Increase in Share Buybacks - A Signal of Optimism in the Market?

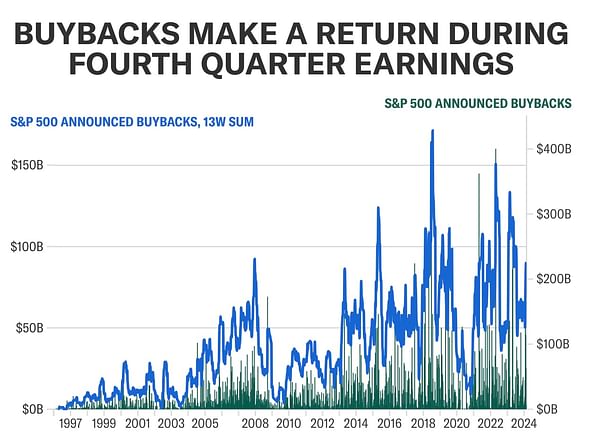

We are coming to the end of February and according to several reports, there has been an increase in the number of companies choosing to conduct buybacks of their shares, which may be a sign of increased confidence in the trajectory of the US economy.

Companies like Meta, Disney, Uber and others, with more to come this year, have announced plans to buy back shares during the last earnings season. According to data from Deutsche Bank, these companies are acting on buyback authorizations, with S&P 500 members buying back a record $63 billion of their own stock during the first week of February, the highest total in a single week since May 2023.

Parag Thatte, Deutsche Bank's head of global asset allocation and U.S. equity strategy, explained that improving corporate profits are often followed by increased buybacks. This is due to the fact that as earnings grow, companies' free cash flow increases, which is first used to pay down debt and then for dividends and investments. Share buybacks reduce the number of shares outstanding, which increases the value of investors' holdings and their potential dividends.

Bob Iger, CEO of Disney, and Prashanth Mahendra-Rajah, CFO of Uber, expressed similar views, emphasizing their confidence in the financial stability of their companies. Meta offered a quarterly dividend for the first time and will buy back $50 billion in shares, another sign of confidence from major players in the market.

While companies are still grappling with higher borrowing costs and fears of a possible recession, the increase in buybacks suggests they are feeling more confident about their financial position in 2024.

In addition to share buybacks, another signal of corporate confidence is the increase in agreements and deals between companies, which may bolster overall market confidence.

In the context of stabilizing interest rates and rising corporate confidence, the U.S. economy and markets appear to have brighter prospects ahead.

So just such a nice message investment friends, don't let's just keep reading the negative headlines. 😊🍀

I'd rather have seen those buybacks last year, especially in $META. It's great that it has higher cashflow, but it's also buying those shares at 3 times what it could have.