India has overtaken Hong Kong to become the 7th largest stock market in the world

We all turn our eyes today to the US and Powell's speech tonight, the Fed's preview of where the economy will go next in America. But in this post I'm going to bounce to the East, because that's what a lot of people have started talking about this year, or India as well, and it definitely has potential. 😊

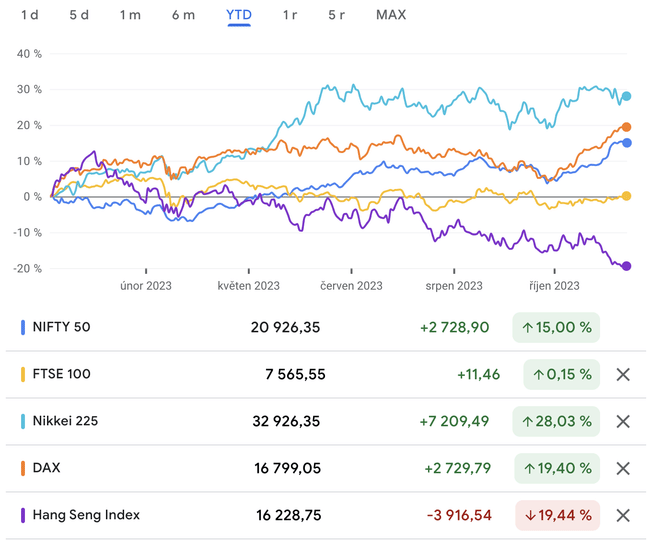

The value of the Indian stock market has overtaken Hong Kong to become the seventh largest in the world. According to data from the World Federation of Exchanges, the total market capitalisation of India's national stock exchange stood at $3.989 trillion as of the end of November, compared with $3.984 trillion in Hong Kong. India's index has notched up a handsome 15% appreciation so far this year and is on course for its eighth consecutive year of growth.

While the Hong Kong index is down less than 20%. The world's most populous country, India is also heading into general elections next year, which analysts say could be another victory for the ruling nationalist Bharatiya Janata Party. The BJP-led government may secure a victory, which could trigger a bull run in the first three to four months of the year on expectations of policy continuity, strategists said. They added that banks, healthcare and power are the sectors best positioned for the coming year. Sectors such as autos, retail, real estate and telecom are also relatively well positioned for 2024, while fast moving consumer goods, utilities and chemicals are among those they categorise as unfavourable.

Hong Kong's Hang Sengje index is poised to record a fourth year of decline and is the worst performer among major Asia-Pacific stock markets. Last week, Moody's cut its outlook for Hong Kong to negative from stable, citing the city's financial, political, institutional and economic ties with mainland China. The downgrade came soon after Moody's cut its outlook on the Chinese government's credit rating to negative to stable.

The Hong Kong government said the economy will grow by 3.2% in 2023, lowering its GDP growth outlook to 5% from the 4% forecast in August. They are poised for a soft landing in 2024 as annual real GDP growth moderates to around 2% from 3.5% in 2023, DBS economists said. China has set a growth target of 5% for 2023. Its GDP reached 4.9% in the third quarter, raising hopes that the world's second-largest economy will meet or exceed expectations.

Here I've given just a small selection of examples for this year, 2023. Don't take the comparison too seriously. I couldn't put more than 5 indices in one chart. Furthermore, in order to fit markets other than the US, I left out the SP500, Nasdaq100, and I didn't put an index for China. What also needs to be said, like the US, the indices are pretty much dragged by their selection, what I mean by that is that the S&P500 as we know does not drag all 500 stocks, but max 7-10 top companies. 😊

So in conclusion, I want to say and ask, how do you friends outside the US look? Are you investing maybe in the east or other stock markets? And last but not the least, what do you think about India? 😊 ...I do follow ETFs, but I don't invest yet and stay only in the US, plus a few titles from Europe.

Wow 👌