These 2 growth stocks could skyrocket 500% by 2032

What can we say, it's anything but positive in the markets right now. In the last month alone, the S&P 500 is down 9.61%. Some people are depressed, while others are welcoming new and new buying opportunities. For the latter group, this text will do just that. Here you will find tips on 2 growth stocks that have made decent gains and that have the potential to shoot up 500% by 2032.

1. Roku $ROKU

Roku operates a streaming TV platform. The company's business consists of two main segments: platform and player. The platform facilitates users to discover and access various movies and TV series, as well as live TV broadcasts, sports news, and more. As of December 31, 2021, Roku had 60.1 million active accounts. It also provides digital and video advertising, content distribution, subscription and billing services, and manufactures, sells, and licenses smart TVs under the Roku TV name.

In addition, the company offers streaming players and audio products and accessories under the Roku brand and sells branded channel buttons on streaming device remotes.

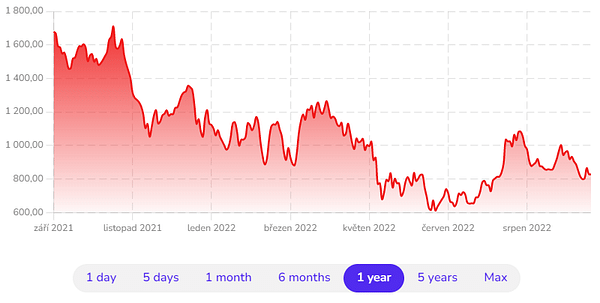

Shares last traded at $56, down nearly 81% on the year. At the current share price, Roku has a market capitalization of $7.86 billion. Since the company only turned a profit last year, it doesn't make much sense to give a PE ratio. In contrast, the PS (price to sales) ratio currently stands at 2.6. That's very respectable.

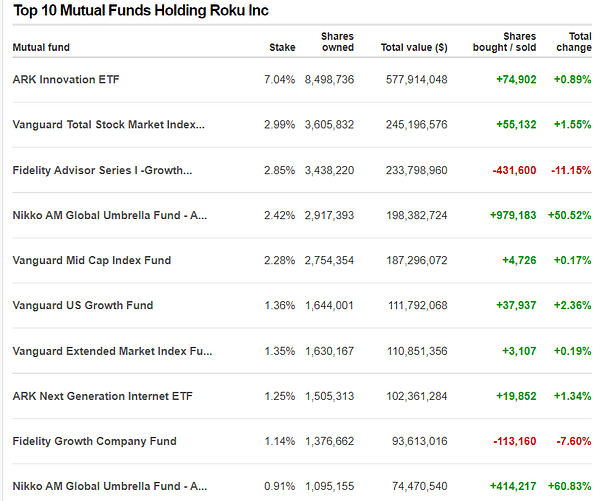

The company is well known, especially among growth company aficionados. It is not surprising as the bull run in 2020 and 2021 alone has seen this stock price increase more than 6 times. That's very impressive. Cathie Wood and her ARK Innovation ETF, which is the largest shareholder in terms of funds, among others, has benefited a lot, owning over 7%. But since the peak last July, the ETF has already fallen almost 84%. This, of course, has had a big impact on the fund's total return.

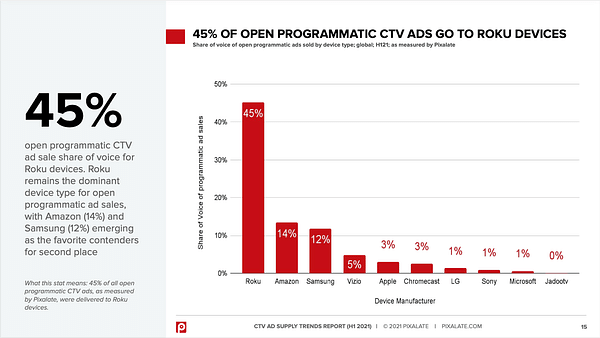

As we can see below, one of Roku's revenue streams is advertising within connected television (CTV). Over the past year, the firm had a 45% share in this focus right away. Which is already down 9% from 2020, but this market is expected to grow more and more in the coming years. This is due to the shift of viewers away from traditional TV and also better targeting of the advertising itself. Specifically, according to BMO Capital Markets, CTV ad spending in the US alone could reach $100 billion by 2030, up from just $21 billion in 2021.

