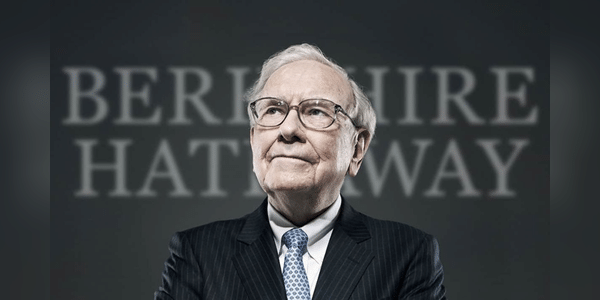

Warren Buffett, known as the "Oracle of Omaha," celebrates his 94th birthday today with a historic triumph as his Berkshire Hathaway investment empire reached a market capitalization of more than $1 trillion this week. This achievement is all the more extraordinary because Berkshire Hathaway is the first non-technology company in the US to surpass this significant milestone. It joins an elite group of companies that includes tech giants such as Apple, Nvidia, Microsoft, Alphabet, Amazon and Meta.

The Buffett Way: From textile company to investment giant

Warren Buffett took control of Berkshire Hathaway in the 1960s when the firm was still a struggling textile company. With exceptional investment talent and long-term vision, Buffett transformed Berkshire into a conglomerate encompassing a wide range of industries, from insurance to railroads to energy and retail. This growth under his leadership is not only the result of strategic investments, but also an emphasis on values such as…