A complete overview of the factors that will influence investment in 2023

The year was a turning point for many people. For many investors, it may have been their first profitable year because it was preceded by one of the longest bull markets. Unfortunately, 2023 has yet to bring the coveted light at the end of the tunnel. However, we can look at what is likely to impact the next year from an investment perspective!

Covide madness in China. Central banks with the brakes slammed on. Huge losses in the stock market and much more. These are the factors the market and investors must grapple with to avoid a second straight year in the red.

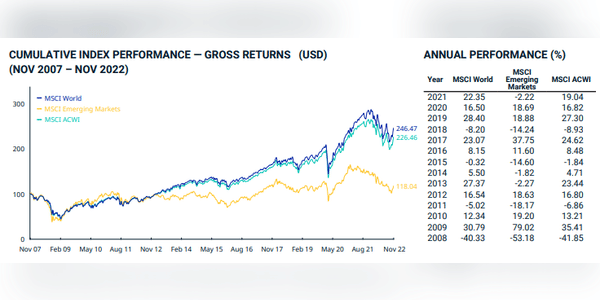

With a decline of more than 20% in 2022, the MSCI World Index is on track for its worst performance since the 2008 crisis, as a jump in interest rates by the Federal Reserve has more than doubled 10-year Treasury yields - rates that underpin the global cost of capital.

nice

A bull market is the condition of a financial market in which prices are rising or are expected to rise. The term "bull market" is most often used to refer to the stock market but can be applied to anything that is traded, such as bonds, real estate, currencies, and commodities.

Because prices of securities rise and fall essentially continuously during trading, the term "bull market" is typically reserved for extended periods in which a large portion of security prices are rising. Bull markets tend to last for months or even years.

good nice information

NICE POST THANKS!

https://communityin.oppo.com/thread/1257017037646725120https://communityin.oppo.com/thread/1257019883783716870https://communityin.oppo.com/thread/1257019890276499461https://communityin.oppo.com/thread/1257019896350113793https://communityin.oppo.com/thread/1257019901584605185https://communityin.oppo.com/thread/1257027661189349382https://communityin.oppo.com/thread/1257028217236881415https://communityin.oppo.com/thread/1257029618385813506https://communityin.oppo.com/user/1257016204397903876

https://communityin.oppo.com/thread/1257024250809155591https://communityin.oppo.com/thread/1257024355155050505https://communityin.oppo.com/thread/1257024863395905541https://communityin.oppo.com/thread/1257025179948417025https://communityin.oppo.com/thread/1257025538007760900https://communityin.oppo.com/thread/1257029650715508742https://communityin.oppo.com/thread/1257029703454949378

https://bulios.com/status/83355-avatar-2-the-way-of-water-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83356-avatar-2-the-way-of-water-2022-yts-torrent-download-yify-movieshttps://bulios.com/status/83357-avatar-2-the-way-of-water-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83358-watch-avatar-2-the-way-of-water-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83354-download-avatar-2-the-way-of-water-2022-full-movie-download-free-720p-480p-and-1080p

https://bulios.com/status/83359-watch-m3gan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83360-m3gan-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83361-m3gan-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83362-m3gan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83363-download-m3gan-2022-full-movie-download-free-720p-480p-and-1080p

https://bulios.com/status/83364-the-legend-of-maula-jatt-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83365-watch-the-legend-of-maula-jatt-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83366-the-legend-of-maula-jatt-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83367-the-legend-of-maula-jatt-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83368-official-watch-the-legend-of-maula-jatt-full-movies-online-for-free

https://bulios.com/status/83369-babylon-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83370-watch-babylon-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83371-babylon-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83372-babylon-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83373-download-babylon-2022-full-movie-torrent-download-free-720p-480p-and-1080p

https://bulios.com/status/83374-download-pathaan-2022-full-movie-torrent-download-free-720p-480p-and-1080phttps://bulios.com/status/83375-pathaan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83376-pathaan-2022-yts-torrent-download-yify-movieshttps://bulios.com/status/83377-pathaan-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83378-watch-pathaan-2022-fullmovie-free-online-on-123movies

https://events.ydr.com/event/582f22dd5cde86196591ccd7379b3f2ahttps://events.ydr.com/event/573341f4113336a527af765f08463ebehttps://events.ydr.com/event/356d50ea9c09dff5d88c6c6fdefa586chttps://events.ydr.com/event/c066c2529f223ea4cff6f63314f78ee5https://events.ydr.com/event/0865b749a930290be16a9ff1cf85c69bhttps://events.ydr.com/event/f31348ee5633c663265b8816351a5489https://events.ydr.com/event/69b5a43617fb3a889827b440a4d047bbhttps://events.ydr.com/event/72d1ef690f0d0b66a35aa7b45774367chttps://events.ydr.com/event/5977affb36183b91f68bfb51b84b81dchttps://events.ydr.com/event/52ebad4abd13a616d6f06ea30324bf6b

https://communityin.oppo.com/thread/1257102198744809477https://communityin.oppo.com/thread/1257103344284467203https://communityin.oppo.com/thread/1257103372436635653https://communityin.oppo.com/thread/1257103395740188676https://communityin.oppo.com/thread/1257103417709953026

https://communityin.oppo.com/thread/1257033504483966982https://communityin.oppo.com/thread/1257033538994700292https://communityin.oppo.com/thread/1257033611170545669https://communityin.oppo.com/thread/1257033634935472129https://communityin.oppo.com/thread/1257033653390409734

good information, amazing

like your posh

Wow nice post

wow

Start posting, ask questions, discuss. Quality posts will be displayed on the main page!