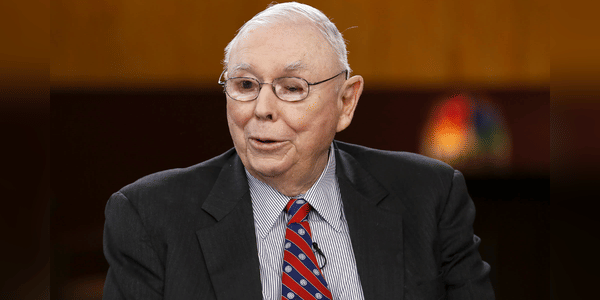

Charlie Munger: How to invest during a recession

Billionaire investor and Warren Buffett's partner at Berkshire Hathaway, Charlie Munger, told the Daily Journal's annual meeting earlier this year that the markets are in for "significant trouble". That prediction is a little more relevant now with the risk of recession back on the horizon, so let's take a look at how to make money during this difficult period.

Charlie Munger predicts trouble in the stock market

The conclusion from Charlie Munger's remarks in light of current macroeconomic and market conditions is that future SPY returns are likely to be below average over the next few years. The reasons are fairly simple:

- The outlook for economic growth is weak, if not negative, for the foreseeable future. Without strong economic growth, earnings growth will also be weak.

- Interest rates are likely to rise further based on persistently high inflation and recent comments from the Federal Reserve. Higher interest rates in the near term will make the market appear overvalued…

Read the full article for free?

Go ahead 👇

Do you have an account? Then log in

. Or create a new one

.

https://vk.com/@779832255-watch-teen-wolf-the-movie-2023-in-hd-online

https://vk.com/@779832255-teen-wolf-film-complet-en-francais-2023-voir-streaming-hd

https://vk.com/@779832255-teen-wolf-the-movie-2023-in-full-length

https://bulios.com/status/76639-teen-wolf-filmul-online-subtitrat-2023-subtitrat-dublat-in-r0mana

https://bulios.com/status/76658-filmul-extraction-2020-online-subtitrat-h-d-subtitrat-in-r0mana

https://bulios.com/status/76663-filmul-don-jon-online-subtitrat-2o13-ubtitrat-dublat-in-r0mana

https://bulios.com/status/76667-teen-wolf-the-m0vie-online-subtitrat-in-romana-2023-filmul

https://bulios.com/status/76674-filmul-shotgun-wedding-online-2022-subtitrat-in-romana-urmari

https://bulios.com/status/76692-winnie-pooh-blood-honey-2o22-pelicula-completa-en-esp-latino

https://bulios.com/status/76694-historia-de-honor-pelicula-completa-2-0-2-2-en-espanol-y-latinos-online