Claude Malouxe

The next few days may bring some volatility back to the markets, why?🤔 Tomorrow we have inflation data, namely the Consumer Price Index (CPI). Then on Thursday, we'll get Producer Price Index (PPI) data.

Since inflation is still a pretty hot topic, I decided to get out of the markets today with options. Iron Condor, which I opened yesterday, I closed again today, and took $22...

Read more

Zobrazit další komentáře

How about a bet on the VIX index? After all, there will be tension now, fear around these days and so it could go up? 😊 Otherwise, I'm still learning trading slowly and managed to make $40 on oil in two days now.

The current downturn is not much to use for investing, but there are other ways to squeeze money out of the markets.👇

✅Markets are down due to not so good unemployment data, and fears of another bank collapse. Our volatility index has jumped up.

The way I see it, I'm going to see if I can open some short-term option positions.👍

How about you? How are you doing? Did you do any...

Read more

Zobrazit další komentáře

I also don't understand opcim yet and would like to learn, anyone here good at this? I 😊 and trade, sometimes try it but still feel weaker mentally. I'm watching Oil quite a bit now and I'm thinking it might go up again after the drop, looking at the chart it's been flying up and down in the 70-80$ range for a long time.

🚨We have another victim of Hidenburg Research.🚨

📉 Corporate activist Carl Icahn's fortune suffered a record $10 billion loss after the well-known Hindenburg Research accused him of using a "ponzi-like" economic structure at his investment firm. Icahn Enterprises LP, his publicly traded limited partnership, saw its biggest-ever drop of 20%.

...Read more

I had a little time before the markets opened today, so I was just paddling around the markets, and I came across some companies that had insane dividend yields.

So I was wondering which company in your portfolio has the highest dividend yield, and how much is it ?

Zobrazit další komentáře

Well, we have the same Martin :), I would add Meyer Burger and Mercedes-Benz.

New York Community Bancorp $NYCB beat expectations with $652 million in revenue for Q1 2023, an increase of 88.4%! EPS meets estimates - well done! 👍📊

As a result of the good results, the share price is flying up quite a bit today 📈 Any of you have the stock in your portfolio? Or did anyone make any trades on these results?

Zobrazit další komentáře

Both$GOOGL and $MSFT are large corporations. And this is what limits the growth potential that AI can bring them. They're just so diversified that this revolution here won't have as big an impact on them as it will on pure AI companies.

As a young investor, I'm trying to find a company that's purely AI development. So I'm hoping to make it happen.🚀

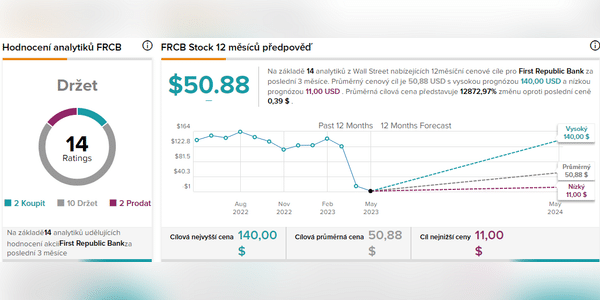

The analysis at the broker is sometimes pretty random 😀. I don't think the stock can go up yet.