expensive for me right now. I have only traded stocks like $NVDA and $INTC. It is true that Buffett sold his position in $TSM, but the main reason was geopolitical risk. I personally wouldn't invest there either and would rather use the capital elsewhere.

But it is still a sector of the future and the leading players in the market will not just disappear from the charts. Even today they can be bought at decent prices. For example, Intel $INTC is very undervalued for me and with its dividend, it has made some interesting percentages due to its low price.

Warning.

This is not financial advice. I am providing publicly available data and sharing my opinions on how I would handle myself in these situations. Investing is risky and everyone is responsible for their decisions.

I may be a fool, but I'm not really worried about TSM in the long run. Plus, they are trying to strategically move production and processes out of Taiwan, so they won't be out even in a potential conflict.

Is this not another case of boosted demand during COVID?

I would wait to buy, I believe the price will come down.