After three years of intense lock-downs, China's economy finally began to break through the constraints of the COVID-19 pandemic in early 2023. Investors, seeing how stocks performed in other markets after the lifting of pandemic restrictions, began buying Chinese stocks in the hope that companies would begin to improve their finances again. This could be an opportunity for other investors. China is an interesting market, but if you choose to invest there, you need to be aware of the risks that are strongly linked to Chinese geopolitics.

Online sales boomed worldwide during the COVID-19 pandemic, but there are signs of slowing growth in some places as the economy reopens. The funny thing is that China's e-commerce market continues to grow and is expected to reach $3.3 trillion in sales in 2023 and $3.56 trillion in 2024. It is the largest e-commerce market in the world and accounts for more than 50% of global payment volumes in this sector.

1. JD.com $JD

Since its inception in 1998, JD.com has grown into one of the biggest players in the market and has earned the loyalty of millions of customers.

Founded by Richard Liu, JD.com began as a small electronics store in Zhongguancun, Beijing. It has gradually grown to include a wide range of products, including electronics, clothing, cosmetics, food and other goods. JD.com later transformed into an online platform and has established a strong position in this regard.

One of the main factors behind JD.com's success is its commitment to providing quality goods and services to customers. The company owns its own logistics infrastructure that ensures fast and reliable delivery of products to the customer's doorstep. JD also focuses on innovation and uses advanced technologies such as artificial intelligence and robotics to improve its business processes and customer experience.

Building long-term partnerships with leading brands and suppliers is also an important part of JD.com's strategy . The company offers a platform to sell goods to these partners and helps them gain access to a huge number of customers. JD is also actively involved in collaborating with global brands and expanding its reach in international markets.

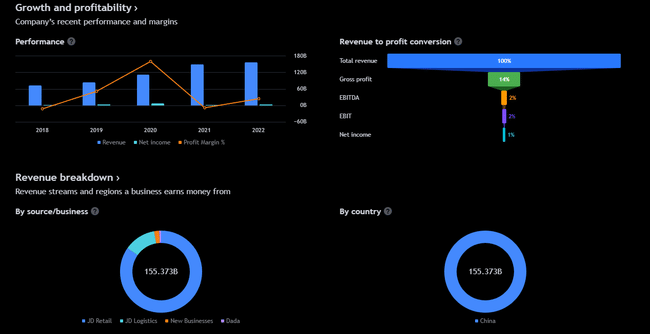

The company generates tons of revenue but with minimal margins. Over the past 12 months, JD generated $153 billion in revenue and $2.87 billion in net income, which equates to a net margin of just 1.9%. The stock trades at a relatively cheap price-to-earnings (P/E) ratio of 20.6, but investors would be well served by either sustained margin expansion or further revenue growth to make an investment in JD.com work over the long term.

2. Pinduoduo $PDD

Pinduoduo is an innovative Chinese e-commerce platform that specializes in collective shopping. Since its inception in 2015, it has quickly developed into one of the most prominent companies in China's online retail industry and has gained immense popularity among consumers.

Pinduoduo differs from traditional e-commerce platforms by connecting consumers into groups and allowing them to buy products in large quantities with better prices. This concept of collective shopping has proven to be very attractive to Chinese consumers, especially those who are looking for bargains and like to shop with family, friends or neighbours.

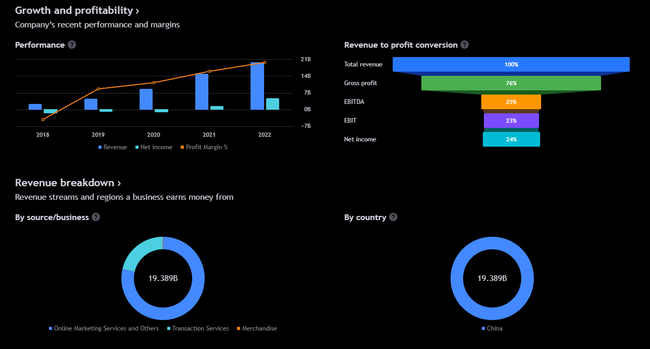

Since going public, PDD's revenue has grown nearly 8,000%, outpacing JD.com's 215% growth over the same period. Consumers in China have embraced the Pinduoduo marketplace because of its social features and wide product selection. Over the past 12 months, Pinduoduo generated US$21 billion in sales and US$5.4 billion in net income, giving it a much higher profit margin than JD.com. This is because PDD does not make first-party sales for e-commerce, but simply handles a portion of the transactions going through its marketplace.

The company has huge ambitions, having recently expanded into Western markets with the launch of Temu. Temu has been the most downloaded app in the United States and other Western countries for months, suggesting that Pinduoduo will succeed with its international expansion plans.

Today, PDD trades at a P/E of 19.4, which is actually cheaper than JD.com. This company is hugely profitable. Compared to JD, it has profits more than 20 times higher. That's why investors now seem to like it more and more.

It's not a financial advisory service. I am providing publicly available data and sharing my views on how I would handle myself in given situations. Investing is risky and everyone is responsible for their decisions.

I still have respect for China in investments. I don't think anything terrible will happen in the end, but I still see a $BABAscenario there...