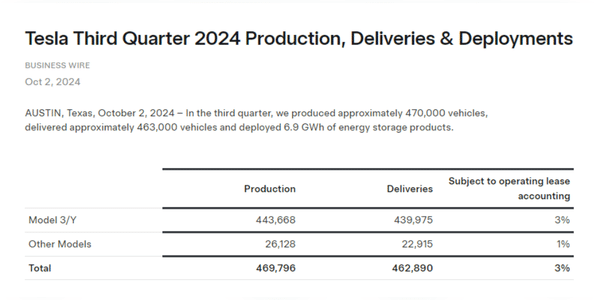

Tesla released its delivery results for the third quarter of 2024, delivering 462,890 electric vehicles. This result fell just short of estimates, which were 463,300 (some companies report even more) cars delivered. While the difference is only a few hundred units, this news disappointed investors as expectations were high given previous optimistic forecasts and the recent rise in the stock price.

Unrealistic expectations and market reaction

Expectations were set high as Wall Street analysts had predicted deliveries of around 461,000 to 470,000 cars. Thus, Tesla's result at least surpassed the previous quarter when the company delivered 444,000 cars.

Cybertruck as a potential gamechanger

An interesting factor that may influence Tesla's future development is the growing sales of the Cybertruck. In July, Tesla sold over 5,000 units of this revolutionary car, with total sales for 2024 reaching nearly 18,000 units. Analysts estimate that as many as 13,500 Cybertrucks could have been sold in…