Three stocks that could strengthen if the Fed cuts interest rates in September

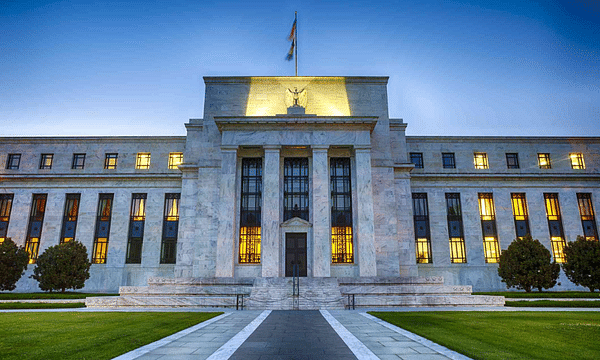

The Federal Reserve (Fed) could cut interest rates in September for the first time in four years, which could have an immediate impact on the stock market.

However, some companies could benefit from the move in the longer term and see sustained growth. In this article, we look at three stocks that analysts believe could benefit significantly from an interest rate cut.

Amazon

Amazon

AMZNAmazon $AMZN+1.8% is the world's largest online retailer and is among the companies that should benefit significantly from the interest rate cut. When the Fed cuts interest rates, it will affect all other rates, from mortgages to credit cards and car loans. The main reason for lowering rates is to stimulate economic activity by lowering the cost of borrowing money.

For Amazon, this means that consumers will pay less interest on their purchases, which should increase their activity on the platform and thus Amazon's sales. Wall Street experts have set a target price for Amazon stock at $220.

Smaller companies and mid-sized businesses have been hit hardest by the policy of raising interest rates in recent years. While large companies have enough liquidity and capital to invest in their growth even with higher rates, smaller companies are having a much harder time. A reduction in interest rates could therefore bring welcome relief to these firms.

Affirm Holdings

Affirm Holdings

AFRMAnother firm is Affirm Holdings $AFRM+1.6%, which offers "buy now, pay later" (BNPL) services. Affirm makes money on fees from merchants and interest on loans that customers repay. However, during periods of high rates, the company has had trouble making a profit because it has to use third-party services to make loans, which costs it more money when rates are high. In addition, high interest rates discourage consumers from making hire purchase purchases. Reducing rates should alleviate both of these obstacles.

Affirm's stock is down 37% this year, but experts have set a median target price of $40 a share.

PayPal

PayPal

PYPLSimilar to Amazon and Affirm, PayPal $PYPL+6.1%could also benefit from a potential rate cut . As a payment platform, PayPal makes money on every transaction that users and businesses make through its service. Lower rates could therefore increase activity on the platform, leading to higher fee income.

PayPal is currently in a period of transformation, having improved its transaction margins, reduced cost growth and increased its financial targets for 2024. In addition, it recently entered into an agreement with Dutch payment service provider Adyen to roll out PayPal Fastlane for expedited payments for customers in the US.

PayPal shares are trading at a relatively low price to future earnings ratio of 15x. The stock is up 16% this year to $71 per share, and JPMorgan recently raised its target price to $80 per share, which would imply another 12% upside.

Disclaimer: You'll find plenty of inspiration on Bulios, but stock selection and portfolio construction is up to you, so always do a thorough analysis of your own.

Source..