FED vs INVESTORS

Another week ends and we also begin December 1, 2023, the last month of the year (so far growth), despite high interest rates. I took the liberty of choosing this headline because the situation looks like that to me now. On the one hand, investors who are flooding the market with optimism, and against them the Fed, which is still trying to keep the option on the table, "watch out, we can still hike".

Federal Reserve chief Jerome Powell has given a new warning to investors who believe the Fed is done raising rates and will soon move to a cut, saying the central bank needs to see more evidence that inflation is on its way back to the Fed's 2% target.

"It would be premature to conclude with confidence that we have reached a sufficiently restrictive stance or to speculate on when policy might ease," Powell said Friday in prepared remarks at Spelman College in Atlanta.

While acknowledging that monetary policy is "well into restrictive territory," he left further rate increases on the table. "We are prepared to tighten policy further if appropriate," he added.

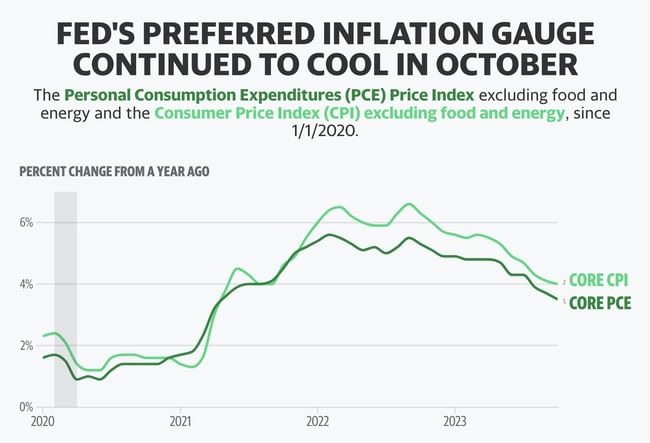

Core PCE came in at 3.5% for October, down from 3.7% in September and continuing a downward trend from 4.3% in June. Core PCE is one of the inflation indicators the Fed tracks most closely. Investors have recently raised estimates again that the Fed is done with hiking. Some are even predicting a cut during the first half of 2024.

The Fed will meet for the last time this year on December 12-13. Powell emphasized, "While the lower inflation readings of the past few months are welcome, this progress must continue if we are to reach our 2% target." He also reiterated that the outlook for the economy is unusually uncertain and that the Fed is "proceeding cautiously" and making decisions at meetings.

New York Fed President John Williams, for example, said inflation remains "too high" and the Fed's job "is not nearly done." San Francisco Fed President Mary Daly, in an interview published by a German newspaper, said rates are in a "very good place" but that it's too early to talk about whether hikes will end or when cuts might begin.

In general, Powell and his colleagues expect growth and consumer spending to slow over the next year as the impact of the pandemic wears off and higher rates slow growth. The full effects of the Fed's aggressive rate hikes are unlikely to be felt yet, he said. $^GSPC $SPY $^NDX

And how do you investors feel about this? ...I personally think that the Fed is lagging us in the imaginary "war" so far, despite its plan to keep a restrictive stance, investors are keeping a positive mood and we have seen nice growth in the month of November. 😊🍀 So let's keep it going in the month ahead. 🚀

I don't foresee the Fed raising rates again. For November, stocks and ETFs like the SPY and NDX have been rising very nicely, so I would say most investors are in a positive mood that will remain for the rest of the year for sure.