While investment guru Warren Buffett remains cautious about the current situation, one company has caught his attention. Berkshire Hathaway, of which Buffett is chairman, recently increased its investment in Occidental Petroleum by more than $200 million. What prompted Buffett to make this decision?

Occidental Petroleum caught Buffett's attention, with Berkshire Hathaway increased its stake in the company by another $246 million, moving to a 28% stake in the company. This investment follows other purchases in the past, indic ating Buffett'slong-term interest in the company.

One of the key factors is Occidental's strong position in Texas, making it an important player. The company's cheap oil resource gives it a competitive advantage, which it strengthened with the $10 billion Berkshire$BRK-B-backed acquisition of Anadarko. Another factor that convinced Buffett to buy is the positive outlook for oil prices.

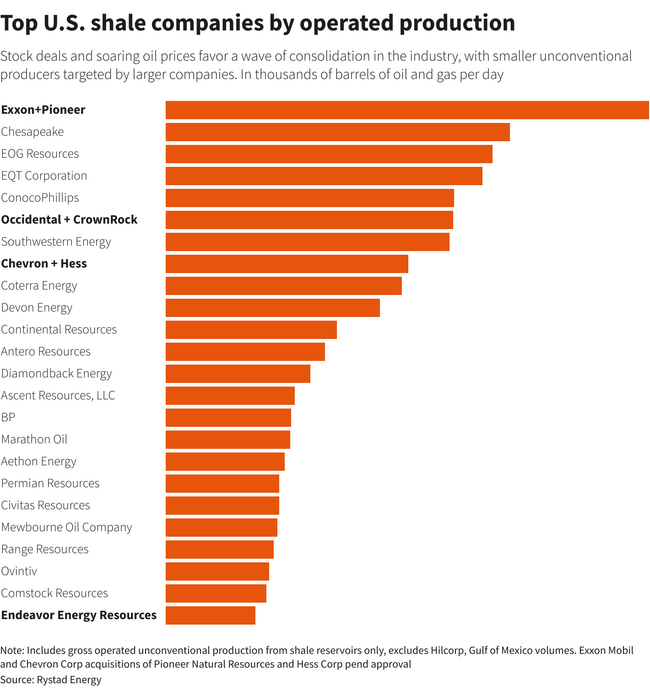

Company Occidental Petroleum recently acquired the American oil producer CrownRock through the acquisition of for $12 billion. The deal will boost OXY's production by 170,000 barrels of oil and gas per day in the Permian Basin in Texas, bringing the company's total production to close to1.2 million barrels per day.

It should beemphasized, however, that despite Buffett's confidence in Occidental's management and its long-term potential, his investment in the company remains a relatively small portion of his overall portfolio. With its emphasis on long-term potential and attractive valuation, $OXY stock may bean interesting choice for investors looking for opportunities.

Disclaimer: You will find a lot of inspiration on Bulios, but stock selection and portfolio construction is up to you, so always conduct a thorough analysis of your own.

Source.