Paramount shares are getting ever closer to the covid low at $10. Those are really low levels far from the peak, which was at $100 in 2021. Can this stock rally and live up to its name, which still carries weight in the world?

Paramount Pictures Corporation is an American film and television production company that specializes in the production, distribution and financing of films. It is one of the oldest and most important film companies in the world.

Paramount Pictures was founded in 1912 and has since produced and distributed a wide range of films in a variety of genres. The company is known for its successful films like "The Godfather", "Titanic", "Transformers", "Mission: Impossible" and many more.

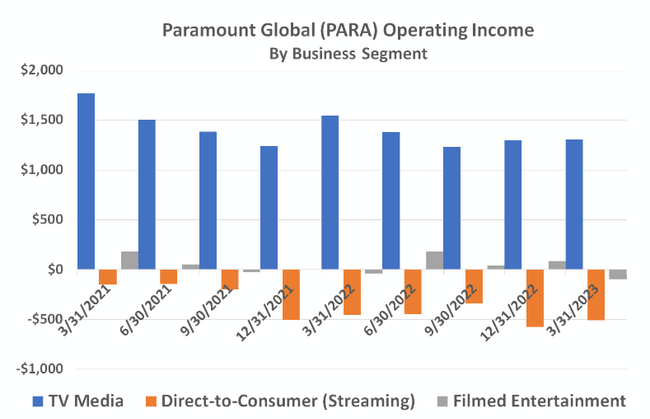

It would be easy to think that Paramount $PARA is a lost cause. While its movie studio remains a superpower, its streaming business remains in the red - and increasingly so.

Cable TV channels(including Nickelodeon, Showtime and MTV) as well as its broadcast network CBS are decent platforms that most probably know from their childhood years (at least I remember them), but the problem here isn't quality or content - classic programming on TVs around the world is struggling. Here in the Czech Republic, it may not seem like it to some, but it's true.

The advent of streaming created new opportunities for media players, which Paramount took advantage of as best it could at the time. Paramount+ launched in early 2021, and although it has been around since 2014, Paramount acquired the free-to-air Pluto TV platform in 2019. The two services now serve 60 million and 80 million viewers respectively.

Most companies, including Disney $DIS, wanted to take on the streaming market with the giant and dominant Netflix $NFLX at any price, as they saw a huge opportunity in the industry. As a result,they spent a huge amount of money on their platforms and promotion. To this day, these platforms are loss making and waiting to see if they can swing profits over costs.

Scale matters in this business. The cost of making a TV show or movie is the same no matter how many people see it. The more people pay to see it, the more profitable the movie or program becomes. Paramount's spending on streaming content has so far grown and exceeded streaming revenue.

However, streaming is starting to reach sufficient scale that the cost-benefit calculation is starting to make more fiscal sense. It makes so much sense that Paramount is even reassessing its previous projections for streaming spending.

CFO Naveen Chopra earlier this year suggested that Paramount may spend less on streaming in 2024 than previously proposed - $6 billion. That reduction will be made possible, at least in part, by the launch of a new service combining Paramount+ and Showtime.

Something else that streaming services cannot be is a standalone product - there is too much competition in the market. They often pay off when bundled with another product or service or enhanced with exclusive premium content.

Case in point: In September, Walmart began offering free access to Paramount+ for Walmart+ subscribers, increasing the appeal of Walmart+ while monetizing Paramount+ for customers who would never subscribe. Meanwhile, Paramount+ established relationships with Formula One racing.

Under what circumstances could the company's stock recover?

- The first possibility is that Paramount's streaming business will eventually get out of the red, just as CEOs Bakish and Chopra suggest. Given the ongoing evolution of streaming, that's not an implausible expectation. Meanwhile, the company's film and TV businesses remain solidly profitable. This success could restore the recently reduced dividend and boost the stock's ultimate upside.

- The second and much shorter-term option is to acquire the company either as a whole or a part - perhaps streaming.

It wouldn't be the first time someone has been interested in an acquisition. Bob Bakish himself can expect an acquisition after selling certain assets. Paramount BET is reportedly attracting buyer interest. Earlier this year, Paramount reportedly rejected a $3 billion bid for Showtime.

This is not financial advice. I am providing publicly available data and sharing my opinions on how I would handle the situation myself. Investing is risky and everyone is responsible for their decisions.

Nice stock with potential. I'll take a closer look.

The fact that it was at $100 USD for a couple of days before the covid is a bit misleading to me... when you look at the chart, it's obvious that it wasn't a classic natural growth but rather some kind of "anomaly" and this stock is realistically somewhere between $50-30 :)

I've been watching Paramount, but I'm more into $WBD in this industry, I trust them more and wait for a little better opportunity. But I don't think $PARA is bad, at least not at this price.

With Paramount, while I like the current price, I don't have much insight into their content and whether they are solely dependent on that revenue source. Here in this sector, I'm more in favor of Disney.