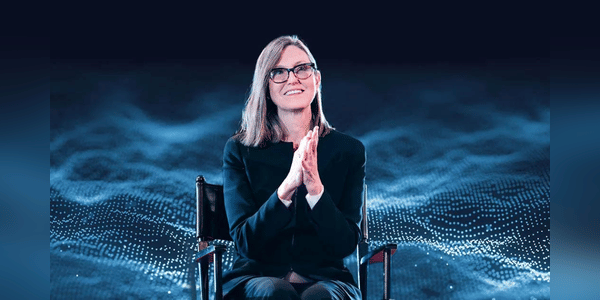

Cathie Wood, co-founder and CEO of Ark Invest, is once again attracting attention with her innovative investment style focused on growth stocks. Its largest fund has seen a 17% rise in recent weeks after an earlier decline, putting it back in the spotlight for investors.

Thanks to Ark Invest's transparency, which publishes its trading activity on a daily basis, we have an overview of the companies it is currently buying.

Three purchases in particular are interesting: Advanced Micro Devices (AMD), DraftKings and Tempus AI. Let's take a closer look at these companies.

Advanced Micro Devices $AMD

What if the world of artificial intelligence (AI) started to develop in earnest, but one of the largest chipmakers, Advanced Micro Devices, was left on the sidelines? Although AMD is losing value in 2024, the company is looking to make its mark in AI. It is expected to unveil its plans at this week's "Advancing AI 2024" event, where it will unveil a new generation of accelerators, server processors…