The legendary analyst presented a list of companies based on simple metrics and indicators. If history repeats itself, these are some really interesting picks for companies with decent potential!

Matt Krantz - author of several books and countless popular and analytical articles. Last time, I presented you with his picks for companies he'd be guaranteed to avoid. Now, let's take a look at his selection of titles that he thinks are, on the contrary, very decent choices!

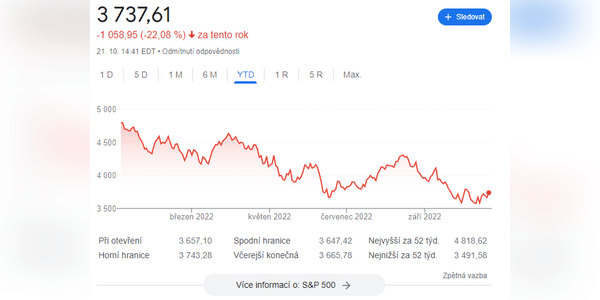

We'll go over this pick again with the help of numbers and an interesting metric - Shares of S&P 500 companies that have consistently outperformed earnings over the past 12 months are actually down only 8% on average this year. That's significantly better than the 20% decline in the S&P 500 over that time.

Please!! note that this is not financial advice Every investment must go through a thorough analysis....

Companies that beat earnings projections will be valued all the more highly.