One of the richest investors of our time is not happy about the tentative agreement to raise the US debt ceiling because he believes that the agreement does nothing to address the real problem of the ever-increasing national debt. In his latest Tweet, he broke down each point and played teacher as he handed out grades and added a short commentary.

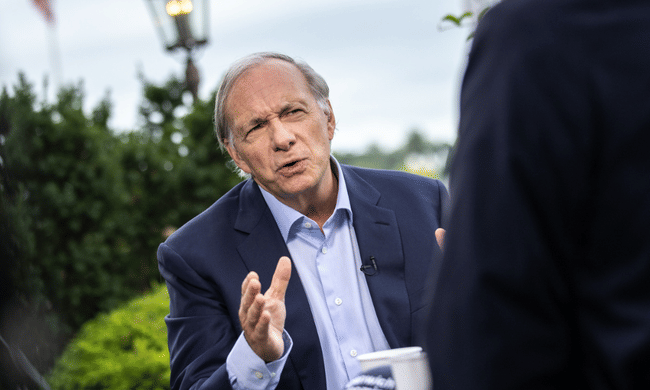

The billionaire and founder of Bridgewater Associates wrote on social media that the deal between President Joe Biden and House of Representatives Speaker Kevin McCarthy is far from satisfactory.

"The proposed deal will not make a substantial difference."

Biden and McCarthy announced over the weekend that they had agreed to temporarily postpone the debt ceiling until January 2025 while limiting federal spending for 2024 and 2025.

If Congress approves their proposal, it should avert the potentially critical default that Treasury Secretary Janet Yellen warned was coming in early June.

However, lawmakers have separately decided to raise or expand borrowing limits a total of seventy-six times since 1960, according to the Treasury Department, leading investor Dalio to criticize the debt ceiling concept itself in the past.

Overall, the investor legend believes that a two-year extension of federal borrowing is a "sensible" policy move, as it would avoid reigniting the debt ceiling debate during the 2024 election cycle, but it is merely a postponement of an issue with an unclear outcome.

https://twitter.com/RayDalio/status/1663660305212137472

Ray Dalio said on Twitter:

I was asked to comment on the debt ceiling deal, so here's my opinion in a nutshell. It was what I expected, which is the best that could have been achieved in the situation, though it is far from satisfactory for the following reasons:

1. Bipartisanship (Bipartisanship means working together across the political spectrum) - Rating = A (excellent).

Everyone has united against the radicals in their parties. This is a great success. Is this the beginning of strengthening a strong cross-party center united against the radicals? We'll see how this develops.

2. Solving the problem of the constant piling up of an already considerable pile of debt: rating = D (Underperformance).

The proposed adjustment will not make a significant difference going forward.

3. Planning for a smart bipartisan commission on debt and economic reform: Grade = B

It was acknowledged that it is desirable to do this after the 2024 election to avoid conflicts in the middle of an election campaign. Therefore, extending it to two years was reasonable, but it is only postponing the problem. Overall, no surprise. Best possible outcome given the situation, but it's not great. We'll see if the situation improves when a smart non-partisan commission is appointed after the 2024 election. Let's hope it does.

In response to Dalio's post, Justin Amash, former member of the US House of Representatives, provided a very interesting opinion 👇

Why are both Biden and McCarthy so happy with this "deal"?

McCarthy can credibly claim he got concessions, but they are mostly tricks, accounting tricks or meaningless tricks, so Biden doesn't mind. The baseline spending levels are close to the elevated levels of recent years. Even if he automatically cut 1% of that spending, we'd still be near an all-time high.

Biden will actually end up better off than he would have been with a net increase in the debt ceiling by a fixed dollar amount because the law suspends the limit until 2025. That's the biggest concession in the "deal". McCarthy doesn't mind, however, because he personally benefits from having fewer battles in the future that put him at odds with conservatives.

It's a win for Biden and McCarthy and a loss for everyone else. This spending and debt level is not sustainable. And you can't tax your way out of it. Theannual deficit is so large that there is no tax rate that comes close to filling the gap (mathematically, it would require a tax increase about 10 times larger than the 2017 tax cuts) and if you tried to do that, you would crush the economy (and not actually gain tax revenue).

https://twitter.com/justinamash/status/1663674361704857604

- What do you think of Biden and McCarthy's proposed deal? In your opinion, is it just a postponement of the problems?

I don't agree with the move either, I'm losing faith that my US colleagues will stand for it🧐

I agree that this is not a good solution and the best thing would be if this discussion never came up and no cap had to be raised. But if this is the way it is, the politicians will get their way again and screw the economists...Welcome to capitalism😅

Undoubtedly, this is merely postponing the inevitable unless something is done about it... I mean, it probably won't. So now it's a question of how long you can put off a problem like this.

The economy is based on endless borrowing that will one day end in hyperinflation. Therefore, I consider the best investment to be investing in your own home.

I like Mr. Amash's opinion here very much, and above all he backs it up with facts. But this is what got me the most - "mathematically, it would require a tax increase about 10 times larger than the 2017 tax cuts" and if you tried to do that, you would crush the economy. So classically, no solution, delay proper.