Coterra Energy analysis

1. Business and Scope: Coterra Energy specializes in oil and gas exploration and production, with a primary focus on Texas' Permian Basin, Oklahoma's Anadarko Basin, and Appalachia's Marcellus Shale. This geographic diversification allows the company to diversify its resources and increases its resilience to regional influences.

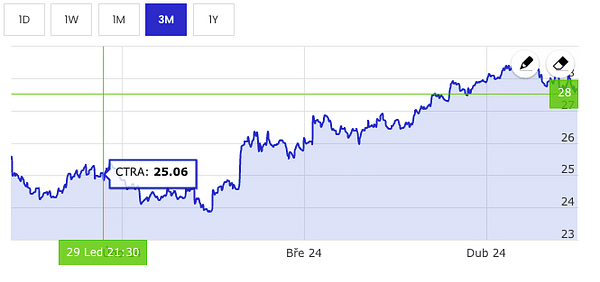

2. Financial performance: Although Coterra reported a year-over-year decline in revenue in Q4 2023, the value of revenue exceeded expectations. Non-GAAP earnings per share fell slightly short of expectations, which could be due to a variety of factors, including operating costs or changes in commodity prices.

3. Dividend Policy: The 5% dividend increase signals confidence in the company's long-term stability and ability to generate sufficient cash flow to pay dividends. The annual payout rate of 84 cents yields a future percentage yield of 2.97%, which may be attractive to investors seeking stable returns.

4. Growth prospectsA: With more than 50% of free cash flow dedicated to shareholders and an estimated cash yield of 22% over the next three years, Coterra appears to be a promising player in the oil market. Its dividend paying strategy and focus on the oilfield contribute to its attractiveness to investors.

Overall, Coterra Energy has solid financial fundamentals and a promising dividend policy. Its geographic diversification and ability to adapt to market changes allows it to better manage risks and take advantage of opportunities in the energy sector.