Several adverse influences and circumstances are currently plaguing markets and investors. Unfortunately, two big names on Wall Street don't have good news for us either. They even believe that we are heading for a small market apocalypse that will surpass that of 1929.

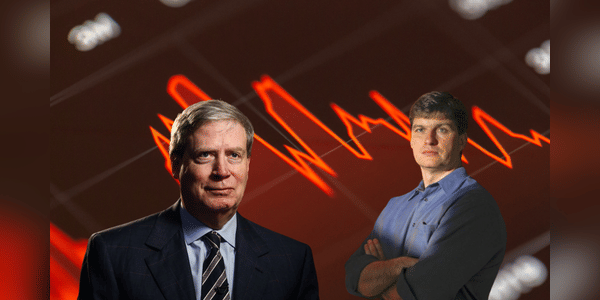

"Quite possibly the situation will be significantly worse than any we know in history." Stanley Druckenmiller, the legendary investor, has been saying for some time.

I have also written about his long term position on the Fed's actions and on the markets here: Urgent Warning from a Famous Billionaire and Manager. Why does he believe the markets will soon fall to their knees?

And he's joined by an even bigger name - Michael Burry. When you hear such a big and scary warning, the first question to ask is: who is it coming from? Is the person issuing the warning trustworthy?

Yes, Burry should be taken seriously, despite some of his recent actions and…

Since last year's peak, the S&P has plunged as much as 27%. If we are indeed facing the mother of all crashes, total losses could approach 55%, as they did in 2008. That would bring the S&P 500 down to about 2,150, 43% below current levels.

"All of these factors that are causing the bull market are not just stopping, they are reversing, every one of them. As a result, its most likely that the stock market will be at zero for the next decade," Druckenmiller said.

I like this article!

nice information

good

wow

nice

good

wow

nice