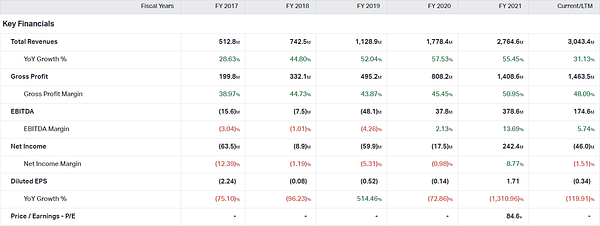

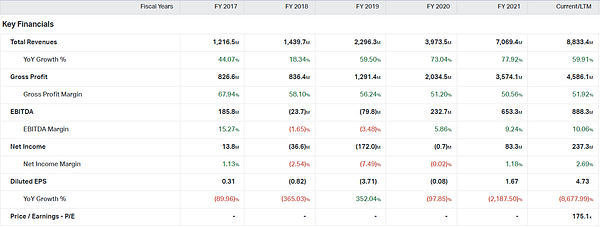

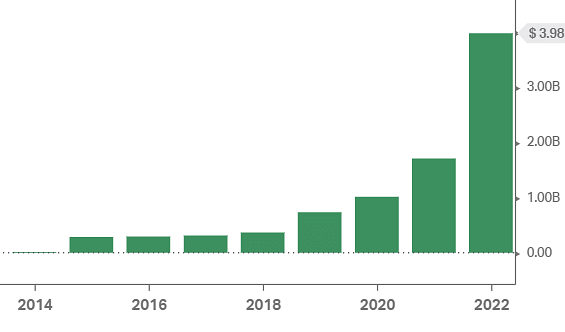

When looking at the financials, we have to take into account that Roku is young and a typical growth company. That's why we're currently most interested in how it manages to improve its results on a regular basis. As we can see in the chart, sales are up really nicely year-over-year. Last year, the company made $2.765 billion, up a solid 55.5% from the year before. So, on average, revenue has grown 47.7% over the past few years. Gross profit is also showing rapid growth, which was $1.409 billion last year. Related to this is the gross margin, which reached 50.95%. Last year, the company has already turned a profit of $242.4 million as well.

What's the basis for the somewhat crazy 500% growth forecast? This is a pretty long horizon, a lot can happen within a decade. There have been similar bull runs in the past, and in just 11 months. The argument for it may also be the ever-growing CTV advertising market, where Roku controls the majority.

2. Mercadolibre $MELI

The company manages a wide range of online commerce platforms in Latin America. Its portfolio includes brokerage offering goods, fintech, investments, loans, logistics, real estate listings or services, advertising, and online stores. It is the largest e-commerce agent in Latin America. MercadoLibre can be thought of as the Amazon of its region.

The stock ended the last trading day at $872.78, a drop of more than 50% in one year. The company currently has a market capitalization of $41.67 billion. Like Roku, MercadoLibre is a typical growth company where it doesn't make much sense to list the PE ratio, which is currently at 175. The price to sales ratio comes in at 4.7, which is slightly worse than Roku.

We can observe a really good upward trend in sales. Last year, the company earned a total of $7.069 billion, which is a 77.92% improvement year-over-year. On average, sales grew 54.57% year-over-year. Last year, the company earned a gross profit of $4.568 billion, which represents a gross margin of 50.56%. Here, in contrast, we see a downward trend in gross margin. Thus, the firm's revenues are growing significantly, but so are its costs. Last year, the company reported a profit for the first time since 2017 , which was $83.3 million. Moreover, it is expected that the profit could still grow significantly for this year.

The company has been able to generate quite a lot of cash. Free cash flow was $392.1 million. The company helped itself by issuing new shares for a total of $1.52 billion, which is a common occurrence for growth companies. The company is regularly increasing the amount spent on capital expenditures (CapEx), which is a good sign. Last year, it spent a total of $572.9 million on these investments. Taking a quick look at the balance sheet, we can see a big increase in total debt, which has climbed to $3.983 billion over the past year. The debt is expected to continue to grow this year.

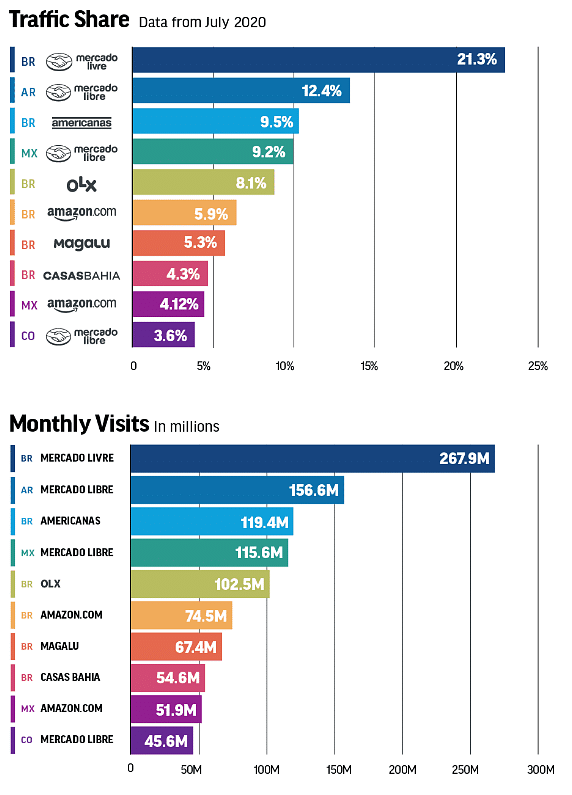

To get an idea of just how much of a monopoly the company has in the Latin American market, we can look at the charts below. The data is from 2020. In the first chart, we see the traffic shares. In Brazil, MercadoLibre immediately has a 21.3% share, with Argentina's MercadoLibre in second place with 12.4%. These shares are still shown on the second chart in terms of monthly visits.

What is the basis for the forecast for such massive growth of 500% by 2032? The majority of MercadoLibre's revenue comes from Argentina, Brazil and Mexico. All of these countries are among the top 10 fastest growing markets in e-commerce. Statista.com adds another reason for the growth, saying that e-commerce revenues will grow drastically in the countries where the company operates. It should be up 18% annually, totaling $260 billion by 2025. Digital payment volume is expected to grow 15% annually, reaching $510 billion by 2027. This could play significantly into MercadoLibre's hands.

Do you think any of these companies really have a chance to achieve 500% growth in 10 years, or not? 🤔

Disclaimer: This is not an investment recommendation