The leadership of a company is crucial to its success, both in the short and long term. Investors in the three major companies now hope that the new CEOs will bring positive changes that will improve their performance and strengthen their market position.

Specifically, 3M, Boeing, and Johnson Controls are companies where new leadership can bring the desired improvement.

3M $MM

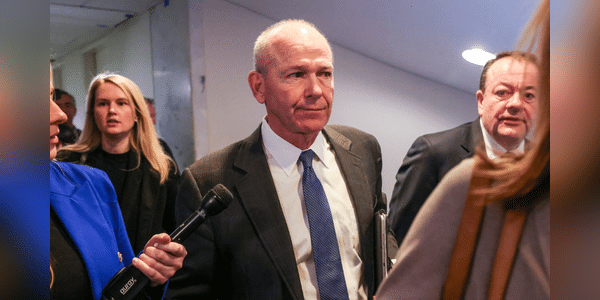

William Brown took over as CEO of 3M in early May, and his impact on investors is already evident. During his first earnings presentation, he made clear his intentions to restructure the company and fix its organic growth, which has been below expectations in recent years. Brown is emphasizing new product development, particularly through increased investment in research and development (R&D), while also looking to streamline the company's operational processes.

One of Brown's key goals is to streamline 3M's supply chain, implement "lean" manufacturing principles and improve purchasing efficiency. He also plans to…