2 interesting stocks with a giant dividend above 10%

A high dividend is understandably tempting. But it is important to beware of some of the pitfalls and risks that can be found in such stocks. Can you find any skeletons in the closet with these two companies?

Understandably, the biggest risk to watch out for with a high dividend is the dividend trap.

A dividend trap occurs when a company provides a high dividend, but one that is not sustainable by its actual business performance. Dividends exceed operating profits or cash flow, and debt or asset sales are used to pay them. Investors are attracted by the high dividend yield, but low business growth signals that dividends may not be sustainable in the longer term. It is therefore possible that they will be reduced or stopped altogether, even if they initially offer a high income. A dividend trap means that dividends do not reflect the true strength of the business, earnings and cash flow of the company. Therefore, an investor should evaluate the company's fundamentals rather than relying on dividend yield alone to avoid the trap, which can lead to a loss of dividend income as well as a fall in share price.

Arbor Realty Trust $ABR+0.6% is a real estate investment trust that specializes in providing mortgage and financing solutions for the real estate market. They focus on several core activities.

Mortgage Origination - Provides mortgages to developers, non-standard and individual home buyers. Mortgages include a variety of types including construction, renovation, acquisition and refinance mortgages.

Asset Management - Manages an extensive portfolio of real estate investments including mortgage receivables, freehold and investment properties with long-term leases.

Receivables Management - Managing client receivables including collections and mortgage buyouts.

Its competitors include Realty Income $O-0.1%, Ladder Capital and Starwood Property Trust $STWD+0.6%.

Through their structured business, Arbor originates various types of loans, primarily bridge loans (97%), and bonds (3%). The majority of their loans are for multi-family residential properties (91%), followed by single-family properties (7%) and commercial properties (1-1%). Their average loan size is $19.1 million.

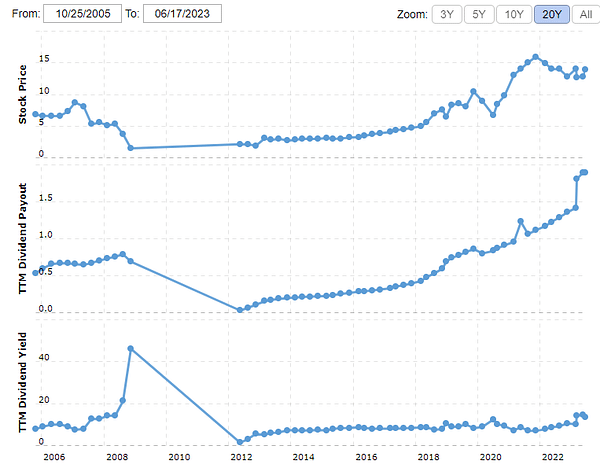

As a result of the price decline and dividend increase, ABR's dividend yield has increased to approximately 13%, which is very attractive. It now remains steady at a nice 11.6%. Despite the challenges that many REITs have faced over the past few quarters due to increased interest rates, ABR has been able to improve its financial results.

The Fed has raised interest rates to fight inflation, which appears to be under control. But to reach the 2% inflation target, rates need to stay high and the Fed is unlikely to cut soon. But high rates can cause instability in the markets. This can lead to a crisis and a decline in real estate values. This restricts ABR from originating mortgages and increases the risk of loan losses.

The U.S. housing market continues to have problems selling homes in 2023, which limits ABR's growth. Its earnings potential is reduced, which may lead to a reduction in dividends. High rates and inflation are also deteriorating ABR's credit quality. Loss reserves will increase and more loans will default. This will lead to additional costs.

Apollo Commercial Real Estate Finance $ARI+2.2%

This is a real estate investment trust that focuses on commercial real estate mortgage lending.

ARI mainly provides mezzanine and subordinate loans on various commercial properties such as office buildings, shopping malls, hotels, apartment buildings, warehouses, industrial estates, etc.

A mezzanine loan is a form of debt financing. It is a loan with collateral between the senior loan and the bonds. Mezzanine loans thus have a lower priority of repayment than senior loans but a higher priority than bonds.

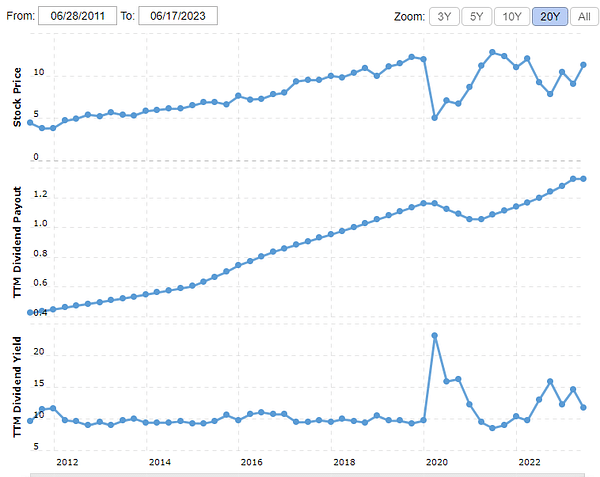

The Company operates on a nationwide basis in the United States. It provides financing in the range of $10 million to $100 million for individual projects. The dividend rate is stable, and ARI has paid it regularly without interruption since 2011. Management plans to maintain the dividend at current levels or increase it as the business grows.

The company is performing well, able to pay down most of its debt in 2022 and generate sufficient operating cash flow to pay dividends. Analysts are positive on the company's prospects.

Apollo Commercial had Q1 net income of 51 cents per share, while the dividend was 35 cents. Dividends cover 68% of earnings, so a dividend cut is unlikely. I mean, it wasn't. As Fed rates rise, the yield on the floating rate portfolio will increase, which may support the current dividend level. The market doesn't believe the company's dividend growth prospects - in fact, the stock is still trading at a discount despite the high dividend yield of 12.4%.

Disclaimer: This is by no means an investment recommendation. This is purely my summary and analysis based on data from the internet and other sources. Investing in the financial markets is risky and everyone should invest based on their own decisions. I am just an amateur sharing my opinions.