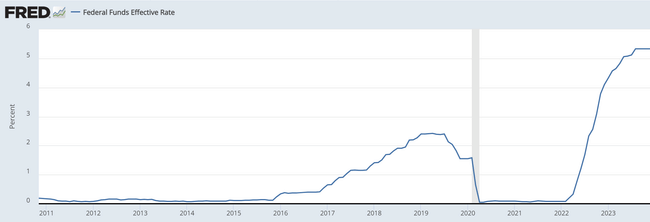

The Federal Reserve announced on Wednesday that it would keep interest rates unchanged, causing a stir in financial markets and sparking a debate about the future direction of monetary policy. The Federal Reserve decided to omit passages that had so far suggested it could raise interest rates further, provided inflation remained above the Fed's 2% target.

However, the Federal Committee stressed that at the moment there are no plans to take any action to lower rates. This change in policy formulation has sparked speculation and uncertainty aboutabout the direction monetary policy will take in the coming months.

Although some analysts anticipate that the Fed will continue to pursue a "soft landing" that could lead to a decline in inflation without negatively impacting economic growth, others warn of the risks associated with a possible change in policy direction.

Fed Chairman Jerome Powell has said a March rate cut is unlikely, raising further questions about how monetary policy might evolve in the near future.

"I don't think it's likely that the committee will reach a level of confidence by the March meeting. We want to see more good data. It's not that we're looking for better data, we're looking for a continuation of the good data we've seen."

Jerome Powell, Fed Chairman

Market reactions to the decision were mixed, but some stock indexes fell. Investors are closely watching other economic data and the markets' reaction that could determine, which direction the Fed's policy will take in the coming weeks and months. Given the uncertainty about the future direction of monetary policy, financial markets are expected to remain in volatile in the period ahead.

Overall, the Federal Reserve's decision to keep interest rates unchanged has sparked speculation and uncertainty in financial markets. Investors are in a quandary about the direction of monetary policy in the near future, which causing volatility in the markets and encouraging a cautious approach to investment decisions.

Moreover, economic data and indicators appear to offer a mixed picture of the current state of the economy. While some indicators suggest solid growth and falling inflation, others suggest some signs of weakness, particularly in the labour market and wages.

Disclaimer: You will find a lot of inspiration on Bulios, but stock selection and portfolio construction is up to you, so always do a thorough analysis of your own.

Source.